FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

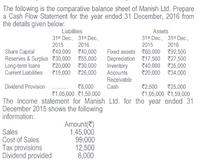

Transcribed Image Text:The following is the comparative balance sheet of Manish Ltd. Prepare

a Cash Flow Statement for the year ended 31 December, 2016 from

the details given below:

Liabilities

Assets

31st Dec., 31st Dec.,

2015

31st Dec., 31st Dec.,

2015

2016

2016

Share Capital

Reserves & Surplus 730,000 755,000

Long-term loans

Current Liabilities

Fixed assets 760,000 792,500

Depreciation 717,500 27,500

Inventory

Accounts

740,000 740,000

720,000 30,000

715,000 26,000

740,000 735,000

20,000 734,000

Receivable

Dividend Provision

78,000

マ1,05,000 1,59,000

Cash

72,500

725,000

そ1,05,000 マ1,59,000

The Income statement for Manish Ltd. for the year ended 31

December 2015 shows the following

information:

Amount(*)

1,45,000

99,000

12,500

8,000

Sales

Cost of Sales

Tax provisions

Dividend provided

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Text Predictions: On ABC Inc. Balance Sheet as at December 31, 2015 and 2016 ($ thousands) Current Assets Cash Accounts Receivable Inventory Total Current Assets Fixed Assets Property, Plant & Equipment Less Accumulated Depreciation Property, Plant & Equipment, net Total Assets Liabilities and S/H Equity Current Liabilities Accounts Payable Notes Payable and short-term debt Total Current Liabilities Long-Term Debt Shareholders' Equity Common Shares Paid-In Capital Retained Earnings Total Total Liabilities and S/H Equity ABC Inc. Income Statement for 2015 and 2016 ($ thousands) Revenue Cost of Goods Sold Operating Expenses Depreciation Earnings Before Interest & Taxes (EBIT) Interest Paid Income Before Taxes (EBT) Taxes Paid Net Income (NI) Dividend Accessibility: Investigate 2015 $ 200 450 550 $1,200 2.200 (1.000) 1,200 $2,400 $ 200 0 $ 200 $ 600 300 600 700 $1,600 $2,400 2015 $1,200 700 30 220 S 250 50 $ 200 180 $ 120 $ S 2016 $ 150 425 625 $1,200 2016 $1,450 850 40 200 $360 160 $ 300…arrow_forwardCalculate the cash operating cycle of Stone Limited for the year ended 30 April, 2018 and 2019.arrow_forwardQuestion: The following selected data for ABC Corporation for the year ended December 31, 2020, is available to you for preparing the cash flow statement: Cost of goods sold $56,500 Sales revenue $97,300 Amortization expense 14,100 Interest revenue 4,100 Income tax expense 2,300 Dividend revenuearrow_forward

- opines Text Predictions: On ABC Inc. Balance Sheet as at December 31, 2015 and 2016 ($ thousands) Current Assets Cash Accounts Receivable Inventory Total Current Assets Fixed Assets Property, Plant & Equipment Less Accumulated Depreciation Property, Plant & Equipment, net Total Assets Liabilities and S/H Equity Current Liabilities Accounts Payable Notes Payable and short-term debt Total Current Liabilities Long-Term Debt Shareholders Equity Common Shares Paid-In Capital Retained Earnings Total Total Liabilities and S/H Equity ABC Inc. Income Statement for 2015 and 2016 ($ thousands) Revenue Cost of Goods Sold Operating Expenses Depreciation Earnings Before Interest & Taxes (EBIT) Interest Paid Income Before Taxes (EBT) Taxes Paid Net Income (N) Dividend Accessibility: Investigate $ 200 450 550 $1,200 2.200 (1,000) 1,200 2015 $2,400 $ 200 0 $ 200 $ 2015 300 600 700 $1,600 $2,400 $1,200 700 30 220 $ 250 50 $ 200 1180 $ 120 600 mm 2016 $1,450 850 40 200 $ 360 60 $ 300 120 180 80 $ 2016 $…arrow_forwardHow do I describe the cash flow patternarrow_forwardStatement of Cash FlowPresented below are the financial statements for the Amphlett Corporation, as of year-end 2012 and 2013. AMPHLETT CORPORATIONConsolidated Balance Sheets As of Year-End ($ thousands) 2013 2012 Assets Current Cash $18,000 $108,000 Marketable securities 240,000 - Accounts receivable (net) 708,000 528,000 Inventory 720,000 738,000 Total current assets 1,686,000 1,374,000 Noncurrent Long-term investments 372,000 468,000 Property & equipment 2,160,000 1,320,000 Less: Accumulated depreciation (600,000) (600,000) Property & equipment (net) 1,560,000 720,000 Intangibles (net) 114,000 126,000 Total noncurrent assets 2,046,000 1,314,000 Total assets $3,732,000 $2,688,000 Liabilities & Shareholders' Equity Accounts payable $1,080,000 $1,020,000 Short-term bank debt 228,000 - Total liabilities 1,308,000 1,020,000…arrow_forward

