FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:2. Prepare the investing activities section of the statement of cash flows for

Laporte Inc. for the year ended December 31, 2017. (Negative answers

should be indicated by a minus sign. Enter your answers in millions.)

LAPORTE INC.

Statement of Cash Flows (Partial)

For the Year Ended December 31,

2017

Cash flows from investing

activities:

Purchase of equipment

Sale of equipment

Sale of long-term investment

$ (30)

12

40

Net cash flow from

22

investing activities

3. Compute each of the following for the year 2017: (a) quality of earnings ratio,

(b) capital expenditures ratio, and (c) free cash flow. (Negative answers

should be indicated by a minus sign. Round "Ratio" answers to 2 decimal

places.)

Quality of

(а)

earnings ratio

(0.56)

Сapital

(b) expenditures

ratio

(c) Free cash flow

4. Based on your answers to (1.) and (2.) above, determine the net cash flow

from financing activities. (Hint: This can be done without preparing the

financing activities section of the statement.) (Enter your answer in

millions.)

Cash flow from financing

activities

$ 12

5. The president of Laporte Inc., Tanya Turcotte, was provided with a copy of

the operating activities section of the statement of cash flows that you

prepared in (1.), and made the following comment: “This report is supposed

to show operating cash inflows and outflows during the year, but I don't see

how much cash Laporte Inc. received from customers and how much it paid

to trade suppliers and for income taxes. Please ask whoever prepared this

statement to provide me with these numbers." Based on Tanya's comment,

compute the following amounts for 2017: (Enter your answers in millions.)

Cash collected from

a.

customers

Cash paid to trade

b.

suppliers

Cash paid for income

C.

taxes

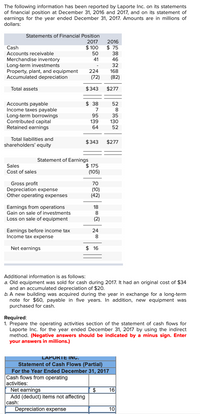

Transcribed Image Text:The following information has been reported by Laporte Inc. on its statements

of financial position at December 31, 2016 and 2017, and on its statement of

earnings for the year ended December 31, 2017. Amounts are in millions of

dollars:

Statements of Financial Position

2017

$ 100

2016

Cash

$ 75

Accounts receivable

50

38

Merchandise inventory

Long-term investments

Property, plant, and equipment

Accumulated depreciation

41

46

32

224

168

(72)

(82)

Total assets

$343

$277

$ 38

Accounts payable

Income taxes payable

Long-term borrowings

Contributed capital

Retained earnings

52

95

35

139

130

64

52

Total liabilities and

$343

$277

shareholders' equity

Statement of Earnings

$ 175

(105)

Sales

Cost of sales

Gross profit

Depreciation expense

Other operating expenses

70

(10)

(42)

18

Earnings from operations

Gain on sale of investments

8

Loss on sale of equipment

(2)

Earnings before income tax

Income tax expense

24

8

Net earnings

$ 16

Additional information is as follows:

a. Old equipment was sold for cash during 2017. It had an original cost of $34

and an accumulated depreciation of $20.

b. A new building was acquired during the year in exchange for a long-term

note for $60, payable in five years. In addition, new equipment was

purchased for cash.

Required:

1. Prepare the operating activities section of the statement of cash flows for

Laporte Inc. for the year ended December 31, 2017 by using the indirect

method. (Negative answers should be indicated by a minus sign. Enter

your answers in millions.)

LAPUΙΕ INC.

Statement of Cash Flows (Partial)

For the Year Ended December 31, 2017

Cash flows from operating

activities:

16

Net earnings

Add (deduct) items not affecting

cash:

