Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please need answer the general accounting question not use ai

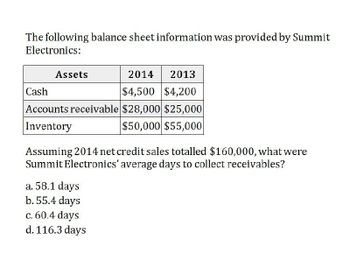

Transcribed Image Text:The following balance sheet information was provided by Summit

Electronics:

Assets

2014 2013

Cash

$4,500 $4,200

Accounts receivable $28,000 $25,000|

Inventory

$50,000 $55,000

Assuming 2014 net credit sales totalled $160,000, what were

Summit Electronics' average days to collect receivables?

a. 58.1 days

b. 55.4 days

c. 60.4 days

d. 116.3 days

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The information below has been extracted from the financial statements of Gifts Pty Ltd. Sales Revenue (20% Cash Sales) Sales Returns Cost of sales Accounts Receivable 2018 $4,5000,000 316,000 3,580,000 316,000 The Accounts receivable balance for 2017 was 11% of Net Credit Sale for 2018. Required: A. Calculate the following for year 2018: 1. Receivable Turnover Ratio Accounts Receivable Turnover Ratio = Net credit sales/ Average Accounts Receivable. | 2. Average Collection Period (Ctrl) - Iarrow_forwardCOMPUTE FOR THE FOLLOWING ACCOUNTS: (THE BALANCE SHEET SHOULD BALANCE) (In Pesos) Annual Credit Sales 1,800,000 Cash 32,720 Gross Profit Margin 25% Marketable Sec. 25,000 Inventory Turnover 6 Accounts Receivable ? No. of days in a year 365 Inventories ? Average Collection Period 45 days Total Current Assets ? Current Ratio 1.6 Net Fixed Assets ? Total Asset Turnover Ratio 1.2 Total Assets ? Debt ratio 60% Accounts Payable 120,000 Notes Payable ? Accruals 20,000 Gross Profit ? Total Current Liabilities ? Long Term Debt ? *ALL SALES ARE CREDIT SALES Stockholders' Equity 600,000 Total Liab. And Equity ?arrow_forward.arrow_forward

- The following information is taken Aiello Corporation's fiscal 2016 annual report. Selected Balance Sheet Data 2016 2015 Inventories........................ $221,418 $226,893 Accounts Receivable........... $121,333 $122,087 Assume that Aiello Corporation had $1,003,881 sales on credit during fiscal year 2016. What amount did the company collect from credit customers during the year? a. $1,003,881 b. $1,004,635 c. $1,003,127 d. $1,247,301arrow_forwardFrom the balance sheet prepare a proforma income statement where revenues can increase by 2% and the firm can borrow at 5.5% BALANCE SHEET 2021 Cash and cash equivalents 280 Receivables 2588 Inventory 2516 Other CA 189 TOTAL CA 5573 Fixed assets 5024 TOTAL ASSETS 10597 Accounts payable 4713 Short term debt 78 TOTAL CL 4790 LT debt 921 Shareh. Equity 4886 TOTAL LIAB. AND SHARH. EQUITY 10597 INCOME STATEMENT 2021 Sales 19418 COGS 13136 Depreciations 354 SG&A 4952 EBIT 976 Interest Expenses 52 Tax 268 Net income 656 Pro-forma statement Pro Forma Forecasts Actual Projected Projected Projected Projected Projected 2021 2022 2023 2024 2025 2026 COGS/REVENUES SGA/SALES INVENTORIES/COGS OTHER CA/SALES AR/SALES AP/COGS SALES/FIXED ASSETS DEPR/ FIXED ASSETS EQUITY/INVESTED CAPITAL ST DEBT/INVESTED…arrow_forwardUse the following information..given answer Accountingarrow_forward

- 1. Use ratios to analyze a company's liquidity and solvency. Calculate Select Ratios - Excel FILE НОМE INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri 11 A A % Alignment Number Conditional Format as Formatting - Table - Paste I Cell Cells Styles - Clipboard Font Styles B36 fx A B C D 1 Condensed financial statements for Games Galore are summarized below: 2 3 Balance Sheet 2016 2015 185,000 $ 80,000 4 Cash $ 143,000 59,000 134,000 5 Accounts Receivable, Net 6 Inventory 104,000 7 Prepaid Insurance 11,900 5,880 Total Current Assets 380,900 341,880 9 Property and Equipment, Net 514,500 407,000 10 Total Assets $ 895,400 $ 748,880 11 12 Current Liabilities 2$ 85,300 $ 96,800 13 Long-term Liabilities 284,000 224,000 Total Liabilities 369,300 299,000 320,800 299,000 14 15 Contributed Capital 16 Retained Earnings Total Stockholders' Equity 227,100 129,080 428,080 17 526,100 18 Total Liabilities and Stockholders' Equity $ 895,400 $ 748,880 19 20 Income Statement $ 3,031,000…arrow_forwardSuppose the 2017 financial statements of 3M Company report net sales of $23.1 billion. Accounts receivable (net) are $3.40 billion at the beginning of the year and $3.54 billion at the end of the year. Compute 3M Company's receivable turnover. (Round answer to 1 decimal place, e.g. 12.5.) times Accounts receivable turnover ratio SHOW LIST OF ACCOUNTS LINK TO TEXT INTERACTIVE TUTORIAL Compute 3M Company's average collection period for accounts receivable in days. (Round answer to 1 decimal place, e.g. 12.5. Use 365 days for calculation.) Average collection period daysarrow_forwardNeed help with this questionarrow_forward

- Financial accountingarrow_forwardAccounting compute the accounts receivable turnoverarrow_forwardSelected information from the comparative financial statements of AppleVerse Company for the year ended December 31 appears below: 2018 2017 Php Php Accounts receivable (net) 175,000 200,000 Inventory 130,000 150,000 Total assets 1,100,000 800,000 Current liabilities 140,000 110,000 Long-term debt 410,000 300,000 Net credit sales 800,000 700,000 Cost of goods sold 600,000 530.000 Interest expense 40.000 25,000 Income tax expense 60.000 29,000 Net income 150.000 85,000 Net cash provided by operating 220,000 135,000 activities Compute for the Receivables Turnover for 2018. O 2.13 O 4.27 O 5.95 O 3.23arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning