FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

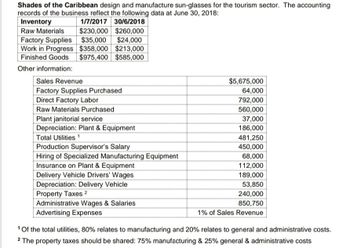

Transcribed Image Text:Shades of the Caribbean design and manufacture sun-glasses for the tourism sector. The accounting

records of the business reflect the following data at June 30, 2018:

Inventory

1/7/2017 30/6/2018

Raw Materials $230,000 $260,000

Factory Supplies

$35,000

$24,000

Work in Progress $358,000 $213,000

Finished Goods $975,400 $585,000

Other information:

Sales Revenue

Factory Supplies Purchased

Direct Factory Labor

Raw Materials Purchased

Plant janitorial service

Depreciation: Plant & Equipment

Total Utilities ¹

Production Supervisor's Salary

Hiring of Specialized Manufacturing Equipment

Insurance on Plant & Equipment

Delivery Vehicle Drivers' Wages

Depreciation: Delivery Vehicle

Property Taxes ²

Administrative Wages & Salaries

Advertising Expenses

$5,675,000

64,000

792,000

560,000

37,000

186,000

481,250

450,000

68,000

112,000

189,000

53,850

240,000

850,750

1% of Sales Revenue

¹ Of the total utilities, 80% relates to manufacturing and 20% relates to general and administrative costs.

2 The property taxes should be shared: 75% manufacturing & 25% general & administrative costs

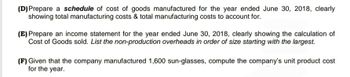

Transcribed Image Text:(D) Prepare a schedule of cost of goods manufactured for the year ended June 30, 2018, clearly

showing total manufacturing costs & total manufacturing costs to account for.

(E) Prepare an income statement for the year ended June 30, 2018, clearly showing the calculation of

Cost of Goods sold. List the non-production overheads in order of size starting with the largest.

(F) Given that the company manufactured 1,600 sun-glasses, compute the company's unit product cost

for the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the information below for the year ended December, 2019 to prepare the Statement of Costs of Goods Manufactured:arrow_forwardDreams Manufacturing Company provided the following information for the year 2015: Purchases—Raw Materials $270,000 Plant Utilities & Insurance 202,500 Indirect Materials 35,250 Indirect Labor 14,250 Ending Balance—Work-in-Process Inventory 42,000 Ending Balance—Raw Materials Inventory 45,000 Direct Labor 352,500 Depreciation on Factory Plant & Equipment 18,000 Beginning Balance—Work-in-Process Inventory 18,000 Beginning Balance—Raw Materials Inventory 63,000 Required: Prepare a statement of the cost of goods manufacturedarrow_forwardPresent entries in general journal form to record the following summarized operations related to production for The John Kinky Toy Company. Please use the following chart of accounts for questions 31 to 41: 10 Cash 20 Accounts Payable 11 Accounts Receivable 21 Wages Payable 12 Materials 22 Plant Taxes Payable 13 Work in Process 30 Common Stock 14 Prepaid Factory Insurance 35 Retained Earnings 15 Finished Goods Inventory 40 Sales 16 Plant 50 Cost of Goods Sold 17 Accumulated Depreciation 70 Factory Overhead ***It is very important that you use the above accounts. Do not use commas or dollar signs ($) in your answer. Direct materials requisitioned for production, $50,000. Date Debit Credit $50,000 $50,arrow_forward

- Selected financial information for Brookeville Manufacturing is presented in the following table omitted). Sales revenue Purchases of direct materials Direct labo Manufacturing overhead Operating expenses Beginning raw materials inventory Ending raw materials inventory Beginning work in process inventory Ending work in process inventory Beginning finished goods inventory Ending finished goods inventory What was the operating income? $2,390 $4,800 $3,010 $4,150 $4,800 $480 $500 $710 $650 $220 $180 $400 $430 $300 $240arrow_forwardThe following information pertains to the most recent quarter at Precious Production Limited. Purchases of raw materials Raw materials inventory, beginning Raw materials inventory, ending Depreciation, factory Insurance, factory Direct labour Maintenance, factory Administrative expenses Sales Utilities, factory Supplies, factory Selling expenses Indirect labour Work in process inventory, beginning Work in process inventory, ending Finished goods inventory, beginning Finished goods inventory, ending Required: 1. Prepare a schedule of cost of goods manufactured. PRECIOUS PRODUCTION $ 388,500 47,600 77,500 215,500 21,900 253,300 127,600 295,200 2,256,000 117,500 4,190 337,100 273,300 28,950 123,800 42,850 171,400arrow_forward. Iron Sheets Company had the following information for the month of June 2021. Sales Purchases Sales and administrative expenses V Factory overhead V Direct labor Shs. 257,000 92.000 79,000 37,000 25.000 Work in process, June 1 22,000 Work in process, June 30 Raw Material inventory, June 1 Raw Material inventory, June 30 Finished goods inventory, June 1 Finished goods inventory, June 30 18.500 6.000 8,000 21,000 25,000 Prepare the following: A manufacturing account An income statement for the month ended June 30, 2021 The inventory section of the statement of financial statement.arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Use the following selected account balances of Delray Manufacturing for the year ended December 31. $ 2,850,000 118,000 153,000 199,000 543,000 652,000 98,000 78,000 156,000 250,000 400,000 142,000 Sales Raw materials inventory, beginning Work in process inventory, beginning Finished goods inventory, beginning Raw materials purchases Direct labor Indirect labor Repairs-Factory equipment Rent cost of factory building Selling expenses General and administrative expenses Raw materials inventory, ending Work in process inventory, ending Finished goods inventory, ending Prepare an income statement for Delray Manufacturing (a manufacturer). Assume that its cost of goods manufactured is $1,472,000. Sales Cost of goods sold: Finished goods inventory, beginning Cost of goods manufactured DELRAY MANUFACTURING Income Statement For Year Ended December 31 Goods available for sale Less: Finished goods…arrow_forwardThe following data relates to the Atlanta Co.: Direct Materials Inventory, Beginning $650 Direct Materials Inventory, Ending $600 Direct Materials Purchases $4,500 Direct Labor $2,300 Factory Overhead $3,200 Work-in-Process Inventory, Beginning $1,350 Work-in-Process Inventory, Ending $1,440 Finished Goods Inventory, Beginning $2,400 Finished Goods Inventory, Ending $2,350 Sales Revenue $14,500 Selling and Administrative Expenses $2,800 Income Tax Rate 35% Required: a. Prepare a Statement of Cost of Goods Manufactured. b. Prepare an Income Statementarrow_forwardHello tutor give correct answerarrow_forward

- Gore Company makes products for sporting events. The following data are for the year ended December 31, 2014: Materials inventory, January 1, 2014 $45,000Materials inventory, December 31, 2014 65,000Materials purchases 175,000Direct labor 225,000Work in process inventory, January 1, 2014 30,000Work in process inventory, December 31, 2014 40,000Manufacturing overhead 130,000Finished goods inventory, January 1, 2014 80,000Finished goods inventory, December 31, 2014 140,000Prepare a Cost of Goods Manufactured Statement and compute the cost of goods sold.arrow_forwardThe following data were taken from the records of ABC Company for the year ended June 30,2014. Raw Materials Inventory 7/1/2013 Raw Materials Inventory 6/30/2014 Finished Goods Inventory 7/1/2013 Finished Goods Inventory 6/30/2014 Work in Process Inventory 7/1/2013 Work in Process Inventory 6/30/2014 Direct Labor Indirect Labor Accounts Receivable Cash Bad Debts Expenses Selling Expenses $48,000 39,600 96,000 75,900 19,800 18,600 139,250 24,460 27,000 32,000 5,500 20,000 Factory Insurance Factory Machinery Depreciation Factory Utilities Office Utility Expense Sales Revenue Sales Discounts Plant Manager’s Salary Factory Property Taxes Factory Repairs Raw Materials Purchases Indirect Material Used Administrative Expenses $4,600 16,000 27,600 8,650 534,000 4,200 58,000 9,600 1,400 96,400 2,200 28,500 Required:(a)Prepare a cost of goods manufactured schedule and an income statement through gross profit.arrow_forwardBag Teeth manufactures dental supplies & equipment. Bag Teeth Ack's Total sales for year 2022 is $1,587,560 cost of goods sold & gross margin Calculate Inventory: Finished Goods, Jan. 01 Work in process, Jan.o1 Raw Materials Jan. 01 Raw materials purchased Raw Materials, Dec 31 Work in Process, Dec. 31 Finished Goods, Dec. 31. other Factory Expenses! Factory Supervisor salary Equipment repairs Plant utilities plant property tax Assembly employees info: # of employees. hour Wages per Daily hours Annual total days work per employee How much is an 552,000.00 165,000.00 16,500.00 28,000.00 15,000.00 21,000.00 465,000.00 45,000.00 15,500.00 13,500.00 11,500.00 18. 18.50 8 260 total manufacturing account? cost toarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education