Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Calculate the answer for this problem

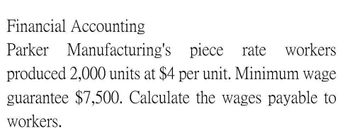

Transcribed Image Text:Financial Accounting

Parker Manufacturing's piece rate workers

produced 2,000 units at $4 per unit. Minimum wage

guarantee $7,500. Calculate the wages payable to

workers.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Financial Accounting Parker Manufacturing's piece rate workers produced 2,000 units at $4 per unit. Minimum wage guarantee $7,500. Calculate the wages payable to workers.arrow_forwardA worker takes 9 hours to complete a job on daily wages and 6 hours on a scheme of payment by results. His day rate is $ 0. 75 an hour, the material cost of the product is $ 4 and the overheads recovered at 150% of the total direct wages. Calculate the factory cost of the products Overheads are Under: (a) Piece Work Plan, (b) Rowan Plan, and (c) Halsey Plan.arrow_forwarda. Incurred $105,000 of direct labor in its Mixing department and $90,000 of direct labor in its Shaping department. Hint. Credit Factory Wages Payable. b. Incurred indirect labor of $23,000. Hint. Credit Factory Wages Payable. View transaction list Journal entry worksheetarrow_forward

- A manufacturing company applies factory overhead based on direct labor hours. At the beginning of the year, it estimated that factory overhead costs would be $353,700 and direct labor hours would be 47,300. Actual manufacturing overhead costs incurred were $319,500, and actual direct labor hours were 52,400. The journal entry to apply the factory overhead costs for the year would include a Oa. debit to Factory Overhead for $391,952 Ob. credit to Factory Overhead for $391,952 Oc. debit to Factory Overhead for $319,500 Od. credit to Factory Overhead for $353,700arrow_forwardA manufacturing company applies factory overhead based on direct labor hours. At the beginning of the year, it estimated that factory overhead costs would be $357,800 and direct labor hours would be 47,300. Actual manufacturing overhead costs incurred were $306,900, and actual direct labor hours were 52,100. The entry to apply the factory overhead costs for the year would include a a.credit to Factory Overhead for $393,876 b.debit to Factory Overhead for $306,900 c.debit to Factory Overhead for $393,876 d.credit to Factory Overhead for $357,800 The Aleutian Company produces two products, Rings and Dings. They are manufactured in two departments—Fabrication and Assembly. Data for the products and departments are listed below. Product Number ofUnits Labor HoursPer Unit Machine HoursPer Unit Rings 960 4 3 Dings 2,050 7 9 All of the machine hours take place in the Fabrication Department, which has an estimated overhead of $89,500. All of the labor hours take place…arrow_forwardGeneral Accountingarrow_forward

- LABOR The following workers of 888 Millenial Sardines, Inc. with their compensation and status are given below: Monthly No. Name of Worker Position Monthly Basic Pay Allowances Production Operator Accounting Manager 15,000.00 40,000.00 18,000.00 22,000.00 30,000.00 20,000.00 25,000.00 12,000.00 13,000.00 26,000.00 Lei Kalang Iselle Balibago 1 15,000.00 1,500.00 500.00 2 3 Dino Dinero Production Staff I 4 Robin Devela Assembler III Marketing Supervisor Production Staff II 5,000.00 1,500.00 Rickman De Guzman Ma. Pepsi Nicola Liwayway Dalamhati Xander Toyota Rafael Rodriguez Sheryl Delara 6 Purchasing Staff Company Driver Maintenance Staff 7 9 10 Assembler V 1,000.00 Other Information: А. Assume that the payroll period is every 15th and 30th of the month. SSS, HDMF and PHIC contributions are deducted every 30th of the month Withholding tax is deducted every 15th and 30th of the month. Lei Kalang has a monthly SSS salary loan amortization of P 500 and Liwayway Dalamhati has a monthly HDMF…arrow_forwardA manufacturing company applies factory overhead based on direct labor hours. At the beginning of the year, it estimated that factory overhead costs would be $348,700 and direct labor hours would be 41,800. Actual manufacturing overhead costs incurred were $317,200, and actual direct labor hours were 50,100. The journal entry to apply the factory overhead costs for the year would include a a.debit to Factory Overhead for $317,200 b.credit to Factory Overhead for $417,834 c.debit to Factory Overhead for $417,834 d.credit to Factory Overhead for $348,700arrow_forwardKingston manufacturing has the solve this questionarrow_forward

- A company that uses job order costing incurred a monthly factory payroll of $200,000. Of this amount, $52,000 is indirect labor and $148,000 is direct labor. Prepare journal entries to record the (a) use of direct labor and (b) use of indirect labor. View transaction list Journal entry worksheet 1 2 > Record the cost of direct labor used. Note: Enter debits before credits. Transaction General Journal Debit Credit а. Record entry Clear entry View general journalarrow_forward3arrow_forwardA manufacturing company applies factory overhead based on direct labor hours. At the beginning of the year, it estimated that factory overhead costs would be $349,900 and direct labor hours would be 47,000. Actual manufacturing overhead costs incurred were $303,900, and actual direct labor hours were 52,500. The journal entry to apply factory overhead costs for the year would include a A. Credit to factory overhead for 349,900 B. Debit to factory overhead for 390,600 C. Credit to factory overhead for $390,600 D. Debit to factory overhead for $303,900arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub