Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

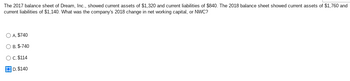

Transcribed Image Text:**Question:**

The 2017 balance sheet of Dream, Inc., showed current assets of $1,320 and current liabilities of $840. The 2018 balance sheet showed current assets of $1,760 and current liabilities of $1,140. What was the company’s 2018 change in net working capital, or NWC?

**Options:**

- A. $740

- B. -$740

- C. $114

- D. $140

The correct answer is **D. $140**.

**Explanation:**

Net Working Capital (NWC) is calculated as the difference between current assets and current liabilities.

For 2017:

- NWC = Current Assets (2017) - Current Liabilities (2017)

- NWC = $1,320 - $840 = $480

For 2018:

- NWC = Current Assets (2018) - Current Liabilities (2018)

- NWC = $1,760 - $1,140 = $620

Change in NWC from 2017 to 2018:

- Change in NWC = NWC (2018) - NWC (2017)

- Change in NWC = $620 - $480 = $140

Thus, the company's change in net working capital for 2018 is $140.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The balance sheet for Aggie Company at December 31, 2021 indicated that total assets were $1,450 and total liabilities were $1,160. At December 31, 2022 total assets had decreased to $1,280. Additional information available for 2022 included the following: Revenues $580 Expenses 370 Dividends 48 Total liabilities on the December 31, 2022 balance sheet were: Select one: O O O O a. $500 b. $452 C. $876 d. $828 e. $1,032arrow_forwardCalculate NOPAT, Net operting Working capital, Capital expenditure and free cash flow for 2021arrow_forwardForecast an Income StatementSeagate Technology reports the following income statement for fiscal 2019. SEGATE TECHNOLOGY PLC Consolidated Statement of Income For Year Ended June 28, 2019, $ millions Revenue $20,780 Cost of revenue 14,916 Product development 1982 Marketing and administrative 906 Amortization of intangibles 46 Restructuring and other, net (44) Total operating expenses 17,806 Income from operations 2,974 Interest income 168 Interest expense (448) Other, net 50 Other expense, net (230) Income before income taxes 2,744 (Benefit) provision for income taxes (1,280) Net income $4,024 Forecast Seagate’s 2020 income statement assuming the following income statement relations ($ millions). Revenue growth 5% Cost of revenue 71.8% of revenue Product development 9.5% of revenue Marketing and administrative 4.4% of revenue Amortization of intangibles No change Restructuring and other, net $0 Interest income No change…arrow_forward

- B. Working Capital = Current Assets - Current Liabilities 2021 = Working Capital $263,000 - $50,000 $213,000 2022 Working Capital = $347,000 $69,000 = $278,000 Current Ratio = Current Assets Current Liabilities 2021 2022 Current Ratio = $263,000 $50,000 $347,000 $69,000 = 5.3:1 5.0:1 Debt to Total Assets = Total Liabilities Total Assets 2021 2022 = $180,000 $382,000 $184,000 $487,000 = 47.1% 37.8% C. The working capital has increased between 2021 and 2022, indicating greater liquidity for the firm in its ability to pay its current liabilities as they become due. The current ratio has decreased between 2021 and 2022; however, it is still quite high. Note also that there is a substantial portion of the current assets in cash and accounts receivable, which may be converted into cash quickly (assuming the receivables are collectible). The company, therefore, should not have any problems in paying its current liabilities as they become due. The debt to total assets indicates the percentage…arrow_forwardWhat’s is the Return on Average Equity?arrow_forward5.17. A company's statement of financial position at the end of 2018 included the following items. 2018 Land Buildings Accum. Depr.-buildings Equipment Accum. Depr.- equipment Patents Long-term investment Current assets Total assets Bond payable Current liabilties Share capital -ordinary Treasury shares Retained earnings Total Liabilities and Equity The following information is available for 2019. 1. Net income was $55,000 30,000 120,000 (30,000) 90,000 (11,000) 40,000 Instructions: 235,000 474,000 a. Prepare a statement of cash flows for 2019. b. Prepare a statement of financial postiion at the end of 2019. 100,000 150,000 180,000 2. Equipment (cost $20,000 and accumulated depreciation 8,000) was sold for 9,000. 3. Depreciation expense was $4,000 on the building and $9,000 on equipment 44,000 474,000 4. Patent amortization was $2,500. 5. Current assets other than cash increased by $25,000. Current liabilities increased by $13,000. 6. An addition to the building was completed at a cost…arrow_forward

- Suppose McDonald’s 2022 financial statements contain the following selected data (in millions). Current assets $3,381.0 Interest expense $466.0 Total assets 30,189.0 Income taxes 1,929.0 Current liabilities 2,963.0 Net income 4,544.0 Total liabilities 16,156.0 (a1)Compute the following values. a. Working capital. (Round to 1 decimal place, e.g. 5,275.5) $enter a dollar amount in millions millions b. Current ratio. (Round to 2 decimal places, e.g. 6.25:1.) enter current ratio rounded to 2 decimal places :1 c. Debt to assets ratio. (Round to 0 decimal places, e.g. 62%.) enter percentages rounded to 0 decimal places % d. Times interest earned. (Round to 2 decimal places, e.g. 6.25.) enter times interest earned rounded to 2 decimal places timesarrow_forwardHypothetical balance sheets of Nike, Inc. are presented here. NIKE, INC.Condensed Balance SheetMay 31($ in millions) 2022 2021 Assets Current Assets $9,600 $8,790 Property, plant, and equipment (net) 1,810 1,800 Other assets 1,580 1,710 Total assets $12,990 $12,300 Liabilities and Stockholders' Equity Current Liabilities $3,170 $3,300 Long-term liabilities 1,230 1,390 Stockholders’ equity 8,590 7,610 Total liabilities and stockholders' equity $12,990 $12,300 (a) Prepare a horizontal analysis of the balance sheet data for Nike, using 2021 as a base. (If amount and percentage are a decrease show the numbers as negative, e.g. -55,000, -20% or (55,000), (20%). Round percentages to 1 decimal place, e.g. 12.5%.) NIKE, INC.Condensed Balance SheetMay 31($ in millions) 2022 2021 Increase(Decrease) PercentageChangefrom 2021…arrow_forwardWakanda Mulla has presented the following financial data for 2017 : Balance Sheet 2016 2017 Non-Current Assets Cost Depn NBV Cost Depn NBV Goodwill 260,000 210,000 Tangible Assets 1,800,000 (360,000) 1,440,000 2,300,000 (450,000) 1,850,000 Long term Investment 130,000 130,000 1,830,000 2,190,000 Current Assets Closing Stock 35,000 55,000 Debtors 65,000 20,000 Short term Investment 40,000 65,000 Bank 0 40,000 Cash 2,000 142,000 17,000 197,000 Total Assets 1,972,000 2,387,000 Capital & Reserves Share Capital 700,000…arrow_forward

- return on Assets Sue Company reports the following information in its financial statements. Numbers are in thousands. 2019 2018Net Sales $42,075 $44,100Net Income 12,780 15,732Total Assets 63,900 87,400 There were 5,000 outstanding shares at December 31, 2019.Required a. What was Sue's return on assets for 2019 and 2019? (Round to one decimal point)arrow_forwardDiscuss the overarching idea of Asset Liability Management and its key objectives. How does the process of Gap Analysis support Asset Liability Management?arrow_forwardHow do I determine the NNO for 2014? Dec. 31, 2016 Dec. 31, 2015 Dec. 31, 2014 Operating Assets 1,447,869 1,513,139 Operating liabilities 1,094,173 1,158,007 Net operating assets (NOA) 353,696 355,132 $ 397,299.00 NNO $ 490,548 $ 473,323 Equity $ 844,244 $ 828,455 $ 726,328.00 NOA= NNO + Equity $ 1,334,792 $ 1,301,778arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education