FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

![Problem 13-5A (Algo) Comparative ratio analysis LO P3

[The following information applies to the questions displayed below.]

Summary information from the financial statements of two companies competing in the same industry follows.

Barco

Company

Kyan Company

Barco

Company

Kyan Company

Data from the current year-end

balance sheets

Data from the current year's income

statement

Assets

$ 800,000

Cash

$ 18,500

$ 32,000

Accounts receivable, net

40,400

Merchandise inventory

Prepaid expenses

Plant assets, net

84,540

6,000

370,000

52,400

130,500

7,800

303,400

$ 526,100

$ 519,440

$ 69,340

$ 99,300

103,000

196,000

Total assets

Liabilities and Equity

Current liabilities

Long-term notes payable

Common stock, $5 par value

Retained earnings

Total liabilities and equity

83,800

180,000

186,300

$ 519,440

127,800

$ 526,100

Sales

Cost of goods sold

Interest expense

Income tax expense

Net income

Basic earnings per share

Cash dividends per share.

Beginning-of-year balance sheet data

Accounts receivable, net

Merchandise inventory

Total assets

Common stock, $5 par value

Retained earnings

594,100

8,000

$ 883,200

652,500

14,000

15,377

24,383

182,523

192,317

5.07

3.77

4.91

4.00

$ 31,800

$ 54,200

57,600

115,400

408,000

422,500

180,000

196,000

139,497

92,283](https://content.bartleby.com/qna-images/question/e18c4c3e-fff6-4ff0-8265-a5151c1bba12/966a9cba-660a-406b-a055-2c330cd2d7f7/c7pxszq_thumbnail.jpeg)

Transcribed Image Text:Problem 13-5A (Algo) Comparative ratio analysis LO P3

[The following information applies to the questions displayed below.]

Summary information from the financial statements of two companies competing in the same industry follows.

Barco

Company

Kyan Company

Barco

Company

Kyan Company

Data from the current year-end

balance sheets

Data from the current year's income

statement

Assets

$ 800,000

Cash

$ 18,500

$ 32,000

Accounts receivable, net

40,400

Merchandise inventory

Prepaid expenses

Plant assets, net

84,540

6,000

370,000

52,400

130,500

7,800

303,400

$ 526,100

$ 519,440

$ 69,340

$ 99,300

103,000

196,000

Total assets

Liabilities and Equity

Current liabilities

Long-term notes payable

Common stock, $5 par value

Retained earnings

Total liabilities and equity

83,800

180,000

186,300

$ 519,440

127,800

$ 526,100

Sales

Cost of goods sold

Interest expense

Income tax expense

Net income

Basic earnings per share

Cash dividends per share.

Beginning-of-year balance sheet data

Accounts receivable, net

Merchandise inventory

Total assets

Common stock, $5 par value

Retained earnings

594,100

8,000

$ 883,200

652,500

14,000

15,377

24,383

182,523

192,317

5.07

3.77

4.91

4.00

$ 31,800

$ 54,200

57,600

115,400

408,000

422,500

180,000

196,000

139,497

92,283

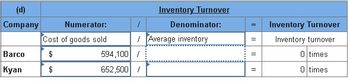

Transcribed Image Text:(d)

Company

Numerator:

Inventory Turnover

Denominator:

Inventory Turnover

Cost of goods sold

Average inventory

=

Barco

$

594,100 /

=

Kyan

$

652,500 /

=

Inventory turnover

0 times

0 times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Godoarrow_forwardProblem 13-2A (Static) Ratios, common-size statements, and trend percents LO P1, P2, P3 Skip to question [The following information applies to the questions displayed below.]Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31 2021 2020 2019 Sales $ 555,000 $ 340,000 $ 278,000 Cost of goods sold 283,500 212,500 153,900 Gross profit 271,500 127,500 124,100 Selling expenses 102,900 46,920 50,800 Administrative expenses 50,668 29,920 22,800 Total expenses 153,568 76,840 73,600 Income before taxes 117,932 50,660 50,500 Income tax expense 40,800 10,370 15,670 Net income $ 77,132 $ 40,290 $ 34,830 KORBIN COMPANY Comparative Balance Sheets December 31 2021 2020 2019 Assets Current assets $ 52,390 $ 37,924 $ 51,748 Long-term investments 0 500 3,950 Plant assets, net 100,000 96,000 60,000 Total assets $ 152,390 $ 134,424 $ 115,698 Liabilities…arrow_forwardAbhaliyaarrow_forward

