ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

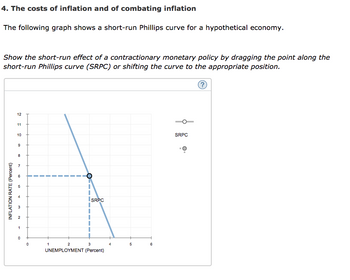

Transcribed Image Text:4. The costs of inflation and of combating inflation

The following graph shows a short-run Phillips curve for a hypothetical economy.

Show the short-run effect of a contractionary monetary policy by dragging the point along the

short-run Phillips curve (SRPC) or shifting the curve to the appropriate position.

INFLATION RATE (Percent)

12

11

10

9

8

7

CD

10

3₂2

2

1

0

0

|

SRPC

1

2

3

UNEMPLOYMENT (Percent)

5

6

SRPC

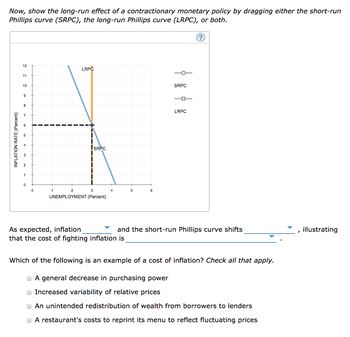

Transcribed Image Text:Now, show the long-run effect of a contractionary monetary policy by dragging either the short-run

Phillips curve (SRPC), the long-run Phillips curve (LRPC), or both.

INFLATION RATE (Percent)

12

11

10

9

8

7

6

in

3₂2

2

1

0

0

LRPC

1

SRPC

2

3

UNEMPLOYMENT (Percent)

As expected, inflation

that the cost of fighting inflation is

5

6

SRPC

LRPC

and the short-run Phillips curve shifts

Which of the following is an example of a cost of inflation? Check all that apply.

A general decrease in purchasing power

Increased variability of relative prices

An unintended redistribution of wealth from borrowers to lenders

A restaurant's costs to reprint its menu to reflect fluctuating prices

illustrating

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Inflation rate Phillips curve, Phillips curveo Unemployment rate In the given graph of the Phillips curve, which of the following would have caused the Phillips curve to shift as shown? Conducting contractionary monetary policy when the economy is at its short-run equilibrium. Conducting expansionary monetary policy when the economy is at its short-run equilibrium. Conducting contractionary monetary policy when the economy is at its long-run equilibrium. 1 Conducting expansionary monetary policy when the economy is at its long-run equilibrium.arrow_forwardEconomics Questionarrow_forward4. Monetary policy and the Phillips curve The following graph shows the current short-run Phillips curve for a hypothetical economy; the point on the graph shows the initial unemployment rate and inflation rate. Assume that the economy is currently in long-run equilibrium. Suppose the central bank of the hypothetical economy decides to decrease the money supply. On the following graph, shift the curve or drag the blue point along the curve, or do both, to show the short-run effects of this policy. Hint: You may assume that the central bank's move was unanticipated. 6 SR Phillips Curve SR Phillips Curve 1 4. 6. 8 10 12 UNEMPLOYMENT RATE (Percent) 4. 2) INFLATION RATE (Percent)arrow_forward

- As with demand and supply analysis, changes in the economy can cause both shifts of and movements along the short-run Phillips curve. Which of the following would cause a shift of the short-run Phillips curve? Check all that apply. An increase in government spending A decrease in short-run aggregate supply An increase in the expected inflation ratearrow_forwardThe data on aggregate expenditure and unemployment was little changed since June. But the Fed expected the unemployment rate to fall and inflation to remain below 2 percent in the near term and then stabilize around the Fed's goal of 2 percent over the medium term.Source: FOMC Minutes, July 25-26, 2017ls the Fed predicting that the U.S. economy will move along a short-run Phillips curve or that the short - run Phillips curve will shift through 2017 and 2018? Explain.arrow_forwardA well-known economic model called the Phillips curve (discussed in the Keynesian Perspective chapter) describes the short run trade off typically observed between inflation and unemployment. Based on the discussion of expansionary and contraction monetary policy, explain why one of these variables usually falls when the other rises.arrow_forward

- Draw a Phillips curve graph here that shows a natural rate of unemployment of 4% and a current inflation rate of 2%. Make sure your lines and axes are labeled and your graph is complete! Use your knowledge of The Phillips Curve to answer the following questions. The threat of future inflation: makes people reluctant to loan money for long periods. makes people eager to loan money for long periods. has no effect on loaning money. increases the value of money paid back in the future. makes people reluctant to borrow money for long periods. According to the short-run Phillips Curve, there is a trade-off between: interest rates and inflation. the growth of the money supply and interest rates. unemployment and economic growth. inflation and unemployment. economic growth and interest rates. Which of the following is true of the long-run Phillips curve? it shows there is a trade-off between unemployment and inflation. it is positively sloped when the inflation rate exceeds…arrow_forwardAccording to the short-run Phillips curve, if the central bank increases the money supply, then inflation and unemployment will both fall. inflation and unemployment will both rise. inflation will fall and unemployment will rise. inflation will rise and unemployment will fall.arrow_forwardThe following graph shows a short-run Phillips curve for a hypothetical economy. Show the short-run effect of a contractionary monetary policy by dragging the point along the short-run Phillips curve (SRPC) or shifting the curve to the appropriate position. (? 12 11 10 SRPC 9 8 7 3 SRPC 2 1 1 2 3 4 6. UNEMPLΟΥΜΕNT (Percent) INFLATION RATE (Percent) LOarrow_forward

- 4. Monetary policy and the Phillips curve The following graph shows the current short-run Phillips curve for a hypothetical economy; the point on the graph shows the initial unemployment rate and inflation rate. Assume that the economy is currently in long-run equilibrium. Suppose the central bank of the hypothetical economy decides to increase the money supply. On the following graph, shift the curve or drag the blue point along the curve, or do both, to show the short-run effects of this policy. Hint: You may assume that the central bank's move was unanticipated. INFLATION RATE (Percent) 6 5 N 1 0 0 SR Phillips Curve + 4 2 3 UNEMPLOYMENT RATE (Percent) 1 5 SR Phillips Curve In the short run, an unexpected increase in the money supply results in the unemployment rate. (?) in the inflation rate and inarrow_forwardPrior to the mid-1970s, many economists thought a higher rate of unemployment would reduce the inflation rate. Why? How does the modern view of the Phillips curve differ from the earlier view?arrow_forwardQuestion 9 Using the Fed model linking the IS-MP framework with the Phillips curve, draw a graph that illustrates the following scenario: Expected inflation is 1.5%. The economy is initially in macroeconomic equilibrium with a real interest rate of 3%, an output gap of -1%, and an actual inflation rate of 1%. Upload Choose a Filearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education