Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Expert of cost account give perfect solution please.

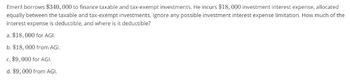

Transcribed Image Text:Emeril borrows $340,000 to finance taxable and tax-exempt investments. He incurs $18,000 investment interest expense, allocated

equally between the taxable and tax-exempt investments. Ignore any possible investment interest expense limitation. How much of the

interest expense is deductible, and where is it deductible?

a. $18,000 for AGI.

b. $18,000 from AGI.

c. $9,000 for AGI.

d. $9,000 from AGI.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Accounting where is the deductible?arrow_forwardAn investor has a taxable income of $125997. He has an investment property which earns $21780 in rental income and incurs $35782 in expenses, including maintenance, local council rates, land tax and interest on a mortgage loan. What is his total income tax payable (excluding the 2% Medicare surcharge)? a. $23865 b. $26865 c. $24865 d. $27865arrow_forwardTaxpayer Y, who has a 30 percent marginal tax rate, invested $65,000 in a bond that pays 8 percent annual interest. Compute Y’s annual net cash flow from this investment assuming that a. The interest is tax-exempt income.b. The interest is taxable income.arrow_forward

- Assuming that Mimaropa is a corporate taxpayer, compute the taxable income. Mr. Mimaropa reported the following data in 2021. Sales Cost of Sales Gain on Sale of Equipment Interest Income from Bank Deposits Deductible Expenses Non-deductible Expenses Your answer P 1,000,000 600,000 60,000 40,000 300,000 200,000 marrow_forward10. Eileen pays $14,000 of interest related to her purchase of investments. During the current year, Eileen's adjusted gross income is $80,000, which includes investment-related income of $9,000. Determine whether the interest is deductible, how it would be deducted on the taxpayer's return (if there are alternatives possible, discuss the conditions that would determine the treatment), and any limitations that might be placed on the deduction.arrow_forwardFirm E must choose between two business opportunities. Opportunity 1 will generate an $11,200 deductible loss in year 0, $7,000 taxable income in year 1, and $28,000 taxable income in year 2. Opportunity 2 will generate $8,000 taxable income in year 0 and $7,000 taxable income in years 1 and 2. The income and loss reflect before-tax cash inflow and outflow. Firm E uses a 5 percent discount rate and has a 40 percent marginal tax rate over the three-year period. Use Appendix A and Appendix B. Required: a1. Complete the tables below to calculate NPV. a2. Which opportunity should Firm E choose? b1. Complete the tables below to calculate NPV. Assume Firm E's marginal tax rate over the three-year period is 15 percent. b2. Which opportunity should Firm E choose? c1. Complete the tables below to calculate NPV. Assume Firm E's marginal tax rate is 40 percent in year 0 but only 15 percent in years 1 and 2. c2. Which opportunity should Firm E choose? Complete this question by entering your…arrow_forward

- Firm E must choose between two business opportunities. Opportunity 1 will generate an $11,840 deductible loss in year 0, $7,400 taxable income in year 1, and $29,600 taxable income in year 2. Opportunity 2 will generate $8,400 taxable income in year 0 and $7,400 taxable income in years 1 and 2. The income and loss reflect before-tax cash inflow and outflow. Firm E uses a 5 percent discount rate and has a 40 percent marginal tax rate over the three-year period. Use Appendix A and Appendix B. Required: a1. Complete the tables below to calculate NPV. a2. Which opportunity should Firm E choose? b1. Complete the tables below to calculate NPV. Assume Firm E's marginal tax rate over thearrow_forwardIf a taxpayer has interest income of $5,500 and investment interest expenses of $6,000 in itemized deductions, what amount can the taxpayer deduct in investment interest expenses? *If zero, enter "0". 5500arrow_forwardA derived its income from its self-operated talpakan business. The details of his business for 2021 are as follows: Gross Receipts - P100,000.00 Operating Expenses - P50,000.00 Income taxes withheld in general - P10,000.00 Question: What is A's taxable income? Group of answer choices P40,000.00 P50,000.00 P90,000.00 P100,000.00arrow_forward

- 16. Wyatt Industries, an accrual-method and calendar year taxpayer, paid $12,000 in real estate taxes on October 1, 2021, covering the period October 1, 2021, to September 30, 2022. The amount of real estate taxes Wyatt can deduct as a business expense in 2021 is: a. b. C. d. e. $12,000. $6,000. $3,000. $0. none of the above.arrow_forwardes c. His $535,500 of taxable income includes $50,000 of long-term capital gain that is taxed at preferential rates. Assume his modified AGI is $570,000. Income tax Net investment income tax Total tax liability $ Amount 0.00arrow_forward36. The following interest payments were made by an individual income taxpayer in 2022: Sua 12/8 TUCK Tueboe y Tudor: TD GETOL va 1 ne gos Interest on loan from BDO used to finance a business Interest on loan from Pag-Ibig to build residence A. 80,000 B. 82,500 C. 175,000 D. 221, 500 Interest on loan obtained from brother and used in business Interest on loan from BPI used to buy computer equipment in the office Interest for late payment of value-added tax Interest on purchase price of residential lot bought on installments Interest payment on a debt which has prescribed The deductible amount of interest is O P 50,000 100,000 25,000 30,000 2,500 2,000 12,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT