College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

expert please answer it simple NO

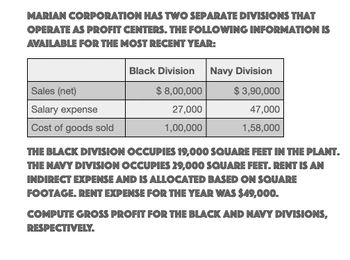

Transcribed Image Text:MARIAN CORPORATION HAS TWO SEPARATE DIVISIONS THAT

OPERATE AS PROFIT CENTERS. THE FOLLOWING INFORMATION IS

AVAILABLE FOR THE MOST RECENT YEAR:

Sales (net)

Salary expense

Cost of goods sold

Black Division

Navy Division

$ 8,00,000

$ 3,90,000

27,000

47,000

1,00,000

1,58,000

THE BLACK DIVISION OCCUPIES 19,000 SQUARE FEET IN THE PLANT.

THE NAVY DIVISION OCCUPIES 29,000 SQUARE FEET. RENT IS AN

INDIRECT EXPENSE AND IS ALLOCATED BASED ON SQUARE

FOOTAGE. RENT EXPENSE FOR THE YEAR WAS $49,000.

COMPUTE GROSS PROFIT FOR THE BLACK AND NAVY DIVISIONS,

RESPECTIVELY.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Xenold, Inc., manufactures and sells cooktops and ovens through three divisions: Home, Restaurant, and Specialty. Each division is evaluated as a profit center. Data for each division for last year are as follows (numbers in thousands): The income tax rate for Xenold, Inc., is 40 percent. Xenold, Inc., has two sources of financing: bonds paying 5 percent interest, which account for 25 percent of total investment, and equity accounting for the remaining 75 percent of total investment. Xenold, Inc., has been in business for over 15 years and is considered a relatively stable stock, despite its link to the cyclical construction industry. As a result, Xenold stock has an opportunity cost of 5 percent over the 4 percent long-term government bond rate. Xenolds total capital employed is 5.04 million (2,600,000 for the Home Division, 1,700,000 for the Restaurant Division, and the remainder for the Specialty Division). Required: 1. Prepare a segmented income statement for Xenold, Inc., for last year. 2. Calculate Xenolds weighted average cost of capital. (Round to four significant digits.) 3. Calculate EVA for each division and for Xenold, Inc. 4. Comment on the performance of each of the divisions.arrow_forwardGeneral Accountingarrow_forwardSolve this questionarrow_forward

- Clouthier Corporation has two divisions: Home Division and Commercial Division. The following report is for the most recent operating period: Total Company Home Division Commercial Division Sales $ 572, 000 $ 268, 000 $ 304, 000 Variable expenses $ 205, 790 $ 88, 360 $ 117, 430 Traceable fixed expenses $ 203, 000 $ 91, 000 $ 112, 000 The company's common fixed expenses total $62, 700. Required: What is the Home Division's break - even in sales dollars? What is the Commercial Division's break - even in sales dollars? What is the company's overall break - even in sales dollars? Note: Round intermediate calculations to three decimal places.arrow_forwardArlington Clothing, Inc., shows the following information for its two divisions for year 1. Lake Region Coastal Region Sales revenue $ 4,160,000 $ 13,070,000 Cost of sales 2,691,300 6,535,000 Allocated corporate overhead 249,600 784,200 Other general and administration 553,900 3,755,000 Required: a. Compute divisional operating income for the two divisions. Ignore taxes. b-1. What are the gross margin and operating margin percentages for both divisions? b-2. How well have these divisions performed?arrow_forwardTerra Company has two divisions, the Retail Division and the Wholesale Division. The following information was gathered for the two divisions for the current year: Operating income Operating assets Retail Division $ 7,200,000 $37,200,000 Wholesale Division $ 3,700,000 $17,200,000 Assuming that these are the only divisions of Terra Company, what is the ROI for the company as a whole?arrow_forward