Depreciation expense

$

10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Text Predictions: On ABC Inc. Balance Sheet as at December 31, 2015 and 2016 ($ thousands) Current Assets Cash Accounts Receivable Inventory Total Current Assets Fixed Assets Property, Plant & Equipment Less Accumulated Depreciation Property, Plant & Equipment, net Total Assets Liabilities and S/H Equity Current Liabilities Accounts Payable Notes Payable and short-term debt Total Current Liabilities Long-Term Debt Shareholders' Equity Common Shares Paid-In Capital Retained Earnings Total Total Liabilities and S/H Equity ABC Inc. Income Statement for 2015 and 2016 ($ thousands) Revenue Cost of Goods Sold Operating Expenses Depreciation Earnings Before Interest & Taxes (EBIT) Interest Paid Income Before Taxes (EBT) Taxes Paid Net Income (NI) Dividend Accessibility: Investigate 2015 $ 200 450 550 $1,200 2.200 (1.000) 1,200 $2,400 $ 200 0 $ 200 $ 600 300 600 700 $1,600 $2,400 2015 $1,200 700 30 220 S 250 50 $ 200 180 $ 120 $ S 2016 $ 150 425 625 $1,200 2016 $1,450 850 40 200 $360 160 $ 300…arrow_forwardThe financial statements of Clearwater Furniture Company include the following items: Cash OA. 0.12 OB. 0.27 OC. 0.21 Short-term Investments Net Accounts Receivable Merchandise Inventory Total Assets Total Current Liabilities Long term Note Payable 2017 $63,500 28,000 94,000 157,000 531,000 234,000 62,000 2016 $51,000 17,000 106,000 143,000 544,000 217,000 52,000 Using the following formula, what is 2017 cash ratio? (Round your answer to two decimal places.). FORMULA: Cash ratio (Cash + Cash equivalents)/Total current liabilitiesarrow_forwardQUESTION: SWISS GROUP REPORTS A NET INCOME OF $40,000 FOR 2017. AT THE BEGINNING OF 2017, SWISS GROUP HAD $200,000 IN ASSETS. BY THE END OF 2017, ASSETS HAD GROWN TO $300,000. WHAT IS SWISS GROUP'S 2017 RETURN ON ASSETS?arrow_forward

- Use the following information to answer this question. Windswept, Inc. 2017 Income Statement ($ in millions) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes Net income Cash Accounts rec.. Inventory Total Net fixed assets Total assets $11,400 8,150 440 $ 2,810 108 $ 2,702 946 $1,756 Windswept, Inc. 2016 and 2017 Balance Sheets ($ in millions) 2016 2017 $ 320 $ 350 What is the equity multiplier for 2017? Accounts payable 1,190 1,090 Long-term debt 2,120 1,805 Common stock $3,630 $3,245 Retained earnings 3,560 4,180 $7,190 $7,425 Total liab. & equity 2016 2017 $1,950 $2,022 1,110 1,393. 3,440 3,070 690 940 $7,190 $7,425arrow_forwardFollowing is the balance sheet for 3M Company. At December 31 2015 2014 Cash and cash equivalents $ 1,798 $ 1,897 Marketable securities-current 118 1,439 Accounts receivable, net 4,154 4,238 Inventories 3,518 3,706 Other current assets 1,398 1,023 Total current assets 10,986 12,303 Marketable securities-noncurrent 126 117 Property, plant and equipment--net 8,515 8,489 Goodwill 9,249 7,050 Intangible assets-net 2,601 1,435 Prepaid pension benefits 188 46 1,053 $32,718 1,769 $31,209 Other assets Total assets $ $ Short-term debt & current portion of LT debt Accounts payable 2,044 106 1,694 1,807 Accrued payroll 644 732 Accrued income taxes 332 435 Other current liabilities 2,404 2,884 Total current liabilities 7,118 5,964 Long-term debt 8,753 6,705 Pension and postretirement benefits 3,520 3,843 Other liabilities 1,580 1,555 Total liabilities 20,971 18,067 3M Company shareholders' equity: Common stock 9. Additional paid-in capital Retained earnings 4,791 4,379 36,575 34,317 Treasury stock…arrow_forwardThe table below contains data on Fincorp Incorporated. The balance sheet items correspond to values at year-end 2021 and 2022, while the income statement items correspond to revenues or expenses during the year ended 2021 and 2022. All values are in thousands of dollars. Revenue Cost of goods sold Depreciation Inventories Administrative expenses Interest expense Federal and state taxes* Accounts payable Accounts receivable. Net fixed assets* Long-term debt Notes payable Dividends paid Cash and marketable securities 2021 $ 4,100 1,700 470 270 520 240 340 320 350 4,800 2,400 687 380 760 Net working capital 2022 $ 4,200 1,800 490 335 570 240 360 355 395 * Taxes are paid in their entirety in the year that the tax obligation is incurred. t Net fixed assets are fixed assets net of accumulated depreciation since the asset was installed. 5,540 2,860 540 380 480 What was the change in net working capital during the year? Note: Enter your answer in thousands of dollars. byarrow_forward

- opines Text Predictions: On ABC Inc. Balance Sheet as at December 31, 2015 and 2016 ($ thousands) Current Assets Cash Accounts Receivable Inventory Total Current Assets Fixed Assets Property, Plant & Equipment Less Accumulated Depreciation Property, Plant & Equipment, net Total Assets Liabilities and S/H Equity Current Liabilities Accounts Payable Notes Payable and short-term debt Total Current Liabilities Long-Term Debt Shareholders Equity Common Shares Paid-In Capital Retained Earnings Total Total Liabilities and S/H Equity ABC Inc. Income Statement for 2015 and 2016 ($ thousands) Revenue Cost of Goods Sold Operating Expenses Depreciation Earnings Before Interest & Taxes (EBIT) Interest Paid Income Before Taxes (EBT) Taxes Paid Net Income (N) Dividend Accessibility: Investigate $ 200 450 550 $1,200 2.200 (1,000) 1,200 2015 $2,400 $ 200 0 $ 200 $ 2015 300 600 700 $1,600 $2,400 $1,200 700 30 220 $ 250 50 $ 200 1180 $ 120 600 mm 2016 $1,450 850 40 200 $ 360 60 $ 300 120 180 80 $ 2016 $…arrow_forwardThe current sections of Crane Inc.’s balance sheets at December 31, 2021 and 2022, are presented here. Crane’s net income for 2022 was $154,700. Depreciation expense was $26,300. 2022 2021 Current assets Cash $102,700 $97,700 Accounts receivable 79,400 90,000 Inventory 168,200 173,000 Prepaid expenses 26,900 22,900 Total current assets $377,200 $383,600 Current liabilities Accrued expenses payable $15,000 $9,300 Accounts payable 84,000 95,600 Total current liabilities $99,000 $104,900 Prepare the operating activities section of the company’s statement of cash flows for the year ended December 31, 2022, using the indirect methodarrow_forwardTable 1: Revenue and expense information for the year 2017 and balance sheet items at 31 December 2017 Cash Net fixed assets Interest paid Creditors Debtors Accumulated retained profit - end of 2017 Costs of goods sold Sales revenue Short-term loans Overdraft balance Expenses Share capital Dividends paid Long-term liabilities Stock of toy parts $1000 $27000 $250 $4000 $3500 $10000 $7500 $27250 $1500 $2000 $7000 $13500 $2500 $5000 $4500arrow_forward

- The following is the comparative balance sheet of Manish Ltd. Prepare a Cash Flow Statement for the year ended 31 December, 2016 from the details given below: Liabilities Assets 31st Dec., 31st Dec., 2015 31st Dec., 31st Dec., 2015 2016 2016 Share Capital Reserves & Surplus 730,000 755,000 Long-term loans Current Liabilities Fixed assets 760,000 792,500 Depreciation 717,500 27,500 Inventory Accounts 740,000 740,000 720,000 30,000 715,000 26,000 740,000 735,000 20,000 734,000 Receivable Dividend Provision 78,000 マ1,05,000 1,59,000 Cash 72,500 725,000 そ1,05,000 マ1,59,000 The Income statement for Manish Ltd. for the year ended 31 December 2015 shows the following information: Amount(*) 1,45,000 99,000 12,500 8,000 Sales Cost of Sales Tax provisions Dividend providedarrow_forwardPresented below is selected financial data for Teague Industries for the current year: Current assets: Current liabilities Cash and cash equivalents $3503 Accounts payable $5385 Short-term investments 1555 Other current liabilities 2892 Receivables, net 1811 Total current liabilities 8277 Merchandise inventories 6205 Noncurrent liabilities 5196 Other current assets 1975 Shareholders' Equity 6250 Total current assets 15,049 Total liabilities and shareholders' equity $19,723 Noncurrent assets 4674 Total assets $19,723 Revenues $50,826 Costs and Expenses 45,963 Operating Income 4,863 Other income/expense (including interest expense of $60) (36) Income before income tax 4827 Income tax expense (1449) Net income $3378 Previous Years' Financial Data Total Assets $17,020 Shareholders' Equity 4000 The financial leverage for Teague Industries is ________. (Round your answer to two decimal places, X.XX.)arrow_forwardBelow are Laiho Industries' 2017 and 2018 balance sheet items: Cash Accounts Receivable Long-Term Debt Accounts Payable Common Stock (total value) Notes Payable Net Fixed Assets Accruals Inventories Retained Earnings $ $ $ $ LA $ LA $ LA $ LA LA 2018 102,850.00 103,365.00 76,264.00 30,761.00 100,000.00 $ $ $ $ Sm 16,717.00 $ 67,165.00 $ 30,477.00 $ 38,444.00 $ 57,605.00 2017 89,725.00 85,527.00 63,914.00 23,109.00 90,000.00 14,217.00 42,436.00 22,656.00 34,982.00 38,774.00 Sales for 2018 were $455,150, and EBITDA was 15% of sales. Furthermore, depreciation and amortization were 11% of net fixed assets, interest was $8,575, the corporate tax rate was 40%, and Laiho pays 40% of its net income as dividends. Given this information, construct the firm's 2018 income statement, statement of cash flows, and statement of owner's equity. Then answer the questions below.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education