Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

solve asap for this general account questions....

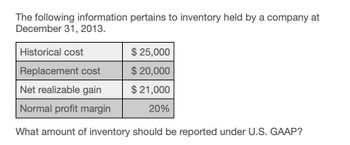

Transcribed Image Text:The following information pertains to inventory held by a company at

December 31, 2013.

Historical cost

$ 25,000

Replacement cost

$ 20,000

Net realizable gain

$ 21,000

Normal profit margin

20%

What amount of inventory should be reported under U.S. GAAP?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Compare the calculations for gross margin for A76 Company, based on the results of the perpetual inventory calculations using FIFO, LIFO, and AVG.arrow_forwardBeginning inventory, purchases, and sales for WCS12 are as follows: Assuming a perpetual inventory system and using the weighted average method, determine (a) the weighted average unit cost after the October 22 purchase, (b) the cost of goods sold on October 29, and (c) the inventory on October 31.arrow_forwardgeneral account solution wantedarrow_forward

- Inventory turnover? General accounting questionarrow_forwardGiven the following information, how much is the Inventory, beginning? Inventory end. P162,000 Net purchases, P216,000 Cost of goods sold, P144,000.arrow_forwardThe inventory footnate from Deere & Company's 2018 10-K follows. Inventories A majority of Inventory owned by Deere & Company and its U.S. equipment subsidiaries are valued at cost, on the "last-in, first-out" (LIFO) basis. Remaining Inventories are generally valued at the lower of cost, on the "first-in, first-out" (FIFO) basis, or net realizable value. The value of gross inventories on the LIFO basis at October 28, 2018, and October 29, 2017, represented 54 percent and 61 percent, respectively, of worldwide gross inventories at FIFO value. If all Inventories had been valued on a FIFO basis, estimated Inventories by major classification at October 28, 2018, and October 29, 2017, in millions of dollars would have been as follows: 2018 2017 $2,233 $1,688 776 4,777 3,182 7,786 5,365 1,637 1,461 $ millions Raw materials and supplies Work-in-process Finished goods and parts Totalvelue Less adjustment to LIFO value 1,637 Inventories 495 $6,149 $3,904 This footnote reveals that not all of…arrow_forward

- General Accountingarrow_forwardAnalyzing an Inventory Footnote Disclosure The inventory footnote from Deere & Company's 2018 10-K follows. Inventories A majority of inventory owned by Deere & Company and its U.S. equipment subsidiaries are valued at cost, on the "last-in, first- out" (LIFO) basis. Remaining inventories are generally valued at the lower of cost, on the "first-in, first-out" (FIFO) basis, or net realizable value. The value of gross inventories on the LIFO basis at October 28, 2018, and October 29, 2017, represented 54 percent and 61 percent, respectively, of worldwide gross inventories at FIFO value. If all inventories had been valued on a FIFO basis, estimated inventories by major classification at October 28, 2018, and October 29, 2017, in millions of dollars would have been as follows: S millions 2018 2017 Raw materials and supplies $2,233 $1,688 Work-in-process 776 495 4,777 3,182 7,786 5,365 Finished goods and parts Total FIFO value Less adjustment to LIFO value 1,637 1,461 Inventories $6,149…arrow_forwardCompute the lower-of-cost-or-net realizable value valuation for Gantner Company's total inventory based on the following: Inventory Categories Cost Data Net Realizable Value Data $18,000 $16,900 13,900 A B с 21,000 Lower-of-cost-or-market valuation $ 14,600 20,500arrow_forward

- What is the inventory turnover on these financial accounting question?arrow_forwardWhat is the ending inventory at estimated cost using the First-in, First-out inventory method? A. 240,000 B. 320,000 C. 224,000 D. 256,000arrow_forwardProblem 13-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below.] Summary information from the financial statements of two companies competing in the same industry follows. Barco Company Kyan Company Barco Company Kyan Company Data from the current year-end balance sheets Data from the current year's income statement Assets $ 800,000 Cash $ 18,500 $ 32,000 Accounts receivable, net 40,400 Merchandise inventory Prepaid expenses Plant assets, net 84,540 6,000 370,000 52,400 130,500 7,800 303,400 $ 526,100 $ 519,440 $ 69,340 $ 99,300 103,000 196,000 Total assets Liabilities and Equity Current liabilities Long-term notes payable Common stock, $5 par value Retained earnings Total liabilities and equity 83,800 180,000 186,300 $ 519,440 127,800 $ 526,100 Sales Cost of goods sold Interest expense Income tax expense Net income Basic earnings per share Cash dividends per share. Beginning-of-year balance sheet data Accounts receivable, net…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,