FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

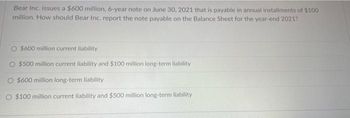

Transcribed Image Text:Bear Inc. issues a $600 million, 6-year note on June 30, 2021 that is payable in annual installments of $100

million. How should Bear Inc. report the note payable on the Balance Sheet for the year-end 2021?

$600 million current liability

$500 million current liability and $100 million long-term liability

$600 million long-term liability

O $100 million current liability and $500 million long-term liability

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following amortization and interest schedule reflects the issuance of 10-year bonds by Wildhorse Corporation on January 1, 2019, and the subsequent interest payments and charges. The company's year-end is December 31, and financial statements are prepared once yearly. Year 1/1/2019 2020 2021 2019 $12,500 2022 2023 2024 2025 2026 2027 Cash 2028 Amortization Schedule $13,305 12,500 13,401 12,500 13,510 12,500 13,631 12,500 13,767 12,500 13,919 14,089 12,500 12,500 12,500 Interest 12,500 14,280 14,493 14,731 Amount Unamortized $14,126 13,321 12,420 11,410 10,279 9,012 7,593 6,004 4,224 2,231 Carrying Value $ 110,874 111,679 112,580 113,590 114,721 115,988 117,407 118,996 120,776 122,769 125,000arrow_forwardOn January 1,2021, Eagle Company borrows $100,000 cash by signing a four-year, 7% installment note. The note requires four equal payments of $29,523, consisting of accrued interest and principal on December 31 of each year from 2021 through 2024. Prepare an amortization table for this installment note.arrow_forwardOn January 1, 2018, Paradiso Company issued 1,000 of its 8%, $1,000 bonds at 93. Interest is payable semiannually on June 30 and December 31. The bonds will mature on December 31, 2027. If the company uses straight-line amortization, determine the amount of interest expense for 2018. answer is 87,000 how do you get there?arrow_forward

- On February 10, 2021, after issuance of its financial statements for 2020, Sunland Company entered into a financing agreement with Cleveland Bank, allowing Sunland Company to borrow up to $8060000 at any time through 2023. Amounts borrowed under the agreement bear interest at 3% above the bank's prime interest rate and mature two years from the date of loan. Sunland Company presently has $3100000 of notes payable with Star National Bank maturing March 15, 2021. The company intends to borrow $4910000 under the agreement with Cleveland and liquidate the notes payable to Star National Bank. The agreement with Cleveland also requires Sunland to maintain a working capital level of $12050000 and prohibits the payment of dividends on common stock without prior approval by Cleveland Bank. From the above information only, the total short-term debt of Sunland Company as of the December 31, 2020 balance sheet date is $8060000. $0. $3990000. $3100000.arrow_forwardA company issues $17000000, 9.8%, 20-year bonds to yield 10% on January 1, 2024. Interest is paid on June 30 and December 31. The proceeds from the bonds are $16708295.53. If the effective-interest method of amortization is used, what amount of interest expense will be recognized in 2024? $833000 $1670756 $1670951 $1666000arrow_forwardRequired information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] On January 1, 2021, Eagle Company borrows $31,000 cash by signing a four-year, 8% installment note. The note requires four equal payments of $9,360, consisting of accrued interest and principal on December 31 of each year from 2021 through 2024. Exercise 10-12 (Algo) Installment note amortization table LO C1 Prepare an amortization table for this installment note. (Round all amounts to the nearest whole dollar.) Payments Period Ending (A) Beginning (B) Debit Interest (C) Debit Notes Balance Expense Payable Date 2021 2022 2023 2024 Total $ 0arrow_forward

- Able Inc. borrowed $60,000 on October 1, 2019 and agreed to pay back $75,000 on October 1, 2022. How much did Able show in interest payable and interest expense in its annual financial statements at December 31, 2021? O Interest expense $5,000; interest payable $11,250 Interest expense $5,000; interest payable $3,750 O Interest expense $5,000; interest payable $5,000 Both interest expense and interest payable $11,250 O Interest expense is $11,250 and interest payable is $5,00Oarrow_forwardCryer, Inc. has a $45,000,000 note payable on its balance sheet as of 12/31/19, of which $6,000,000 is due in 2020. Cryer will report the liability as what on its 12/31/19 balance sheet: O A $6,000,000 current liability and a $45,000,000 long-term liability O A $45,000,000 long-term liability O A $45,000,000 current liability O A $6,000,000 current liability and a $39,000,000 long-term liabilityarrow_forwardOn July 1, 2020, Thomas Company, which follows calendar year accounting, issued $240.000 note to be repaid over four years in monthly installments of $5,000. What would be the proper balance sheet presentation of this transaction at December 31, year 2020. Show it: The Current Portion of the Long-Term Debt and the Long-Term Debt.arrow_forward

- Assume that on September 1, 2022, Brannigan, which has a year-end of December 31, borrows $120,000,000 on a three-year, 7%note. The note requires annual interest payments and repayment ofthe principal plus the final year's interest at the end of the thirdyear.Even though no payment is due on December 31, interest must beaccrued for the periodarrow_forwardGreener Pastures Corporation borrowed $1,950,000 on November 1, 2021. The note carried a 9 percent interest rate with the principal and interest payable on June 1, 2022. (a) The note issued on November 1. (b) The interest accrual on December 31. Indicate the effects of the amounts for the above transactions.arrow_forward5. Soriano's Corporation's liability account balances at June 30, 2020, included a 10% notes payable in the amount of P3,600,000. The note is dated October 1, 2019, and is payable in three equal annual payments of P1,200,000 plus interest. The first interest and principal payment was made on October 1, 2020. In its June 30, 2021 financial statement, what amount should be recorded as accrue interest for this note?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education