Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

I want to correct answer general accounting

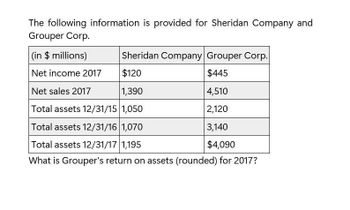

Transcribed Image Text:The following information is provided for Sheridan Company and

Grouper Corp.

Sheridan Company Grouper Corp.

(in $ millions)

Net income 2017

$120

$445

Net sales 2017

1,390

4,510

Total assets 12/31/15 1,050

2,120

Total assets 12/31/16 1,070

3,140

Total assets 12/31/17 1,195

$4,090

What is Grouper's return on assets (rounded) for 2017?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following information is provided for oriole company solve this questionarrow_forwardThe following information is provided for Oceanic Ventures and Pinnacle Holdings: Oceanic Ventures Pinnacle Holdings (in $ millions) Net income 2021 $280 $640 Net sales 2021 3,500 7,200 Total assets 12/31/19 2,400 4,600 Total assets 12/31/202,700 5,000 Total assets 12/31/21 3,000 5,500 Capital expenditures $150 $300 What is Pinnacle Holdings' return on assets (rounded) for 2021?arrow_forwardGeneral accountingarrow_forward

- Financial information for Powell Panther Corporation is shown below: Powell Panther Corporation: Income Statements for Year Ending December 31 (Millions of Dollars) 2018 Sales $ 1,625.0 $ 2017 1,300.0 Operating costs excluding depreciation and amortization 1,300.0 1,105.0 EBITDA $ 325.0 $ 195.0 Depreciation and amortization 39.0 31.0 Earnings before interest and taxes (EBIT) $ 286.0 $ 164.0 Interest 36.0 29.0 Earnings before taxes (EBT) $ 250.0 $ 135.0 Taxes (40%) 100.0 54.0 Net income $ 150.0 $ 81.0 Common dividends $ 135.0 $ 65.0 Powell Panther Corporation: Balance Sheets as of December 31 (Millions of Dollars) 2018 Assets Cash and equivalents $ 23.0 $ 2017 18.0 Accounts receivable 164.0 143.0 Inventories 343.0 312.0 Total current assets $ 530.0 $ 473.0 Net plant and equipment 390.0 312.0 Total assets $ 920.0 $ 785.0 Liabilities and Equity…arrow_forwardWhat is Sarasota's return on assets for 2017 on these general accounting question?arrow_forwardhe condensed balance sheet and income statement data for SymbiosisCorporation are presented below.SYMBIOSIS CORPORATIONBalance SheetsDecember 312014 2013 2012Cash $ 30,000 $ 24,000 $ 20,000Accounts receivable (net) 110,000 48,000 48,000Other current assets 80,000 78,000 62,000Investments 90,000 70,000 50,000Plant and equipment (net) 503,000 400,000 360,000$813,000 $620,000 $540,000 Current liabilities $ 98,000 $ 75,000 $ 70,000Long-term debt 130,000 75,000 65,000Common stock, $10 par 400,000 340,000 300,000Retained earnings 185,000 130,000 105,000$813,000 $620,000 $540,000SYMBIOSIS CORPORATIONIncome StatementsFor the Years Ended December 312014 2013Sales revenue $800,000 $750,000Less: Sales returns and allowances 40,000 50,000Net sales 760,000 700,000Cost of goods sold 420,000 406,000Gross profit 340,000 294,000Operating expenses (including income taxes) 230,000 209,000Net income $110,000 $ 85,000Additional information:1. The market price of Symbiosis common stock was $5.00, $3.50, and…arrow_forward

- What was Lumina Corp.'s rate of return on assets for 2023 on these general accounting question?arrow_forwardComputing Asset Ratios The following information relates to Nicke Inc. Total Fixed Total Net $ millions Assets Assets Revenue Income Fiscal Year 2016 $10,560 $64,188 $97,128 $11,280 Fiscal Year 2015 28,002 200,852 91,803 9,819 Fiscal Year 2014 8,502 55,782 Nicke's fiscal years 2016, 2015, and 2014, end on May 31, 2016, 2015, and 2014, respectively. Required a. Compute the asset turnover ratio for fiscal years 2016 and 2015. b. Compute the return on assets ratio for fiscal years 2016 and 2015. c. Compute the fixed asset turnover ratio for fiscal years 2016 and 2015. Note: Do not round until your final answers. Round final answers to two decimal places. Ratio 2016 2015 a. Asset turnover 0.73 v 0.72 v b. Return on assets 8.53 x 7.65 x c. Fixed asset turnover 5.04 v 5.03 varrow_forwardFinancial information for Powell Panther Corporation is shown below: Powell Panther Corporation: Income Statements for Year Ending December 31 (Millions of Dollars) 2018 2017 Sales $ 1,800.0 $ 1,500.0 Operating costs excluding depreciation and amortization 1,395.0 1,275.0 EBITDA $ 405.0 $ 225.0 Depreciation and amortization 43.0 39.0 Earnings before interest and taxes (EBIT) $ 362.0 $ 186.0 Interest 40.0 33.0 Earnings before taxes (EBT) $ 322.0 $ 153.0 Taxes (40%) 128.8 61.2 Net income $ 193.2 $ 91.8 Common dividends $ 174.0 $ 73.0 Powell Panther Corporation: Balance Sheets as of December 31 (Millions of Dollars) 2018 2017 Assets Cash and equivalents $ 23.0 $ 18.0 Accounts receivable 248.0 225.0 Inventories 396.0 360.0 Total current assets $ 667.0 $ 603.0 Net plant and equipment 429.0 390.0 Total assets $ 1,096.0 $ 993.0 Liabilities and Equity Accounts…arrow_forward

- The following condensed information was reported by Peabody Toys, Inc., for 2018 and 2017:($ in thousands)2018 2017Income statement informationNet sales $5,200 $4,200Net income 180 124Balance sheet informationCurrent assets $ 800 $ 750Property, plant, and equipment (net) 1,100 950Total assets $1,900 $1,700Current liabilities $ 600 $ 450Long-term liabilities 750 750Paid-in capital 400 400Retained earnings 150 100Liabilities and shareholders’ equity $1,900 $1,700Required:1. Determine the following ratios for 2018:a. Profit margin on salesb. Return on assetsc. Return on shareholders’ equity2. Determine the amount of dividends paid to shareholders during 2018.This exercise is based on the Peabody Toys, Inc., data from E 4–27.arrow_forwardThe 2017 Annual Report of Tootsie Roll Industries contains the following information. (in millions) December 31, 2017 December 31, 2016 Total assets $930.9 $920.1 Total liabilities 197.1 208.6 Net sales 515.7 517.4 Net income 80.7 67.2 Compute the following ratios for Tootsie Roll for 2017. (a) Asset turnover (Round answer to 3 decimal places, e.g. 0.851 times.) enter the asset turnover rounded to 4 decimal places times (b) Return on assets (Round answer to 2 decimal places, e.g. 4.87%.) enter the return on assets in percentages rounded to 2 decimal places % (c) Profit margin on sales (Round answer to 2 decimal places, e.g. 4.87%.) enter the profit margin on sales in percentages rounded to 3 decimal places %arrow_forwardPlease givearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning