FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

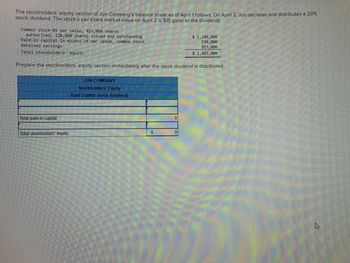

Transcribed Image Text:The stockholders' equity section of Jun Company's balance sheet as of April 1 follows. On April 2, Jun declares and distributes a 20%

stock dividend. The stock's per share market value on April 2 is $15 (prior to the dividend).

Common stock-$5 par value, 415,000 shares

authorized, 220,000 shares issued and outstanding

Paid-in capital in excess of par value, common stock.

Retained earnings

Total stockholders' equity

Prepare the stockholders' equity section immediately after the stock dividend is distributed.

Total paid-in capital

Total stockholders' equity

JUN COMPANY

Stockholders' Equity

April 2 (after stock dividend)

$

0

$ 1,100,000

530,000

853,000

$ 2,483,000

0

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The stockholders’ equity section of the balance sheet for Mann Equipment Co. at December 31, Year 2, is as follows. Stockholders’ Equity Paid-in capital Preferred stock, ? par value, 4% cumulative, 190,000 shares authorized, 49,000 shares issued and outstanding $ 490,000 Common stock, $15 stated value, 240,000 shares authorized, 49,000 shares issued and ?? shares outstanding 735,000 Paid-in capital in excess of par—Preferred 39,000 Paid-in capital in excess of stated value—Common 147,000 Total paid-in capital $ 1,411,000 Retained earnings 340,000 Treasury stock, 8,000 shares (30,000 ) Total stockholders’ equity $ 1,721,000 Note: The market value per share of the common stock is $30, and the market value per share of the preferred stock is $21. Required What is the par value per share of the preferred stock? What is the dividend per share on…arrow_forwardLangley Corporation has 57,000 shares of $11 par value common stock outstanding. It declares a 15% stock dividend on December 1 when the market price per share is $16. The dividend shares are issued on December 31.Prepare the entries for the declaration and issuance of the stock dividend.arrow_forward(R) please answer asap.. The stockholders’ equity section of Jun Company’s balance sheet as of April 1 follows. On April 2, Jun declares and distributes a 20% stock dividend. The stock’s per share market value on April 2 is $10 (prior to the dividend). Common stock—$5 par value, 555,000 sharesauthorized, 290,000 shares issued and outstanding$ 1,450,000Paid-in capital in excess of par value, common stock670,000Retained earnings923,000Total stockholders' equity$ 3,043,000Prepare the stockholders’ equity section immediately after the stock dividend is distributed.arrow_forward

- The stockholders' equity section of Monty Corp.'s balance sheet at December 31 is presented here. Monty Corp. Balance Sheet(Partial) Stockholders' equity Paid-in capital Preferred stock, cumulative, 14,000 shares authorized, 9,800 shares issued and outstanding Common stock, no par, 880,000 shares authorized, 560,000 shares issued Total paid-in capital Retained earnings Total paid-in capital and retained earnings Less: Treasury stock (12,000 common shares) Total stockholders' equity From a review of the stockholders' equity section, answer the following questions. (a) How many shares of common stock are outstanding? (b) Assuming there is a stated value, what is the stated value of the common stock? $ (c) What is the par value of the preferred stock? $ (d) If the annual dividend on preferred stock is $105,840, what is the dividend rate on preferred stock? (e) If dividends of $211.680 were in arrears on preferred stock, what would be the balance reported for retained earnings? eTextbook…arrow_forwardFollowing is the stockholders' equity section as of June 30. Common stock-$20 par value, 200,000 shares authorized, 80,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity On July 1, the directors declare a 5% stock dividend distributable on July 31 to the July 18 stockholders of record. The stock's market value is $50 per share on July 1 before the stock dividend. 1. Prepare entries to record both the dividend declaration and its distribution. 2. Prepare the stockholders' equity section after the stock dividend is distributed. (Assume no other changes to equity.) Enter answers in the tabs below. Required 1 Required 2 $ 1,600,000 400,000 750,000 $ 2,750,000 Prepare the stockholders' equity section after the stock dividend is distributed. (Assume no other changes to equity.) Stockholders' Equity Section of the Balance Sheet July 31 Retained earnings Common stock Paid-in capital in excess of par value, common…arrow_forwardThe following information is available for Metloc Rock Corporation: Common Stock ($5 par) $1,620,000 Retained Earnings 1,205,000 An 17% stock dividend is declared and paid when the market value was $12 per share. Compute total stockholders' equity after the stock dividend. Total Stockholders' Equityarrow_forward

