Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Subject: General Accounting

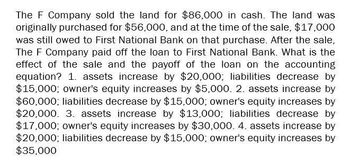

Transcribed Image Text:The F Company sold the land for $86,000 in cash. The land was

originally purchased for $56,000, and at the time of the sale, $17,000

was still owed to First National Bank on that purchase. After the sale,

The F Company paid off the loan to First National Bank. What is the

effect of the sale and the payoff of the loan on the accounting

equation? 1. assets increase by $20,000; liabilities decrease by

$15,000; owner's equity increases by $5,000. 2. assets increase by

$60,000; liabilities decrease by $15,000; owner's equity increases by

$20,000. 3. assets increase by $13,000; liabilities decrease by

$17,000; owner's equity increases by $30,000. 4. assets increase by

$20,000; liabilities decrease by $15,000; owner's equity increases by

$35,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume the seller owes $113,000 on a loan for the land. After receiving the $770,000 cash in, the seller pays $113,000 that's owed.arrow_forwardA vacant lot is acquired for $83,000 cash. Later the owner borrows $52,000 against the land. Three years later, the lot is then sold for $127,000 in cash. After receiving the $127,000 sales price in cash, the seller pay off the loan of the $52,000 owed. What is the effect of the $52,000 payment of the loan on the total amount of the seller’s (1) assets, (2) liabilities, and (3) stockholders’ equity? Assets increase $127,000; liabilities decrease $52,000; Stockholders’ equity increases $44,000 The payment of the loan has no net effect on any of the categories Assets decrease $52,000; liabilities decrease $52,000; Stockholders’ equity increases $44,000 Assets decrease $52,000; liabilities decrease $52,000; Stockholders’ equity is unchangedarrow_forwarda. A vacant lot acquired for $115,000 is sold for $298,000 in cash. What is the effect of the sale on the total amount of the seller’s (1) assets, (2) liabilities, and (3) owner’s equity?b. Assume that the seller owes $80,000 on a loan for the land. After receiving the $298,000 cash in (a), the seller pays the $80,000 owed. What is the effect of the payment on the total amount of the seller’s (1) assets, (2) liabilities, and (3) owner’s equity?c. Is it true that a transaction always affects at least two elements (Assets,Liabilities, or Owner’s Equity) of the accounting equation? Explain.arrow_forward

- An asset that cost $20,000 and on which depreciation of $15,000 has been recorded is traded in on a new replacement asset. The sales price, also the fair value, of the new asset is $27,000. The owner of the old asset was given an allowance of $7,000 for the old asset and paid $20,000 in cash. For financial accounting purposes, what is the amount of gain or loss recorded? Question 5 options: a. a gain of $2,000 b. no gain or loss c. a loss of $2,000 d. a gain of $7,000arrow_forwardOCD exchanged old realty for new like-kind realty. OCD’s adjusted basis in the old realty was $31,700 ($60,000 initial cost − $28,300 accumulated depreciation), and its FMV was $48,000. Because the new realty was worth only $45,000, OCD received $3,000 cash in addition to the new realty. Required: a-1. Compute OCD's realized gain. a-2. Determine the amount and character of any recognized gain. b. Compute OCD’s basis in its new realty.arrow_forwardWhat is the result of this exchange on these financial accounting question?arrow_forward

- Referring to PA7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the purchase of the printer impacts not only depreciation expense each year but also the assets book value. What amount will be recorded as depreciation expense each year, and what will the book value be at the end of each year after depreciation is recorded?arrow_forwardSubject :- Accountingarrow_forwardFollowing are descriptions of land purchases in four separate cases. Requireda. Determine the cost used for recording the land acquired in each case.b. Record the journal entry for each case on the date of the land’s acquisition. Note: Round your answers to the nearest whole dollar. Case One 1. At the midpoint of the current year, a $32,000 check is given for land, and the buyer assumes the liability for unpaid taxes in arrears of $800 at the end of last year and those assessed for the current year of $720. a. Determine the cost used for recording the land acquired.Cost of land $Answer b. Record the journal entry on the date of the Account NameDr.Cr. Answer Answer Answer To record land acquisition.arrow_forward

- In 20x7, Sweet Treats sold a piece of equipment with a purchase value of $371,000 and acumulated depreciation of $247,000 for $75,000. Sweet Treats realized a loss of $49.000 n the sale HoW Would this transaction affect overall cash flows? O a Cash flows would increase by $26.000, 0b Cash flows would increase by S49.00 0¢ Cash flows would ncrease by $75.00 0d Cash flows would decrease by $49.00arrow_forward44.On December 31, 2020, Empresas La Sidrita acquired a building. La Sidrita paid a third of the purchase price in cash and signed a note payable with the seller for the difference. The company closes books on December 31. In the Statement of Cash Flows for 2020, how much will La Sidrita report in the investment activities section? Select one: a. The purchase price of the building. b. Only cash paid. c. Zero. d. The principal of the document payable.arrow_forward! Required information [The following information applies to the questions displayed below.] Russell Corporation sold a parcel of land valued at $400,000. Its basis in the land was $275,000. For the land, Russell received $50,000 in cash in year 0 and a note providing that Russell will receive $175,000 in year 1 and $175,000 in year 2 from the buyer. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) a. What is Russell's realized gain on the transaction? Realized gainarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College