Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Need answer the question

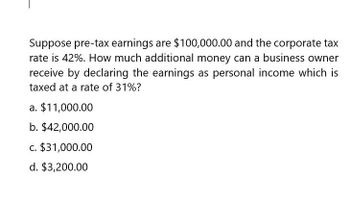

Transcribed Image Text:Suppose pre-tax earnings are $100,000.00 and the corporate tax

rate is 42%. How much additional money can a business owner

receive by declaring the earnings as personal income which is

taxed at a rate of 31%?

a. $11,000.00

b. $42,000.00

c. $31,000.00

d. $3,200.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company has pre-tax or operating income of $120,000. If the tax rate is 40%, what is the companys after-tax income? A. $300,000 B. $240,000 C. $48,000 D. $72,000arrow_forwardAlbion Inc. provided the following information for its most recent year of operations. The tax rate is 40%. Required: 1. Compute the following: (a) return on sales, (b) return on assets, (c) return on stockholders equity, (d) earnings per share, (e) price-earnings ratio, (f) dividend yield, and (g) dividend payout ratio. 2. CONCEPTUAL CONNECTION If you were considering purchasing stock in Albion, which of the above ratios would be of most interest to you? Explain.arrow_forwardSolvearrow_forward

- Helparrow_forwardThe following extracts are from Hassan's financial statements: $ 10,200 (1,600) (3,300) 5,300 Profit before interest and tax Interest Таx Profit after tax Share capital Reserves 20,000 15,600 35,600 6,900 42,500 Loan liability What is Hassan's return on capital employed?arrow_forwardRefer to the data for Eccles Inc. earlier. If the effective personal tax rates on debt income and stock income are Td = 25% and TS = 20% respectively, what is the value of the firm according to the Miller model (Based on the same unlevered firm value in the earlier question)? a. $475,875 b. $536,921 c. $587,750 d. $623,050 O $564,167arrow_forward

- What is the amount of corporate tax the company must pay for this accounting question?arrow_forwardUse the following Income Tax Calculation table to calculate the total income tax that someone would owe if their annual income was $83,350. In the image.arrow_forwardYou are a shareholder in a corporation. The corporation earns $5 per share before taxes. After it has paid taxes, it will distribute the rest of its earnings to you as dividend. The corporate tax rate is 30% and your personal tax rate on dividend income is 25%. What is the amount of your after-tax earnings on dividend? a. 0.875 b. 1.25 c. 1.875 d. 2.625 e. 3.50arrow_forward

- 1 Calculate the Tax implications if the company has earnings before taxes of $ 350,000.00 Both if the company is a Corporation or Sole proprietorship What is the total taxes, average rate and the marginal tax rate Corporate Tax Rate: Total Taxes as Coorporation Personal Marginal Income Tax Rates: Single: Taxable Income Over--- 0 9,525 38,700 82,500 157,500 200,000 500,000 Total Tax Paid Marginal Tax Rate Average Tax Rate Taxable Income 350000 But not over Over--- 0 9,525 38,700 82,500 157,500 200,000 500,000 === 9,525 38,700 82,500 157,500 200,000 500,000 But not over --- 9,525 38,700 82,500 157,500 200,000 500,000 Marginal Tax Rate 10% 12% 22% 24% 32% 35% 37% Marginal Tax Rate 10% 12% 22% 24% 32% 35% 37% 21% Difference Incremental Taxes Cumulative Taxesarrow_forward1arrow_forwardLast year Sherlock had an annual earned income of S58,475. He also had passive income of $1,255, and capital gains of $2,350. What was Sherlock's total gross income for the year? a. $58.475 b. 559.730 c. 560 985 d.562.080arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning  Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT