FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

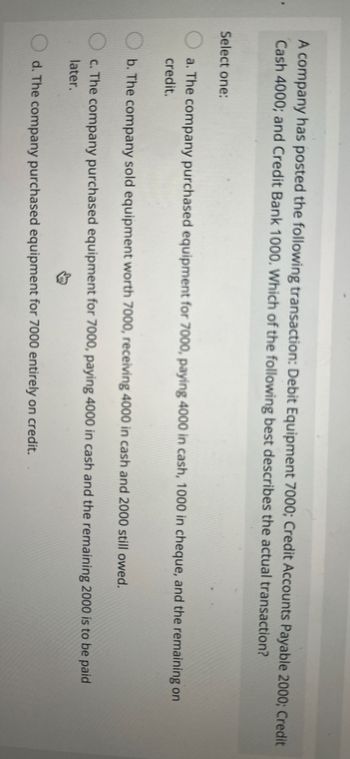

Transcribed Image Text:A company has posted the following transaction: Debit Equipment 7000; Credit Accounts Payable 2000; Credit

Cash 4000; and Credit Bank 1000. Which of the following best describes the actual transaction?

Select one:

a. The company purchased equipment for 7000, paying 4000 in cash, 1000 in cheque, and the remaining on

credit.

b. The company sold equipment worth 7000, receiving 4000 in cash and 2000 still owed.

c. The company purchased equipment for 7000, paying 4000 in cash and the remaining 2000 is to be paid

later.

↓

d. The company purchased equipment for 7000 entirely on credit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The company takes out a $1,000,000 loan from the bank. Provide the journal entry that would be necessary to record the transaction.arrow_forwardCould you please help Me with this question?arrow_forwarda CFE was hired by B Industrial to investigate suspected fraud. the CFE started analyzing the financial statements in CY2021. Cash $20,000 Accounts payable $11,000 Accounts receivable $15,000 Wages payable $5,000 Capital Stock $5,000 Retained earnings $20,000 Inventory $6,000 Notes payable (3-year term) $8,000 Property, plant equipment, net $8,000 Required: Calculate the quick ratio and current ratio.arrow_forward

- The bookkeeper for Wood Manufacturing Company made the following journal entry Land Buildings Cash Notes Payable This transaction involves: Mutiple Choice Debit 201,500 84,500 The sale of land and building for $286,000 Payment of $221000 on a note payable. An increase in liabilities of $221,000 The receipt of $65,000 cash. Credit 65,000 221,000arrow_forward[The following information applies to the questions displayed below.] Sanyu Sony started a new business and completed these transactions during December. 1 Sanyu Sony transferred $65,300 cash from a personal savings account to a checking account in the name of Sony Electric in exchange for its common stock. 2 The company paid $1,800 cash for the December rent. 3 The company purchased $14,200 of electrical equipment by paying $6,000 cash and agreeing to pay the $8,200 balance in 30 days. 5 The company purchased supplies by paying $1,000 cash. 6 The company completed electrical work and immediately collected $1,800 cash for these services. 8 The company purchased $2,820 of office equipment on credit. 15 The company completed electrical work on credit in the amount of $5,500. 18 The company purchased $450 of supplies on credit. 20 The company paid $2,820 cash for the office equipment purchased on December 8. 24 The company billed a client $900 for electrical work completed; the balance is…arrow_forward10. ABC purchased $8,000 worth of equipment from EMT Inc.. They paid $5000 with check #105 and put the rest on account. (Hint: more than 2 accounts will be affected). Which accounts are affected? Is it an increase or decrease to the account? Where will the debit and credit be reported?arrow_forward

- Prepare a balance sheet with the information below Debit Credit $ $ Sales 1,000,000 Sales returns 10,000 Selling expenses 150,000 Administration expenses 205,000 Financial expenses 50,000 Purchases 320,000 Cash at bank 77,000 Accounts receivable 22,000 Provision for Doubtful Debts 2,500 Inventories 42,000 Motor Vehicles 80,000 Furniture 42,000 Plant and Equipment 276,500 Accumulated Depreciation Plant 1,500 Accounts payable 56,000 Bank Loan 12,000 Capital - Bennett 75,000 Capital - Barney 112,500 Current - Bennett 25,000 Current - Barney 35,000 Drawings - Bennett 20,000 Drawings - Barney 25,000arrow_forwardMy question is how to solve this problem, and why don't you include the proceeds from the sale of equipment in the calculation?arrow_forwardI need help with this question. The format of how to respond is belowarrow_forward

- Transaction: Laker Co. pays $3,900 on account for tools bought earlier. Required: For the transaction above, complete the following: (a) Select the accounts that are affected (there will be at least two). (b) Are the selected accounts increased or decreased? (c) What is the dollar amount of change in the accounts? (d) If Retained Earnings is selected, choose the reason that it has changed. Cash Account Accounts Receivable Supplies Tools Accounts Payable Capital Stock Which accounts are affected? Is the account increased or decreased? Increase Decrease OO Increase Decrease Increase Decrease Increase Decrease Increase Decrease Increase Decrease What is the amount of transaction? $0 $0 $0 $ 6A $0 Why has Retained Earnings changed?arrow_forward(Appendix 3.1) Vickelly Company uses cash-basis accounting. At the end of the current year, Vickelly's checkbook shows cash receipts from customers of $112,000 and cash payments for operating expenses of $48,000 for the year. At the end of the year, Vickelly determined that customers owed it $12,000, and it owed creditors $10,00o. Compute Vickelly's sales revenue, operating expenses, and net income on an accrual basis.arrow_forwardRush Corporation borrowed $25,000 from the bank. Which of the following accurately shows the effects of the transaction?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education