FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Archangel Manufacturing calculated a predetermined overhead allocation rate at the beginning of the year based

on direct labor costs. The production details for the year are given below:

Total manufacturing overhead costs estimated at the beginning of the year

Total direct labor costs estimated at the beginning of the year

Total direct labor hours estimated at the beginning of the year

Actual manufacturing overhead costs for the year

Actual direct labor costs for the year

Actual direct labor hours for the year

11,000 di

10,000 di

Calculate the manufacturing overhead allocation rate for the year based on the above data (Round your final

answer to two decimal places.)

A. 28.00%

B. 11.43%

OC. 43.75%

OD. 264.29%

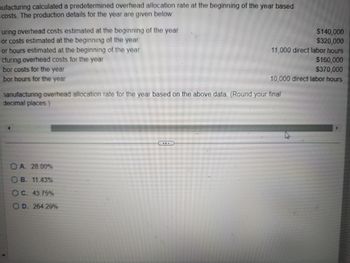

Transcribed Image Text:ufacturing calculated a predetermined overhead allocation rate at the beginning of the year based

costs. The production details for the year are given below:

uring overhead costs estimated at the beginning of the year

or costs estimated at the beginning of the year

or hours estimated at the beginning of the year

cturing overhead costs for the year

bor costs for the year

bor hours for the year

$140,000

$320,000

11,000 direct labor hours

$160,000

$370,000

10,000 direct labor hours

manufacturing overhead allocation rate for the year based on the above data. (Round your final

decimal places.)

A. 28.00%

B. 11.43%

OC. 43.75%

OD. 264.29%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Osborn Manufacturing uses a predetermined overhead rate of $18.50 per direct labor-hour. This predetermined rate was based on a cost formula that estimates $227,550 of total manufacturing overhead for an estimated activity level of 12,300 direct labor-hours. The company actually incurred $221,000 of manufacturing overhead and 11,800 direct labor-hours during the period. Required: 1. Determine the amount of underapplied or overapplied manufacturing overhead for the period. 2. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Would the journal entry to dispose of the underapplied or overapplied overhead increase or decrease the company's gross margin? By how much? 1. Manufacturing overhead 2. The gross margin would by byarrow_forwardABC Inc. uses a plantwide predetermined overhead rate of $22.30 per direct labor-hour. The predetermined rate was based on a cost formula that estimated $267,600 of total manufacturing overhead cost for an estimated 12,000 direct labor-hours. The company incurred actual total manufacturing overhead cost of $270,000 and 11,800 direct labor-hours. Determine the amount of manufacturing overhead cost that would have been applied to all jobs during the period.arrow_forwardA taxpayer filing as single has $25,600 of taxable income. Included in gross income is a 1099-int box 1 intrest income of $5,000, tax exempt intrest of $3,00 and interest on US saving bond of $1,200 additionally the taxpayer has a 1099-div wirth dividend income of 3,000 of which 2,000 is qualified dividends and capital gains distributions of $500 is the following statement accurte about this scenario? 1. the taxpayer will be taxed at 0% for $2,500 which includes the qualified dividends and capital gains distributions. 2. the taxable iinterest and dividend items should appear on Schedule B. 3. the interest on the U.S saving bonds may only be taxed on up to 85% of its value.arrow_forward