- REQUIREDUse the information provided below to prepare the Cash Flow Statement for the year ended 30 June 2020.INFORMATIONThe information given below was extracted from the books of Siyakha Limited for the financial year ended30 June 2020.1. STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE:2020R2019RASSETSProperty, plant and equipment (See note to the financial statements below.) 14 826 000 13 998 000Inventory 1 539 000 1 638 000Accounts receivable 6 243 000 4 572 000Bank 861 000 480 00023 469 000 20 688 000EQUITY AND LIABILITIESOrdinary Share Capital 9 300 000 8 220 000Retained Income 2 031 000 1 701 000Loan: OVS Bank 8 100 000 5 940 000Accounts payable 3 795 000 3 549 000Company tax payable 150 000 564 000Dividends payable 93 000 714 00023 469 000 20 688 0002. STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 JUNE 2020RDepreciation on Vehicles 1 233 000Depreciation on Equipment 1 083 000Operating profit 3 801 000Interest on Loan 1 404 000Profit before tax 2 397 000Profit after tax…arrow_forwardcash flow statment Assets Long term investments long-term assets Brand name & Goodwell The comparative statements of financial position of Lopez Inc. at the beginning and the end of the year 2022 appear as follows. Inventory Accounts receivable Cash Total J Equity and Liabilities Share capital ordinary Retained earnings Accounts payable Income Tax payable Total Ć Lopez Inc. Statements of Financial Position Dec.31, 2022 $ 56,000 115,000 50,000 100,000 65,000 12,000 $398,000 $250,000 61,000 53,000 34,000 $398,000 Jan. 1, 2022 $ 40,000 150,000 43,000 60,000 40,000 43,000 $376,000 $ 200,000 91,000 75,000 10,000 $376,000 Additional information Net income $90,000 Deprecation on long term assets $25,000 dividends of $15,000 were paid in 2022 a long-term asset with a net book value of $10,000 were sold at a gain of $17,000 Instructions From the information given above, prepare a Cash Flow Statement for Lopez Inc. for the period ending 31st Dec., 2022 (Using indirect method). Show very clearly…arrow_forwardPrepare the Cash Flow for the year 2021arrow_forward

- Consider the following balance sheet and income statement for Metro Eagle Outfitters, in condensedform, including some information from the cash flow statement:Balance Sheet 2019 2018 2017Cash and short-term investments $ 630,992 $ 745,044 $ 734,693Accounts receivable 46,321 40,310 36,721Inventory 332,452 367,514 301,208Other current assets 132,035 134,620 101,788Total current assets 1,141,800 1,287,488 1,174,410Long-lived assets 582,832 647,482 593,802Total assets $ 1,724,632 $ 1,934,970 $ 1,768,212Current liabilities $ 432,902 $ 405,401 $ 387,837Total liabilities 503,445 517,786 417,141Shareholders’ equity 1,221,187 1,417,184 1,351,071Total debt and equity $ 1,724,632 $ 1,934,970 $ 1,768,212Income StatementSales $ 3,475,802 $ 3,120,065 $ 2,945,294Cost of sales 2,085,480 1,975,471 1,763,143Gross margin $ 1,390,322 $ 1,144,594 $ 1,182,151Operating expenses 988,284 869,385 864,776Earnings before interest and taxes $ 402,038 $ 275,209 $ 317,375Net income $ 232,108 $ 151,705 $…arrow_forwardThe following summary financial statement information is provided for Denbury Industries: Cash and cash equivalents Short-term investments Accounts receivable Inventory Property, plant, and equipment Long-term investments Total assets Net income Interest expense Investment income Multiple Choice O 2024 2023 $ 239,850 $ 368,740 Calculate the return on investments ratio for 2024. 2.5% 25,640 18,740 658,930 690,760 345,920 415,380 859,710 735,480 83,670 65,300 2,213,720 2,294,400 $ 279,630 $ 199,850 39,540 25,670 5,750 3,170arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education