Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN: 9781337902571

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Don't give me wrong answer

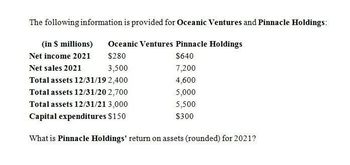

Transcribed Image Text:The following information is provided for Oceanic Ventures and Pinnacle Holdings:

Oceanic Ventures Pinnacle Holdings

(in $ millions)

Net income 2021

$280

$640

Net sales 2021

3,500

7,200

Total assets 12/31/19 2,400

4,600

Total assets 12/31/202,700

5,000

Total assets 12/31/21 3,000

5,500

Capital expenditures $150

$300

What is Pinnacle Holdings' return on assets (rounded) for 2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following information is provided for Oceanic Ventures and Pinnacle Holdings: (in $ millions) Oceanic Ventures Pinnacle Holdings Net income 2021 $280 $640 Net sales 2021 3,500 7,200 Total assets 12/31/19 2,400 4,600 Total assets 12/31/20 2,700 5,000 Total assets 12/31/21 3,000 5,500 Capital expenditures $150 $300 What is Pinnacle Holdings' return on assets (rounded) for 2021?arrow_forwardhe condensed balance sheet and income statement data for SymbiosisCorporation are presented below.SYMBIOSIS CORPORATIONBalance SheetsDecember 312014 2013 2012Cash $ 30,000 $ 24,000 $ 20,000Accounts receivable (net) 110,000 48,000 48,000Other current assets 80,000 78,000 62,000Investments 90,000 70,000 50,000Plant and equipment (net) 503,000 400,000 360,000$813,000 $620,000 $540,000 Current liabilities $ 98,000 $ 75,000 $ 70,000Long-term debt 130,000 75,000 65,000Common stock, $10 par 400,000 340,000 300,000Retained earnings 185,000 130,000 105,000$813,000 $620,000 $540,000SYMBIOSIS CORPORATIONIncome StatementsFor the Years Ended December 312014 2013Sales revenue $800,000 $750,000Less: Sales returns and allowances 40,000 50,000Net sales 760,000 700,000Cost of goods sold 420,000 406,000Gross profit 340,000 294,000Operating expenses (including income taxes) 230,000 209,000Net income $110,000 $ 85,000Additional information:1. The market price of Symbiosis common stock was $5.00, $3.50, and…arrow_forwardAyayai Company Limited reported the following for 2023: sales revenue, $1.16 million; cost of goods sold, $725, 000; selling and administrative expenses, $333, 000; gain on disposal of building, $283,000; and unrealized gain - OCI (related to FV- OCI equity investments with gains/losses not recycled), $17,000. Assume investments are accounted for as FV - OCI equity investments, with gains/losses not recycled through net income. Prepare a statement of comprehensive income. Ignore income tax and EPS.arrow_forward

- Comparative data from the statement of financial position of Munchies Ltd. are shown below. Current assets Property, plant, and equipment Goodwill Total assets Current assets Property, plant, and equipment Total assets 2021 $1,519,000 2021 3,114.000 $4.730,000 % %6 97,000 2020 $1,164.000 2,827,000 107,000 $4,098,000 Using horizontal analysis, calculate the percentage of the base-year amount, using 2019 as the base year. (Round answers to 1 decimal place, e.g. 52.7%) 2020 2019 % $1,227,000 2.871,000 -0- $4,098,000 2019arrow_forwardThe following are selected account balances from Penske Company and Stanza Corporation as of December 31, 2021: Revenues Cost of goods sold Depreciation expense Investment income Dividends declared Retained earnings, 1/1/21 Current assets Copyrights Royalty agreements Investment in Stanza Liabilities Common stock Additional paid-in capital Penske $ (742,000) 264,700 187,000 Not given 80,000 (788,000) 498,000 990,000 772,000 Note: Parentheses indicate a credit balance. Consolidated copyrights Consolidated net income C. Consolidated retained earnings d. Consolidated goodwill Not given (600,000) (600,000) ($20 par) (150,000) a. b. Stanza $ (652,000) 163,000 224,000 0 60,000 (330,000) 598,000 384,000 1,190,000 Amounts 0 On January 1, 2021, Penske acquired all of Stanza's outstanding stock for $829,000 fair value in cash and common stock. Penske also paid $10,000 in stock issuance costs. At the date of acquisition, copyrights (with a six-year remaining life) have a $456,000 book value but a…arrow_forwardSelected financial data regarding current assets and current liabilities for ACME Corporation and Wayne Enterprises, are as follows: ACME Corporation Wayne EnterprisesCurrent assets:Cash and cash equivalents $ 2,494 $ 541Current investments 125Net receivables 1,395 217Inventory 10,710 8,600Other current assets 773 301Total current assets $15,372 $9,784Current liabilitiesCurrent debt $ 1,321 $ 47Accounts payable 8,871 5,327Other current liabilities 1,270 2,334Total current…arrow_forward

- the income statement of x ltd for the year ended was as follows: net sales 4032000, cost of sales 3168000, depreciation 96000, salaries and wages 384000, opex 128000, provision for taxation 140800, net operating profit 11520. compute net profit before working capital changesarrow_forwardFrom the following information for BlueInks Corporation, compute the rate of return on assets. Hint: The numerator is income before interest expense and taxes. Net income $40,878 Total assets at beginning of year $250,100 Total assets at end of year $158,680 a. 15% b. 25% c. 16% d. 20%arrow_forwardConsider the following statement of comprehensive Income for the Dartmoor Corporation: DARTMOOR CORPORATION Statement of Comprehensive Income Taxable income Taxes (34%) Net income Dividends Addition to retained earnings Current assets Cash The statement of financial position for the Dartmoor Corporation follows. Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets $2,500 7,862 EFN Assets DARTMOOR CORPORATION Statement of Financial Position $ 2,950 4,100 6,400 $13,458 $41,300 $54,750 31,300 $15,700 5,338 $10,362 Prepare a pro forma statement of financial position, assuming a 15% Increase in sales, no new external debt or equity financing, and a constant payout ratio. (Do not round Intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign In your response.) Current liabilities Accounts payable Notes payable Total Long-term…arrow_forward

- Suppose in its 2027 annual report that McDonald's Corporation reports beginning total assets of $20.80 billion, ending total assets of $19.20 billion, net sales of $21.80 billion, and net income of $4.10 billion. (a) Compute McDonald's return on assets. (Round return on assets to one decimal place, e.g. 5.1%.) McDonald's return on assets % (b) Compute McDonald's asset turnover. (Round asset turnover to 2 decimal places, e.g. 5.12.) McDonald's asset turnover timesarrow_forwardThe following are selected account balances from Penske Company and Stanza Corporation as of December 31, 2024: Accounts Revenues Cost of goods sold Depreciation expense Investment income Dividends declared Retained earnings, 1/1/24 Current assets Copyrights Royalty agreements Penske $ (742,000) 264,700 187,000 Not given. 80,000 (788,000) 498,000 990,000 Investment in Stanza Liabilities Common stock Additional paid-in capital 772,000 Not given (600,000) (600,000) ($20 par) (150,000) Stanza $ (652,000) 163,000 224,000 0 60,000 (330,000) 598,000 384,000 1,190,000 0 (1,357,088) (200,000) ($10 par) (80,000) Note: Parentheses indicate a credit balance. On January 1, 2024, Penske acquired all of Stanza's outstanding stock for $829,000 fair value in cash and common stock. Penske also paid $10,000 in stock Issuance costs. At the date of acquisition, copyrights (with a six-year remaining life) have a $456,000 book value but a fair value of $660,000. Required: a. As of December 31, 2024, what is…arrow_forwardPlease helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning