FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

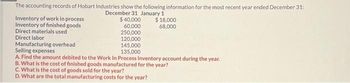

Transcribed Image Text:The accounting records of Hobart Industries show the following information for the most recent year ended December 31:

December 31 January 1

$ 40,000

60,000

250,000

120,000

145,000

135,000

Inventory of work in process

Inventory of finished goods

Direct materials used

Direct labor

Manufacturing overhead

$ 18,000

68,000

Selling expenses

A. Find the amount debited to the Work In Process Inventory account during the year.

B. What is the cost of finished goods manufactured for the year?

C. What is the cost of goods sold for the year?

D. What are the total manufacturing costs for the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Exercise 5 - 10 Schedules of Cost of Goods Manufactured and Cost of Goods Sold [L06]The following data from the just - completed year are taken from the accounting records of Eccles Company:Sales S 713, OOODirect labour cost 100, 000Raw material purchases 142, 000Selling expenses 110, 000Administrative expenses 53, 000Manufacturing overhead applied to work in process 220, 000Actual manufacturing overhead costs 240, 000 Inventory Beginning of Year End of YearRaw materials S 9, 000 S 11, 000Work in process 6, 000 21, 000Finished goods 71, 000 26, 000Required:1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials.2. Prepare a schedule of cost of goods sold.arrow_forwardChapter 17 Homework Item Date August 1 Bal., 4,800 units, 3/5 completed 31 Direct materials, 86,400 units 31 Direct labor 31 Factory overhead 31 Goods finished, 87,600 units 31 Bal., ? units, 3/5 completed Debit Credit Debit Line Item Description Inventory in process, August 1 Started and completed in August Transferred to finished goods in August Inventory in process, August 31 Total 155,520 44,480 25,024 a. Determine the number of units in work in process inventory at August 31. units 223,728 6,912 162,432 206,912 231,936 8,208 8,208 b. Determine the equivalent units of production for direct materials and conversion costs in August. If an amount is z Baking Department Equivalent Units of Production for Direct Materials and Conversion Costs For August Whole Units Credit Equivalent Units Equivalent Direct Materials Units Conversionarrow_forward3,800 units, 60% completed Direct materials, 32,000 units Direct labor Factory overhead Total cost to be accounted for $ 60,400 378,000 274,000 168.000 $880.400 During June, 32,000 units were placed into production and 31,200 units were completed, including those in inventory on June 1. On June 30, the inventory of work in process consisted of 4,600 units which were 85% completed. Inventories are costed by the first-in, first-out method and all materials are added at the beginning of the process. Determine the following (round unit cost data to four decimal places to minimize rounding differences): Equivalent units of production for conversion cost (a) (b) Conversion cost per equivalent unit Total and unit cost of finished goods started in prior period and completed in the current period Total and unit cost of finished goods started and completed in the current period (c) (d) (e) Total cost of work in process inventory, June 30arrow_forward

- Beginning work in process inventory $1,080,000 Beginning raw materials inventory 300,000 Ending work in process inventory 900,000 Ending raw materials inventory Raw materials purchased 480,000 960,000 Direct labor 900,000 Manufacturing overhead Laflin Company's cost of goods manufactured for the year 720,000 isarrow_forwardOn ff Company Company Materials inventory, December 1 $81,110 $109,500 Materials inventory, December 31 (a) 123,730 Materials purchased 206,020 (a) Cost of direct materials used in production 217,370 (b) Direct labor 305,780 246,380 Factory overhead 94,900 122,640 Total manufacturing costs incurred in December (b) 708,470 Total manufacturing costs 773,780 773,780 Work in process inventory, December 1 155,730 263,900 Work in process inventory, December 31 131,400 (c) Cost of goods manufactured (c) 701,900 Finished goods inventory, December 1 137,080 122,640 Finished goods inventory, December 31 143,560 (d) Sales 1,195,560 1,095,000 Cost of goods sold (d) 708,470 Gross profit (e) (e) Operating expenses 155,730 (f) Net income (f) 243,090arrow_forwardUnits 15,000 Work in process, May 1 Units started during May 60,000 Units completed and transferred out 68,000 Work in process, May 31 7,000 Direct Materials Conversion Costs Total Costs: Work in process, May 1 $ 41,250 Costs incurred during May 234,630 Totals $ 16,500 72,000 $275,880 $88.500 None of the answers is correct. $2.50 $2.76. $2.53. $24.750 162,630 $ 187,380 Using the weighted-average method of process costing, the cost per unit of conversion activity is: $2.70.arrow_forward

- ACCT 102 - Subparts d e farrow_forwardD Question 11 A company had a beginning work in process (WIP) inventory balance of $32.900. During the year, $55,100 of direct materials was placed into production Direct labor was $64,400, and Indirect labor was $19,900. Manufacturing overhead is allocated at 140% of direct labor costs. Actual manufacturing overhead was $86,500, and Cost of Goods Manufactured totaled $225,400. What is the ending work in process inventory balance? # $90.160 O $17.160. O $13.500 Ⓒ$187.4460arrow_forwardSharp Enterprises Inventories: March 1 March 31 Raw Material $18,000 $15,000 Work in process 9,000 6,000 Finished Goods 27,000 36,000 Additional information for March: Raw material purchased $42,000 Direct labor payroll 30,000 Direct labor rate per hour 7.50 Overhead rate per direct labor hour 10.00 Refer to Sharp Enterprises. For March, conversion cost incurred was?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education