Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

Sh8

Transcribed Image Text:Cengage

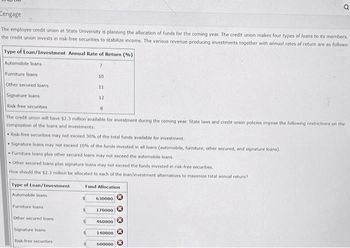

The employee credit union at State University is planning the allocation of funds for the coming year. The credit union makes four types of loans to its members.

the credit union invests in risk-free securities to stabilize income. The various revenue-producing investments together with annual rates of return are as follows:

Type of Loan/Investment Annual Rate of Return (%)

Automobile loans

Furniture loans

Other secured loans

Type of Loan/Investment

Automobile loans

7

Furniture loans

Other secured loa

10

Signature loans

Risk-free securities

The credit union will have $2.3 million available for investment during the coming year. State laws and credit union policies impose the following restrictions on the

composition of the loans and investments:

Risk-free securities may not exceed 30% of the total funds available for investment.

Signature loans may not exceed 10% of the funds invested in all loans (automobile, furniture, other secured, and signature loans).

Furniture loans plus other secured loans may not exceed the automobile loans.

Signature loans

Risk-free securities

11

• Other secured loans plus signature loans may not exceed the funds invested in risk-free securities.

How should the $2.3 million be allocated to each of the loan/investment alternatives to maximize total annual return?

12

8

Fund Allocation

630000

170000

460000

Q

140000

600000

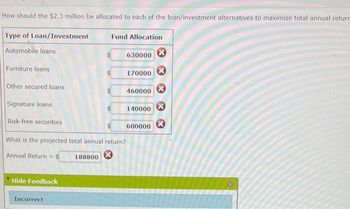

Transcribed Image Text:How should the $2.3 million be allocated to each of the loan/investment alternatives to maximize total annual returr

Type of Loan/Investment

Automobile loans

Furniture loans

Other secured loans

Signature loans

Risk-free securities

What is the projected total annual return?

Annual Return =

Hide Feedback

Incorrect

Fund Allocation

188800

630000

170000

460000

140000

600000

*

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- صورةarrow_forwardSPEED LIMIT 24arrow_forwardQuestion 1 Consider the market for satellite communications. Based in McLean, Virginia, Iridium Communications is a satellite-communications provider. Iridium is now replacing its original fleet of satellites, which started operations in 1998, with a new, advanced fleet of satellites called Iridium Next. Iridium, which mainly offers satellite phone and data services, said it will expand an ongoing $3 billion network modernization with dozens of additional satellites on which it will sell or lease capacity to private customers. In the market for satellite communications, the market price, and market quantity. O increases...increases O increases...decreases decreases...increases O decreases...decreasesarrow_forward

- Question 2 (a) Consider yourself in charge of distribution for a newly launched smart phone for the market in Indonesia but with production based in China. Show the factors to consider in employing air transport to bring the smart phones to the market in Indonesia versus employing sea transport. Apply your understanding to characterise the nature of smart phones in terms of price-sensitivity of air cargo.arrow_forwardS1.16/The Willow Café is located in an open-air mall. Its lease expires this year and the restaurant owner has the option of signing a 1-, 2-, 3-, 4-, or 5-year lease. However, the owner is concerned about recent energy price increases (including the price of gasoline), which affect virtually every aspect of the restaurant operation, including the price of food items and materials, delivery costs, and its own utilities. The restaurant was very profitable when energy prices were lower, and the owner believes if prices remain at approximately their cur- rent level profits will still be satisfactory; however, if prices continue to rise he believes that he might be forced to close. In these latter circumstances a longer-term lease could be a financial disaster, but with a shorter-term lease the mall landlord could always rent the restaurant's space out from under it when the lease expires. Thus, the restaurant owner's estimates of future profits must also reflect the possibility that the…arrow_forwardWhat is equivalent root derivation, and how does it explain the meaning of equivalence point?arrow_forward

- Solve this for mearrow_forwardName customs and trade related factors that could play a role in network design in general.arrow_forwardS7.24 An electronics firm is currently manufacturing an item that has a variable cost of $.50 per unit and a selling price of $1.00 per unit. Fixed costs are $14,000. Current volume is 30,000 units. The firm can substantially improve the product quality by adding a new piece of equipment at an additional fixed cost of $6,000. Variable cost would increase to $.60, but volume should jump to 50,000 units due to a higher- quality product. The electronics firm in Problem is now considering the new equipment and increasing the selling price to $1.10 per unit. With the higher-quality product, the new volume is expected to be 45,000 units. Under these circumstances, should the company purchase the new equipment and increase the selling price?arrow_forward

- Please answer question 1arrow_forward42) The General Agreement on trade in Services (GATS) defines trade in service as the supply of a service through which of the following? a) Consumption abroad b) Cross border supply C) Both A and B d) Neither A and Barrow_forwardFaw Motors, Inc., was incorporated in Volkswagen on July 01, 2003. It has 4 plants across the China that design, manufacture, and market earth moving, construction, and materials handling equipment. It also manufactures engines for earthmoving vehicles and tractor-trailers. Faw Motors products are distributed worldwide. Net income last year totaled $350,000,000. Faw Motors has developed a "Transportation Quality" program in order to reduce shipping damages to its equipment and to ensure its just-in-time production and inventory system. The program consists of two parts. The first part ensures proper lifting and tie-down provisions by working with engineers in the design process. The second part focuses on internal practices to prepare the product for shipment. The chief transportation quality engineer has developed a carrier certification program for both inbound and outbound freight. The program establishes standards requiring the carrier to adhere to 100 percent performance. Use of…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.