- On January 1, Pharoah Company had 87000 shares of $10 par value common stock outstanding. On May 7, the company declared a 5% stock dividend to stockholders of record on May 21. Market value of the stock was $16 on May 7. The stock was distributed on May 24. The entry to record the transaction of May 24 would include aarrow_forwardOn June 13, the board of directors of Siewert Inc. declared a 5% stock dividend on its 40 million, $1 par, common shares, to be distributed on July 1. The market price of Siewert common stock was $15 on June 13. Complete the below table to calculate the stock dividend.Prepare a journal entry that summarizes the declaration and distribution of the stock dividend.arrow_forwardThe stockholders’ equity section of Creighton Company’s balance sheet is shown as follows: CREIGHTON COMPANY As of December 31, Year 3 Stockholders’ equity Preferred stock, $10 stated value, 7% cumulative,300 shares authorized, 50 issued and outstanding $ 500 Common stock, $10 par value, 250 shares authorized,100 issued and outstanding 1,000 Common stock, class B, $20 par value, 400 sharesauthorized, 150 issued and outstanding 3,000 Common stock, no par, 150 shares authorized,100 issued and outstanding 2,200 Paid-in capital in excess of stated value—preferred 600 Paid-in capital in excess of par value—common 1,200 Paid-in capital in excess of par value—class B common 750 Retained earnings 7,000 Total stockholders’ equity $ 16,250 Requireda. Assuming the preferred stock was originally issued for cash, determine the amount of cash collected when the stock was issued.b. Based on the class B common stock alone,…arrow_forward

- A company with 95,000 authorized shares of $7 par common stock issued 42,000 shares at $16. Subsequently, the company declared a 2% stock dividend on a date when the market price was $34 per share. What is the amount transferred from the retained earnings account to paid-in capital accounts as a result of the stock dividend?arrow_forwardOn June 30, Sharper Corporation's stockholders' equity section of its balance sheet appears as follows before any stock dividend or split. Sharper declares and immediately distributes a 50% stock dividend. Common stock-$10 par value, 76,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity (1) Prepare the updated stockholders' equity section after the distribution is made. (2) Compute the number of shares outstanding after the distribution is made. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Answer is complete but not entirely correct. Prepare the updated stockholders' equity section after the distribution is made. SHARPER CORPORATION Stockholders' Equity Section of the Balance Sheet June 30 Common stock-$10 par value Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity ✓ $ 1.140,000 $ 760,000 330,000 725,000 $ 1,815,000…arrow_forwardThe stockholders’ equity section of Jun Company’s balance sheet as of April 1 follows. On April 2, Jun declares and distributes a 15% stock dividend. The stock’s per share market value on April 2 is $20 (prior to the dividend). Common stock—$5 par value, 405,000 sharesauthorized, 215,000 shares issued and outstanding $ 1,075,000 Paid-in capital in excess of par value, common stock 520,000 Retained earnings 848,000 Total stockholders' equity $ 2,443,000 Prepare the stockholders’ equity section immediately after the stock dividend is distributed.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education