- The chief cost accountant for Voltaire Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning May 1 would be $2,340,000 and total direct labor costs would be $1,800,000. During May, the actual direct labor cost totaled $145,000 and factory overhead cost incurred totaled $192,100. Question Content Area a. What is the predetermined factory overhead rate based on direct labor cost? Enter your answer as a whole percent not in decimals. fill in the blank 1772e2fb3039fb1_1 % Question Content Area b. Journalize the entry to apply factory overhead to production for May. If an amount box does not require an entry, leave it blank. blank - Select - - Select - - Select - - Select - Question Content Area c. What is the May 31 balance of the account Factory Overhead—Blending Department? Amount: $fill in the blank 1ea1070e903a021_1 Debit or Credit? d. Does the balance in part (c) represent overapplied or underapplied factory…arrow_forwardOsborn Manufacturing uses a predetermined overhead rate of $18.90 per direct labor-hour. This predetermined rate was based on a cost formula that estimates $240,030 of total manufacturing overhead for an estimated activity level of 12,700 direct labor-hours. The company actually incurred $237,000 of manufacturing overhead and 12,200 direct labor-hours during the period. Required: 1. Determine the amount of underapplied or overapplied manufacturing overhead for the period. 2. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Would the journal entry to dispose of the underapplied or overapplied overhead increase or decrease the company’s gross margin? By how much?arrow_forwardCorporation bases its predetermined overhead rate on the estimated machinehours for the upcoming yearfor the upcoming year appear below Estimated machine - hours Estimated variable manufacturing overhead Estimated total fixed manufacturing overhead 36,000 3.01 per machine-hour 1,058,040 The predetermined overhead rate for the recently completed year was closest toarrow_forward

- Caple Corporation applies manufacturing overhead on the basis of machine-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $16,660. Actual manufacturing overhead for the year amounted to $25,000 and actual machine-hours were 1,460. The company's predetermined overhead rate for the year was $11.90 per machine-hour. The predetermined overhead rate was based on how many estimated machine-hours? Question 19 options: 1,400 2,101 2,742 1,460arrow_forwardCaber Corporation applies manufacturing overhead on the basis of machine-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $61,400, Actual manufacturing overhead for the year amounted to $69,000 and actual machine-hours were 6,900. The company's predetermined overhead rate for the year was $10.10 per machine-hour. The applied manufacturing overhead for the year was closest to: Multiple Choice $70,700 $68,117 $68,697 $69,690arrow_forwardOsborn Manufacturing uses a predetermined overhead rate of $18.30 per direct labor-hour. This predetermined rate was based on a cost formula that estimates $221,430 of total manufacturing overhead for an estimated activity level of 12,100 direct labor-hours. The company actually incurred $217,000 of manufacturing overhead and 11,600 direct labor-hours during the period. Required: 1. Determine the amount of underapplied or overapplied manufacturing overhead for the period. 2. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Would the journal entry to dispose of the underapplied or overapplied overhead increase or decrease the company’s gross margin? By how much?arrow_forward

- Ali Company uses a job order cost system in each of its three manufacturing departments. Manufacturing overhead is applied to jobs on the basis of direct labor cost in Department X and machine hours in Department Z. In establishing the predetermined overhead rates for 2020, the following estimates were made for the year. Department X Z Manufacturing overhead $78000 $75000 Direct labor costs $60000 $60000 Direct labor hours 5000 4000 Machine hours 10000 15000 During March, the job cost sheets showed the following costs and production data. Department X Z Direct materials used $9200 $6400 Direct labor costs $4800 $5000 Manufacturing overhead incurred $6600 $6210 Direct labor hours 400 420 Machine hours 800 1260 Required: Compute the predetermined overhead rate for…arrow_forwardCollins Corporation uses a predetermined overhead rate based on direct labor cost to apply manufacturing overhead to jobs. The following information applies to the Collins Corporation for the current year: Direct Labor Hours Estimated for the Year 24,000 Actual Hours Worked 19,500 Direct Labor Cost Estimated for the Year 300,000 Actual Cost Incurred 210,000 Manufacturing Overhead Estimated for the Year 240,000 Actual Cost Incurred 185,000 The manufacturing overhead cost for the current year will be:arrow_forwardBobby Pte Ltd charges manufacturing overhead to products by using a pre-determined overhead rate, computed on the basis of labour hours. The following data pertain to the current year:Budgeted manufacturing overhead $480,000Actual manufacturing overhead $440,000Budgeted labour hours 20,000Actual labour hours 16,000How much is overhead over-applied or under-applied, stating clearly whether it is over or under applied.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education