- Problem 16-17 (Static) Interpretation of Financial Ratios [LO16-2, LO16-3, LO16-6] Pecunious Products, Incorporated's financial results for the past three years are summarized below: Sales trend Current ratio Acid-test ratio Accounts receivable turnover Inventory turnover Dividend yield Dividend payout ratio Dividends paid per share* Year 3 128.0 2.5 9.4 6.5 7.1% 40% $1.50 Year 2 115.0 2.3 0.9 10.6 7.2 6.5% 50% $ 1.50 Year 1 100.0 2.2 1.1 12.5 8.0 5.8% 60% $ 1.50 *There have been no changes in common stock outstanding over the three-year period. Required: Review the results above and answer the following questions: 1. Is it becoming easier for the company to pay its bills as they come due? 2. Are customers paying their accounts at least as fast now as they were in Year 1? 3. Are the accounts receivable increasing, decreasing, or remaining constant? 4. Is inventory increasing, decreasing, or remaining constant? 5. Is the market price of the company's stock going up or down? 6. Is the…arrow_forwardSegment Analysis Verity Company does business in two customer segments: Retail and Wholesale. The following annual revenue information was determined from the accounting system's invoice information: 20Y5 20Y4 Retail $145,400 $138,500 Wholesale 173,100 189,300 Total revenue $318,500 $327,800 Prepare a horizontal analysis of the segments. Round percentages to one decimal place. Enter negative values as negative numbers. Verity Company Horizontal Analysis For the Years 20Y4 and 20Y5 20Y5 20Y4 Difference - Amount Difference - Percent Retail $145,400 $138,500 $fill in the blank fill in the blank % Wholesale 173,100 189,300 fill in the blank fill in the blank % Total revenue $318,500 $327,800 $fill in the blank fill in the blank % Prepare a vertical analysis of the segments. If required, round percentages to one decimal place. Verity Company Vertical Analysis For the Years 20Y4 and 20Y5 20Y5 Amount 20Y5 Percent 20Y4…arrow_forwardsarrow_forward

- Please help with the following question, thank you!arrow_forwardHow to solve questionarrow_forwardSelected hypothetical comparative statement data for the giant bookseller Barnes & Noble are presented here. All balance sheet data are as of the end of the fiscal year (in millions). Net sales Cost of goods sold Net income Accounts receivable (net) Inventory Total assets Total common stockholders' equity a. b. C. d. e. Profit margin Asset turnover Return on assets 2025 $5,050.3 Gross profit rate 3,700.7 65.1 65.0 1.250.1 Compute the following ratios for 2025. (Round asset turnover to 2 decimal places, e.g 1.83 and all other answers to 1 decimal place, e.g. 1.8 or 2.5%) 2,950.1 940.6 Return on common stockholders' equity 2024 $5,800.9 3,200.1 190.9 106.6 1,350.1 3,250.1 1,100.5 % times % % %arrow_forward

- Problem 13-2A (Algo) Ratios, common-size statements, and trend percents LO P1, P2, P3 [The following information applies to the questions displayed below] Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31 2021 2020 2019 Sales Cost of goods sold $ 402,346 $ 308,230 242,212 $ 213,900 194,493 136,896 Gross profit 160,134 113,737 77,004 Selling expenses 57,133 42,536 28,235 Administrative expenses 36,211 27,124 17,754 Total expenses 93,344 69,660 45,989 Income before taxes Income tax expense 66,790 44,077 31,015 12,423 9,036 6,296 Net income $ 54,367 $ 35,041 $ 24,719 KORBIN COMPANY Comparative Balance Sheets December 31 Assets Current assets Long-term investments Plant assets, net Total assets Current liabilities Liabilities and Equity Common stock Other paid-in capital Retained earnings Total liabilities and equity $ 180,932 2021 $ 63,959 116,973 0 2020 $ 42,808 800 106,691 $ 180,932 $ 150,299 $…arrow_forwardRatios Calculated Year 1 Year 2 3.64 +Q+ Price-to-cash-flow 5.20 Inventory turnover 10.40 Debt-to-equity 0.70 8.32 0.56 Year 3 2.91 6.66 0.45 Based on the preceding information, your calculations, and your assumptions, which of the following statements can be included in your analysis report? Check all that apply. Cold Goose Metal Works Inc.'s ability to meet its debt obligations has improved since its debt-to-equity ratio decreased from 0.70 to 0.45. A decline in the inventory turnover ratio can be explained by the new Inventory management system that the company recently adopted, which led to more efficient inventory management. A decline in the debt-to-equity ratio implies a decline in the creditworthiness of the firm. A plausible reason why Cold Goose Metal Works Inc.'s price-to-cash-flow ratio has decreased is that investors expect lower cash flow per share in the future.arrow_forwardVertical Analysis Two income statements for Upward Company follow: Upward Company Income Statements For the Years Ended December 31 20Y5 20Y4 Fees earned $924,000 $784,000 Operating expenses 545,160 478,240 Income from operations $378,840 $305,760 a. Prepare a vertical analysis of Upward Company's income statements. Enter percents as whole numbers. Upward Company Income Statements For the Years Ended December 31 20Y5 Amount 20Y5 Percent 20Y4 Amount 20Y4 Percent Fees earned $924,000 100 % $784,000 100 % 545,160 0X % 478,240 X % Operating expenses X % $305,760 X % Income from operations $378,840arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education