FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please help me to create the balance sheet and income statement. Thank you

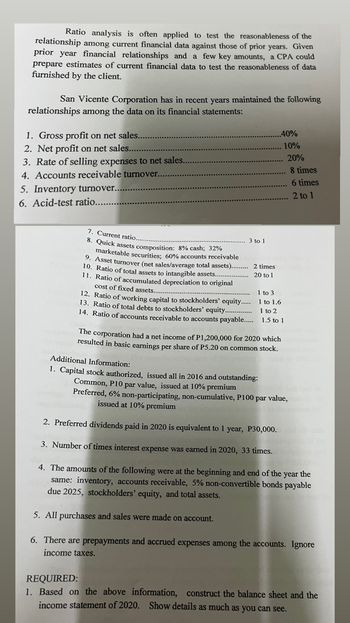

Transcribed Image Text:Ratio analysis is often applied to test the reasonableness of the

relationship among current financial data against those of prior years. Given

prior year financial relationships and a few key amounts, a CPA could

prepare estimates of current financial data to test the reasonableness of data

furnished by the client.

San Vicente Corporation has in recent years maintained the following

relationships among the data on its financial statements:

1. Gross profit on net sales..

2. Net profit on net sales....

3. Rate of selling expenses to net sales..

4. Accounts receivable turnover..

5. Inventory turnover......

6. Acid-test ratio....

7. Current ratio...

8. Quick assets composition: 8% cash; 32%

marketable securities; 60% accounts receivable

9. Asset turnover (net sales/average total assets).......... 2 times

10. Ratio of total assets to intangible assets...

...... 20 to 1

11. Ratio of accumulated depreciation to original

3 to 1

.40%

cost of fixed assets...

1 to 3

12. Ratio of working capital to stockholders' equity..... 1 to 1.6

13. Ratio of total debts to stockholders' equity................ 1 to 2

14. Ratio of accounts receivable to accounts payable..... 1.5 to 1

The corporation had a net income of P1,200,000 for 2020 which

resulted in basic earnings per share of P5.20 on common stock.

Additional Information:

1. Capital stock authorized, issued all in 2016 and outstanding:

Common, P10 par value, issued at 10% premium

10%

20%

Preferred, 6% non-participating, non-cumulative, P100 par value,

issued at 10% premium

2. Preferred dividends paid in 2020 is equivalent to 1 year, P30,000.

3. Number of times interest expense was earned in 2020, 33 times.

8 times

6 times

2 to 1

4. The amounts of the following were at the beginning and end of the year the

same: inventory, accounts receivable, 5% non-convertible bonds payable

due 2025, stockholders' equity, and total assets.

5. All purchases and sales were made on account.

6. There are prepayments and accrued expenses among the accounts. Ignore

income taxes.

REQUIRED:

1. Based on the above information, construct the balance sheet and the

income statement of 2020. Show details as much as you can see.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How does the software Quickbooks relate to accounting?arrow_forwardI need the income statement of the above transactions. Thank youarrow_forwardWhen using the Spreadsheet (work sheet) method to analyze noncash accounts, it is best to start with Group of answer choices cash net income retained earnings revenuearrow_forward

- How does the data flow from the transaction (e.g. MRI scan) to financial statements? Use the following key terms in your response: transaction, journal entry, general ledger, financial statement.arrow_forwardCan I get the income statement, a statement of retained earnings, and a classified balance sheet also?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education