FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

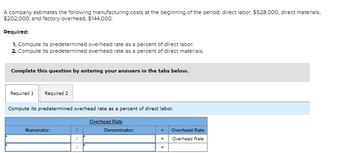

Transcribed Image Text:A company estimates the following manufacturing costs at the beginning of the period: direct labor, $528,000; direct materials,

$202,000; and factory overhead, $144,000.

Required:

1. Compute its predetermined overhead rate as a percent of direct labor.

2. Compute its predetermined overhead rate as a percent of direct materials.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Compute its predetermined overhead rate as a percent of direct labor.

Overhead Rate

Numerator:

"

1

"

Denominator:

Overhead Rate

Overhead Rate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Figuring a predetermined overhead rate using direct materials as the allocation base. $130500 estimated manufacturing overhead cost and $87000 as allocation base. Then whats next in the formulaarrow_forwardOwe Subject: acountingarrow_forward(c) Calculate the total manufacturing overhead cost for the period. $ __________________ (d) Calculate the total manufacturing cost for the period. $ __________________arrow_forward

- The following information has been collected from the cost records of P&L company for theyear ended 31st October, 2021:Direct Materials 500,000Direct Labour 400,000Direct Expenses 40,000Works Overheads 320,000Office Expenses 189,000The total number of direct labour hours were 200,000 involving 80,000 machine hours.I. Calculate the percentage on direct wagesII. Calculate the productive labour hours rateIII. Calculate the machine hour ratearrow_forwardapplying factory overhead should be direct labor hours, which are estimated to be 96,900 hours. Question Content Area a. Compute the predetermined factory overhead rate. Round your answer to the nearest cent.fill in the blank 1 of 1$ per direct labor hour b. Determine the amount of factory overhead applied to Job 345 if the amount of direct labor hours is 1,200 and to Job 777 if the amount of direct labor hours is 3,000.Job 345 fill in the blank 1 of 1$Job 777 fill in the blank 1 of 1$ Question Content Area c. Journalize the entry for the factory overhead applied if Jobs 345 and 777 are the only jobs for the period. If an amount box does not require an entry, leave it blank. blank Account Debit Credit blankarrow_forwardThe related data of Manushi Company: Actual direct labor hours 10,000 Actual overhead cost 682,500 Overapplied factory overhead 125,700 Factory overhead is based on direct labor hours. How much is the predetermined rate?arrow_forward

- 11. Subject:- Accountingarrow_forward2.A company makes two products 1 and 2. The finishing activity pool has estimated manufacuring costs of $82,749 and the cost drivers for Product 1 is 359 and 282 for Product 2. The assembling activity pool has estimated costs of $63,039 and the cost drivers for Product 1 is 200 and 300 for Product 2. Direct labor hours for Product 1 is 497and 303 for Product 2. What is the total manufacturing overhead cost to be assigned to Product 1 using a single overhead rate as under tradional cost accounting? Round your final answer to the nearest whole dollar and do not put a dollar sign in your answer.arrow_forwardPlease help complete parts of question 1 1a. If 8,000 units are produced, what is the total amount of manufacturing overhead cost incurred to support this level of production at is this total amount expressed on a per unit basis? (Round your "per unit" answer to 2 decimal places.) Total manufacturing overhead cost: Manufacturing overhead per unit it: 1b. If 12,500 units are produced, what is the total amount of manufacturing overhead cost incurred to support this level of production? What is this total amount expressed on a per unit basis? (Round your "per unit" answer to 2 decimal places.) Total manufacturing overhead cost: Manufacturing overhead per unit: 1c. If the selling price is $22 per unit, what is the contribution margin per unit? (Do not round intermediate calculations. Round you answer to 2 decimal places.) 1d. If 11,000 units are produced, what are the total amounts of direct and indirect manufacturing costs incurred to support this leve production? (Do not round…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education