FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

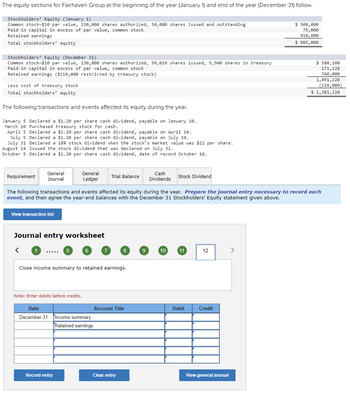

Transcribed Image Text:The equity sections for Fairhaven Group at the beginning of the year (January 1) and end of the year (December 31) follow.

Stockholders' Equity (January 1)

Common stock-$10 par value, 130,000 shares authorized, 50,000 shares issued and outstanding

Paid-in capital in excess of par value, common stock

Retained earnings

Total stockholders' equity

Stockholders' Equity (December 31)

Common stock-$10 par value, 130,000 shares authorized, 58,010 shares issued, 5,500 shares in treasury

Paid-in capital in excess of par value, common stock

Retained earnings ($110,000 restricted by treasury stock)

Less cost of treasury stock

Total stockholders' equity

The following transactions and events affected its equity during the year.

January 5 Declared a $1.20 per share cash dividend,

March 20 Purchased treasury stock for cash.

payable on January 10.

April 5 Declared a $1.20 per share cash dividend,

payable on April 10.

July 5 Declared a $1.20 per share cash dividend, payable on July 10.

July 31 Declared a 18 % stock dividend when the stock's market value was $22 per share.

August 14 Issued the stock dividend that was declared on July 31.

October 5 Declared a $1.20 per share cash dividend, date of record October 10.

Requirement

General

Journal

View transaction list

<

Journal entry worksheet

General

Ledger

Note: Enter debits before credits.

Date

December 31

The following transactions and events affected its equity during the year. Prepare the journal entry necessary to record each

event, and then agree the year-end balances with the December 31 Stockholders' Equity statement given above.

Close income summary to retained earnings.

Record entry

Trial Balance

Income summary

Retained earnings

8

Account Title

Clear entry

Cash

Dividends

Stock Dividend

10

11

Debit

12

Credit

$ 500,000

75,000

410,000

$ 985,000

View general journal

$ 580,100

171, 120

740,000

1,491,220

(110,000)

$ 1,381,220

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- The following accounts and their balances appear in the ledger of Goodale Properties Inc. on June 30 of the current year: Line Item Description Amount Common Stock, $15 par $154,500 Paid-In Capital from Sale of Treasury Stock 6,700 Paid-In Capital in Excess of Par—Common Stock 12,360 Retained Earnings 255,000 Treasury Stock 9,595 Prepare the "Stockholders' Equity" section of the balance sheet as of June 30. Regarding the common stock, 50,000 shares are authorized, and 505 shares have been reacquired.arrow_forwardPlease help mearrow_forwardThe equity sections for Fairhaven Group at the beginning of the year (January 1) and end of the year (December 31) follow. Stockholders' Equity (January 1) Common stock-$10 par value, 130,000 shares authorized, 50,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity Stockholders' Equity (December 31) Common stock-$10 par value, 130,000 shares authorized, 58,010 shares issued, 5,500 shares in treasury Paid-in capital in excess of par value, common stock Retained earnings ($110,000 restricted by treasury stock) Less cost of treasury stock Total stockholders' equity The following transactions and events affected its equity during the year. January 5 Declared a $1.20 per share cash dividend, payable on January 10. March 20 Purchased treasury stock for cash. April 5 Declared a $1.20 per share cash dividend, payable on April 10. July 5 Declared a $1.20 per share cash dividend, payable on July 10. July 31 Declared…arrow_forward

- The equity sections for Atticus Group at the beginning of the year (January 1) Stockholders' Equity (January 1) Common stock-$4 par value, 100,000 shares authorized, 40,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity Stockholders' Equity (December 31) Common stock-$4 par value, 100,000 shares authorized, 47,000 shares issued, 5,000 shares in treasury Paid-in capital in excess of par value, common stock Retained earnings ($50,000 restricted by treasury stock) Less cost of treasury stock Total stockholders' equity The following transactions and events affected its equity during the year. January 5 Declared a $0.40 per share cash dividend, date of record January 10. March 20 Purchased treasury stock for cash. April 5 July 5 Declared a $0.40 per share cash dividend, date of record April 10. Declared a $0.40 per share cash dividend, date of record July 10. July 31 August 14 Declared a 20% stock dividend when…arrow_forwardA company reported the following stockholders' equity on January 1 of the current year: Common stock-$10 par value, 1,000,000 shares authorized; 260,000 shares issued Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity Prepare journal entries for the following selected transactions. March 1 Purchased 11,000 shares of its own stock for $21 cash per share. May 5 Sold 5,000 shares of its treasury stock for $21 cash per share. October 12 Sold 3,000 shares of its treasury stock for $22 cash per share. View transaction list 1 2 Purchased 11,000 shares of its own stock for $21 cash per share. Sold 5,000 shares of its treasury stock for $21 cash per share. 3 Sold 3,000 shares of its treasury stock for $22 cash per share. $ 2,600,000 1,270,000 1,685,000 $ 5,555,000 X Credit >arrow_forwardGodoarrow_forward

- Shown below is information relating to the stockholders' equity of Grant Corporation at December 31, Year 1: 6.5% cumulative preferred stock, $100 par value; authorized, 18,000 shares; issued and outstanding, 9,000 shares Common stock, $4 par value; authorized, 340,000 shares; issued and outstanding, 204,000 shares Additional paid-in capital: preferred stock Additional paid-in capital: common stock Retained earnings Dividends have been declared and paid for Year 1. The average issue price per share of Grant's preferred stock was: Multiple Choice O $52.50. $100.00. $105.00. $ 900,000 $ 816,000 $ 45,000 $ 1,500,000 $ 920,000arrow_forwardThe equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow. Stockholders' Equity (January 1) Common stock-$6 par value, 100,000 shares authorized, 35,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity Stockholders' Equity (December 31) Common stock-$6 par value, 100,000 shares authorized, 41,400 shares issued, 3,000 shares in treasury Paid-in capital in excess of par value, common stock Retained earnings ($60,000 restricted by treasury stock) Less cost of treasury stock Total stockholders' equity The following transactions and events affected its equity during the year. January 5 Declared a $0.40 per share cash dividend, date of record January 10. March 20 Purchased treasury stock for cash. April 5 July 5 July 31 August 14 October 5 $ 210,000 170,000 340,000 $ 720,000 Declared a $0.40 per share cash dividend, date of record April 10. Declared a…arrow_forwardThe equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow. Stockholders' Equity (January 1) Common stock-$5 par value, 100,000 shares authorized, 30,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity Stockholders' Equity (December 31) Common stock-$5 par value, 100,000 shares authorized, 35,400 shares issued, 3,000 shares in treasury Paid-in capital in excess of par value, common stock Retained earnings ($60,000 restricted by treasury stock) Less cost of treasury stock Total stockholders' equity The following transactions and events affected its equity during the year. January 5 Declared a $0.40 per share cash dividend, date of record January 10. March 20 Purchased treasury stock for cash. April 5 Declared a $0.40 per share cash dividend, date of record April 10. Declared a $0.40 per share cash dividend, date of record July 10. July 5 July 31…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education