FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Compute the firm’s predetermined

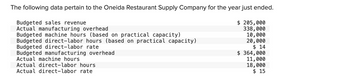

Transcribed Image Text:The following data pertain to the Oneida Restaurant Supply Company for the year just ended.

Budgeted sales revenue

Actual manufacturing overhead

Budgeted machine hours (based on practical capacity)

Budgeted direct-labor hours (based on practical capacity)

Budgeted direct-labor rate

Budgeted manufacturing overhead

Actual machine hours

Actual direct-labor hours

Actual direct-labor rate

$ 205,000

338,000

10,000

20,000

$ 14

$364,000

11,000

18,000

$15

Transcribed Image Text:Cost Drivers

(a) Machine hours

(b) Direct-labor hours

(c) Direct-labor dollars

Overhead Rate

per machine hour

per direct-labor hour

per direct-labor dollar

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Figuring a predetermined overhead rate using direct materials as the allocation base. $130500 estimated manufacturing overhead cost and $87000 as allocation base. Then whats next in the formulaarrow_forwardBerry Company applies overhead on the basis of direct labor hours. Given the following data, calculate overhead applied and the under- or over-application of overhead for the period: Estimated annual overhead cost $450,000 Actual annual overhead cost $445,000 Estimated direct labor hours 90,000 Actual direct labor hours 88,000arrow_forwardAssume the following: 1. Estimated fixed manufacturing overhead for the coming period of $220,000 2. Estimated variable manufacturing overhead of $2.00 per direct labor hour 3. Actual manufacturing overhead for the period of $320,000 4. Actual direct labor-hours worked of 54,000 hours 5. Estimated direct labor-hours to be worked in the coming period of 55,000 hours. The amount of overhead applied to production during the period is closest to: Note: Round your intermediate value of "Predetermined overhead rate" to two decimal places. Multiple Choice $325,926. $324,000. $336,004.arrow_forward

- Carver Company uses a plantwide overhead rate based on direct labor costs. Suppose that Carver raises its wage rate for direct labor during the year. How would that affect the overhead applied? The total cost of jobs?arrow_forwardA company estimates its manufacturing overhead will be $525,000 for the next year. What is the predetermined overhead rate given the following independent allocation bases? When required, round your answers to nearest cent. A. Budgeted direct labor hours: 42,000 per direct labor hour B. Budgeted direct labor expense: $1,050,000 per direct labor dollar C. Estimated machine hours: 70,000 per machine hourarrow_forwardAt the beginning of the year, Mirmax set its predetermined overhead rate for movies produced during the year by using the following estimates: overhead costs, $1,840,000, and direct labor costs, $460,000. At year-end, the company’s actual overhead costs for the year are $1,829,800 and actual direct labor costs for the year are $460,000. Determine the predetermined overhead rate using estimated direct labor costs. Enter the actual overhead costs incurred and the amount of overhead cost applied to movies during the year using the predetermined overhead rate. Determine whether overhead is over- or underapplied (and the amount) for the year. Prepare the entry to close any over- or underapplied overhead to Cost of Goods Sold. Please see picture for format.arrow_forward

- Corporation bases its predetermined overhead rate on the estimated machinehours for the upcoming yearfor the upcoming year appear below Estimated machine - hours Estimated variable manufacturing overhead Estimated total fixed manufacturing overhead 36,000 3.01 per machine-hour 1,058,040 The predetermined overhead rate for the recently completed year was closest toarrow_forwardStuart Corporation expects to incur indirect overhead costs of $102,000 per month and direct manufacturing costs of $13 per unit. The expected production activity for the first four months of the year are as follows. Estimated production in units Required a. Calculate a predetermined overhead rate based on the number of units of product expected to be made during the first four months of the year. b. Allocate overhead costs to each month using the overhead rate computed in Requirement a. c. Calculate the total cost per unit for each month using the overhead allocated in Requirement b. Required A Required B Complete this question by entering your answers in the tabs below. January February March 4,500 8,200 5,000 Required C Predetermined overhead rate $ Answer is complete but not entirely correct. Calculate a predetermined overhead rate based on the number of units of product expected to be made during the first four months of the year. April 6,300 4 X per unit Required A Required B >arrow_forwardCarter Company expected to incur $10,350 in manufacturing overhead costs and use 4,500 machine hours for the year. Actual manufacturing overhead was $9,500 and the company used 4,700 machine hours. 9. Calculate the predetermined overhead allocation rate using machine hours as the allocation base. 10. How much manufacturing overhead was allocated during the year? O 9. Calculate the predetermined overhead allocation rate using machine hours as the allocation base. Predetermined overhead allocation rate per machine hourarrow_forward

- please solve for overhead rate per direct labor cost, overhead rate per direct labor hour, and overhead rate per machine hourarrow_forwardAssume (1) estimated fixed manufacturing overhead for the coming period of $207,000, (2) estimated variable manufacturing overhead of $2.00 per direct labor hour, (3) actual manufacturing overhead for the period of $320,000, (4) actual direct labor-hours worked of 54,000 hours, and (5) estimated direct labor-hours to be worked in the coming period of 55,000 hours. The amount of overhead applied to production during the period is closest to: (Round your intermediate value of "Predetermined overhead rate" to two decimal places.) Multiple Choice $317,000. $311,040. $325,926. $322,564.arrow_forwardThe predetermined manufacturing overhead rate is usually computed: Select one: A. During the financial year B. When overheads have been incurred C. At the beginning of the financial year D. At the end of the financial yeararrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education