FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

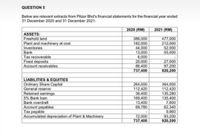

Transcribed Image Text:QUESTION 5

Below are relevant extracts from Pitzer Bhd's financial statements for the financial year ended

31 December 2020 and 31 December 2021:

2020 (RM)

2021 (RM)

ASSETS:

Freehold land

Plant and machinery at cost

Inventories

Bank

Tax recoverable

386,000

182,000

44,000

13,000

6,000

20,000

86,400

737,400

477,000

212,000

52,000

55,000

Fixed deposits

Account receivables

27,000

97,200

920,200

LIABILITIES & EQUITIES

Ordinary Share Capital

General reserve

Retained earnings

5% Bank loan

Bank overdraft

Account payables

Tax payable

Accumulated depreciation of Plant & Machinery

264,000

112,420

36,400

169,400

13,400

69,780

364,000

112,420

135,280

135,400

7,600

62,340

9,960

93,200

920,200

72,000

737,400

Transcribed Image Text:Additional information:

1.

The profit before tax for the year ended 31 December 2021 was RM213,640.

2.

Fixed deposits were qualified as Cash & Cash Equivalent.

3.

During the year, the following transactions incurred for property, plant & equipment:

i. There was a purchase of freehold land & plant and machinery during the year

ii.

A piece of land costing RM100,000 had been sold for RM200,000

i.

The current year's depreciation expense for the year for plant and machinery

amounted to RM21,200.

4.

There is a repayment of bank loan of at the end of the year.

5.

Dividend of RM57,400 for the year has been fully paid.

6.

Tax expense for the year was RM57,360.

Required:

Prepare the Statement of Cash Flows for the year ended 31 December 2021 for Pitzer

Bhd using the INDIRECT METHOD in accordance with MFRS107.

a.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- dsgdffxvcgbcfvfdxarrow_forwardComparative statement of financial position of Alpha Sdn Bhd as at 31 December 2023 and 2022 are as following: 2023 2022 RM million RM million Cash at bank 108.5 50.4 Accounts receivable (less: provision for doubtful debts) 393.0 219.0 Inventories 84.0 134.4 585.5 403.8 Plant and equipment (NBV) 475.6 364.8 Investment in government securities 33.6 33.6 509.2 398.4 Total assets 1,094.7 802.2 Ordinary shares 530.0 290.0 180 million 10% Preference shares 180.0 180.0 Retained earnings 105.0 73.5 815.0 543.5 Accounts payable 205.9 197.8 Tax payable 15.0 10.0 Deferred taxation 37.8 50.9 10% Debentures 21.0…arrow_forwardLoans and borrowings Deferred taxek liability 14,130 10,220- 1,010 960- 15,140 11,180 Current Liabilities Trade payable Current tax 1,260 1,140 1,040 920 payable Interest payable 980- 740k 3,280 40,190 2,800 32,960 Total Equity and Liabilities 2019 £'000 2018 £'000 Sales Cost of sales Distribution costse Administration expenses Gain on disposal of PPE 22,000 (11,800) (3,100) (1,630) 280 16,000 (8,200) (2,600) (1,420) Interest expensee a Тах еexpensee (1,140) (1,820) (760) (1,240) Net profit 2,790 1,780 1. The company disposal of PPE during the year with a book value of £1,000,000. 2. Depreciation of property, plant and equipment for the year was £650,000.4 The intangibles were acquired for cash towards the end of the year and were not sub ject to any amortisation in the current period.e 3. Prepare the statement of cash flows using the indirect method.arrow_forward

- What is Ratio Corporation's Current Ratio at 12/31/2021? Question 2 options: 2.11 2.22 1.21 None of these optionsarrow_forwardNotes 2022 2021 ASSETS Cash on hand 1,404,561 2,529,876 Statutory deposits with Central Banks 7,508,221 7,045,773 Due from banks 9,178,784 12,425,341 Treasury Bills 8,400,605 4,934,664 Advances 4 56,829,415 55,515,628 Investment securities 5 19,953,780 19,259,501 Investment interest receivable 203,693 205,204 Investment in associated companies 6 62,603 55,961 Premises and equipment 7 3,255,758 3,218,670 Right-of-use assets 8 (a) 398,405 477,858 Intangible assets 9 1,143,560 1,171,222 Pension assets 10 (a) 1,200,717 1,415,216 Deferred tax assets 11 (a) 316,556 246,214 Taxation recoverable 49,290 72,817 Other assets 12 1,071,755 594,950 TOTAL ASSETS 110,977,703 109,168,895 LIABILITIES AND EQUITY LIABILITIES Due to banks 445,410 155,985 Customers’ current, savings and deposit accounts 13 87,586,189 86,609,634 Other fund raising instruments 14 4,461,931 4,618,554 Debt securities in issue 15 1,674,719 1,865,895 Lease liabilities 8 (b) 420,088 482,867 Pension liability 10 (a) 40 25,356…arrow_forwardQuestion 10 of 25 Based on the following data, what is the amount of working capital? Accounts payable Accounts receivable Cash Intangible assets Inventory Long-term investments Long-term liabilities Short-term investments Notes payable (short-term) Property, plant, and equipment Prepaid insurance $404240 O $411680 > O $458800 $79360 141360 86800 124000 171120 198400 248000 99200 69440 1661600 2480arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education