- Combe Corporation has two divisions: Alpha and Beta. Data from the most recent month appear below: Alpha Beta Sales $ 167,000 $ 362,300 Variable expenses $ 106,880 $ 166,300 Traceable fixed expenses $ 101,970 $ 120,900 The company’s common fixed expenses total $84,800. The break-even in sales dollars for Alpha Division is closest to: *MULTIPLE CHOICE: see imagearrow_forwardPanda Airlines Inc. has two divisions organized as profit centers, the Passenger Division and the Cargo Division. The following divisional income statements were prepared: PANDA AIRLINES INC.Divisional Income StatementsFor the Year Ended April 30, 20Y9 Passenger Division Cargo Division Revenues $2,114,000 $2,114,000 Operating expenses (1,711,280) (1,884,000) Operating income before service department charges $402,720 $230,000 Less service department charges: Training $94,500 $94,500 Flight scheduling 89,010 89,010 Reservations 94,800 (278,310) 94,800 (278,310) Operating income (loss) $124,410 $(48,310) The service department charge rate for the service department costs was based on revenues. Since the revenues of the two divisions were the same, the service department charges to each division were also the same. The following additional information is available: PassengerDivision CargoDivision Total…arrow_forwardMach Co. operates three manufacturing departments as profit centers. The following information is available for its most recent year: Dept. Sales 1 2 3 $1,100,000 430,000 710,000 Cost of goods sold $735,000 156,500 305,000 Direct expenses Indirect expenses $110,000 $85,000 40,200 105,000 165,000 21,000 Which department has the greatest departmental contribution to overhead and what is the amount contributed? Group of answer choices Dept. 3; $430,000 Dept. 1; $255,000 Dept. 2; $110,000 Dept. 3; $240,000 Dept. 2; $156,500arrow_forward

- Wild Sun Airlines Inc. has two divisions organized as profit centers, the Passenger Division and the Cargo Division. The following divisional income statements were prepared: WILD SUN AIRLINES INC. Divisional Income Statements For the Year Ended December 31, 20Y9 1 Passenger Division Cargo Division 2 Revenues $3,025,000.00 $3,025,000.00 3 Operating expenses 2,450,000.00 2,736,000.00 4 Income from operations before service department charges $575,000.00 $289,000.00 5 Less service department charges: 6 Training $125,000.00 $125,000.00 7 Flight scheduling 108,000.00 108,000.00 8 Reservations 151,200.00 151,200.00 9 Total service department charges $384,200.00 $384,200.00 10 Income from operations $190,800.00 $(95,200.00) The service department charge rate for the service department costs was based on revenues. Because the revenues of the two…arrow_forwardNicholas Technologies operates two divisions. Hardware Services and Software Services. During the current month, the two divisions reported the following results. Hardware Sales Varlable costs (as a percentage of sales) Traceable fixed costs Software $ 850, 000 45% $ 125, 000 $ 660, 000 40% $ 250,000 In addition, fixed costs common to both divisions amounted to $228,000. Prepare an income statement showing percentages as well as dollar amounts. Conclude your statement with income from operations for the business and with the responsibility margin for each division. (Round percentage answers to 2 decimal place. i.e. 0.1234 should be considered as 12.34%.) NICHOLAS TECHNOLOGIES Responsibility Income Statement For the Current Month Entire Company Hardware Servicos Division Software Services Division Percent of Sales Dollars Dollars Percent of Sales Dollars Percent of Salesarrow_forwardZachary Company operates three segments Income statements for the segments imply that profitability could be improved if Segment A were eliminated. ZACHARY COMPANY Income Statements for Year 2 Segment Sales Cost of goods sold Sales commissions Contribution margin General fixed operating expenses (allocation of president's salary) Advertising expense (specific to individual divisions) Net income (loss) Required a. Prepare a schedule of relevant sales and costs for Segment A A $ 168,000 (126,000) (20,000) 22,000 (34,000) (6,000) B $ 235,000 (79,000) (32,000) 124,000 (51,000) (19,000) $ (18,000) $ 54,000 $ 253,000 (82,000) (28,000) 143,000 (34,000) $ 109,000 b. Prepare comparative income statements for the company as a whole under two alternatives (1) the retention of Segment A and (2) the elimination of Segment A Complete this question by entering your answers in the tabs below.. Required A Required B Prepare a schedule of relevant sales and costs for Segment A. Relevant Revenue and Cost…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning