FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

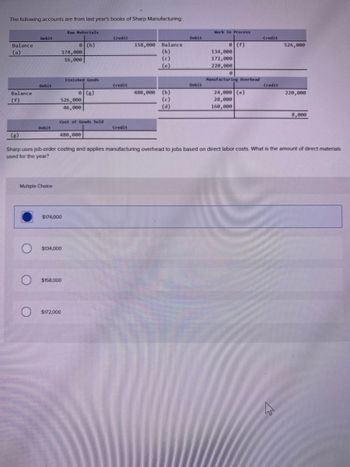

Transcribed Image Text:The following accounts are from last year's books of Sharp Manufacturing:

Raw Materials

Work In Process

Debit

Credit

Debit

Credit

Balance

(a)

0 (b)

174,000

16,000

158,000 Balance

e (f)

526,000

(b)

134,000

(c)

172,000

(e)

220,000

0

Finished Goods

Manufacturing Overhead

Debit

Credit

Debit

Credit

Balance

(f)

e (g)

526,000

46,000

480,000 (b)

(c)

24,000 (e)

220,000

28,000

(d)

160,000

8,000

Cost of Goods Sold

Debit

Credit

(g)

480,000

Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs. What is the amount of direct materials

used for the year?

Multiple Choice

$174,000

$134,000

$158,000

$172,000

M

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 5arrow_forwardAt the beginning of the year, Barrington Manufacturing had the following account balances: Work-in-Process Inventory 2,000 Finished Goods Inventory 8,000 Manufacturing Overhead 0 The following additional details are provided for the year: Direct materials placed in production $80,000 Direct labor incurred 190,000 Manufacturing overhead incurred 300,000 Manufacturing overhead allocated to production 295,000 Cost of jobs completed 500,000 Write the journal entries and calculate the ending balances (you may use T accounts) for Work-in-Process Inventory, Finished Goods Inventory, and Manufacturing Overhead accounts (unadjusted).arrow_forwardSelected T-accounts of Moore Company are given below for the just completed year: Balance 1/1 Debits Balance 12/31 Debits Debit Debits Debit Balance 1/1 Direct materials Direct labor Overhead Balance 12/31 Debits Debit Debit Debit Balance 1/1 Debits Balance 12/31 Debit Raw Materials 15,000 Credits 120,000 25,000 Manufacturing Overhead 230,000 Credits Work in Process 20,000 Credits 90,000 150,000 240,000 ? Factory Wages Payable 185,000 Balance 1/1 Credits Finished Goods 40,000 Credits ? Credit 60,000 Cost of Goods Sold Credit Balance 12/31 Credit Credit Credit Credit ? ? 470,000 9,000 180,000 4,000 ? Required: 1. What was the cost of raw materials used in production? 2. How much of the materials in (1) above consisted of indirect materials? 3. How much of the factory labor cost is indirect labor?arrow_forward

- Davis Manufacturing Company had the following data: January 1 December 31 Accounts receivable $27,000 $33,000 Materials inventory 22,500 6,000 Work in process inventory 70,200 48,000 Finished goods inventory 3,000 15,000 Collections on account were $625,000. Cost of goods sold was 68% of sales. Direct materials purchased amounted to $90,000. Factory overhead was 300% of the cost of direct labor. a. Compute sales revenue (all sales were on account). b. Compute cost of goods sold. c. Compute cost of goods manufactured. d. Compute direct materials used. $ e. Compute direct labor incurred. $ f. Compute factory overhead incurred.arrow_forward. Iron Sheets Company had the following information for the month of June 2021. Sales Purchases Sales and administrative expenses V Factory overhead V Direct labor Shs. 257,000 92.000 79,000 37,000 25.000 Work in process, June 1 22,000 Work in process, June 30 Raw Material inventory, June 1 Raw Material inventory, June 30 Finished goods inventory, June 1 Finished goods inventory, June 30 18.500 6.000 8,000 21,000 25,000 Prepare the following: A manufacturing account An income statement for the month ended June 30, 2021 The inventory section of the statement of financial statement.arrow_forward! Required information [The following information applies to the questions displayed below.] Use the following selected account balances of Delray Manufacturing for the year ended December 31. $ 2,850,000 118,000 153,000 199,000 543,000 652,000 98,000 78,000 156,000 250,000 400,000 142,000 Sales Raw materials inventory, beginning Work in process inventory, beginning Finished goods inventory, beginning Raw materials purchases Direct labor Indirect labor Repairs-Factory equipment Rent cost of factory building Selling expenses General and administrative expenses Raw materials inventory, ending Work in process inventory, ending Finished goods inventory, ending Prepare an income statement for Delray Manufacturing (a manufacturer). Assume that its cost of goods manufactured is $1,472,000. Sales Cost of goods sold: Finished goods inventory, beginning Cost of goods manufactured DELRAY MANUFACTURING Income Statement For Year Ended December 31 Goods available for sale Less: Finished goods…arrow_forward

- The WIP account given below relates to the activities of Jones Ltd for the month of April: WIP Inventory A/C Debit side : April1 Bal $15,000, Direct Material Used 123,000, Direct Labour Incurred ??, Manufacturing Overhead Applied ??, Credit Side: Finished Goods ??, Additional data: Manufacturing Labour Costs incurred..$163,500 (75% represents direct labour), Manufacturing Overhead Rate....120% of direct labour cost, Actual Manufacturing Overhead Costs for April...$165,150 Two jobs were completed with total costs of $183,000 and $105,000 respectively. They were sold on account at a mark-up of 50% on cost. After these transactions have been recorded, the balance in Cost of Goods sold account (after adjusting ffor the MOH variace )is: a. 288,000 b. 306,000 c. 270,000 d. 432,000arrow_forwardThe accounting records of EVAN Manufacturing Inc., include the following information: December 31 Work in Process Inventory Finished Goods Inventory Direct Materials Used Direct Labor P50,000 300,000 875,000 450,000 312,500 January 1 P125,000 350,000 Selling Expensesarrow_forwardQuestion: The accounting records of Dolphin Company revealed the following information: Total manufacturing costs $780,000 Work-in-process inventory, Jan. 1 81,000 Work-in-process inventory, Dec. 31 103,000 Finished goods inventory, Jan. 1 171,000 148,000 Finished goods inventory, Dec. 31 What is Dolphin's cost of goods sold?arrow_forward

- The following accounts are from last year's books at Sharp Manufacturing: Bal (a) Bal (f) (g) Raw Materials 0 (b) 166,000 11,200 Finished Goods e (g) 513,200 49,200 Cost of Goods Sold 464,000 154,800 Bal (b) (c) (e) 464,000 (b) (c) (d) Work In Process 0 (f) 132,400 168,800 212,000 0 Manufacturing Overhead 22,400 (e) 26,400 156,800 513, 200 212,000 6,400 Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs. What is the manufacturing overapplied or underapplied for the year?arrow_forwardThe following is extracted from the records of a manufacturing company for last year: £ Sales 600,000 Inventory of direct materials as of 1st of January 39,000 Purchases of direct materials 158,000 Inventory of direct materials as of 31st of December 19,000 Direct manufacturing labour 28,000 Indirect manufacturing costs 45,000 Inventory of finished goods as of 1st of January 47,000 Cost of goods manufactured 121,000 Inventory of finished goods as of 31st of December 33,000 Selling and administrative costs 119,000 What is the company’s operating income? a. £177,000 b. None of the above c. £346,000 d. £95,000arrow_forwardCOGS?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education