FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

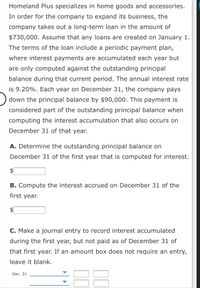

Transcribed Image Text:Homeland Plus specializes in home goods and accessories.

In order for the company to expand its business, the

company takes out a long-term loan in the amount of

$730,000. Assume that any loans are created on January 1.

The terms of the loan include a periodic payment plan,

where interest payments are accumulated each year but

are only computed against the outstanding principal

balance during that current period. The annual interest rate

is 9.20%. Each year on December 31, the company pays

down the principal balance by $90,000. This payment is

considered part of the outstanding principal balance when

computing the interest accumulation that also occurs on

December 31 of that year.

A. Determine the outstanding principal balance on

December 31 of the first year that is computed for interest.

$

B. Compute the interest accrued on December 31 of the

first year.

C. Make a journal entry to record interest accumulated

during the first year, but not paid as of December 31 of

that first year. If an amount box does not require an entry,

leave it blank.

Dec. 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject:arrow_forwardSwathmore Clothing Corporation grants its customers 30 days’ credit. The company uses the allowance method for its uncollectible accounts receivable. During the year, a monthly bad debt accrual is made by multiplying 3% times the amount of credit sales for the month. At the fiscal year-end of December 31, an aging of accounts receivable schedule is prepared and the allowance for uncollectible accounts is adjusted accordingly. At the end of 2020, accounts receivable were $574,000 and the allowance account had a credit balance of $54,000. Accounts receivable activity for 2021 was as follows: Beginning balance $ 574,000 Credit sales 2,620,000 Collections (2,483,000 ) Write-offs (68,000 ) Ending balance $ 643,000 The company’s controller prepared the following aging summary of year-end accounts receivable: Summary Age Group Amount Percent Uncollectible 0–60 days $ 430,000 4 % 61–90 days 98,000 15 91–120 days 60,000 25…arrow_forwardU.S. Fax has been granted a loan from a commercial finance company for $1 million at a stated interest rate of 10 percent. The loan requires that interest payments be made at the end of each of the next 5 years. At the end of 5 years, the entire loan balance must be repaid. The finance company requires U.S. Fax to pay a $25,000 loan-processing fee at the time the loan is approved. What is the effective cost of this loan?arrow_forward

- On January 1, 2018, Jimbo Enterprises purchased new equipment for its training center. The equipment cost $220,000. Jimbo paid $25,000 down and is required to pay the rest in semiannual installments for the next 8 years. Jimbo's cost of borrowing is 4%. What is the total amount of interest expense Jimbo will pay over the life of the loan?arrow_forwardAt the beginning of the year, your company borrows $33,600 by signing a six-year promissory note that states an annual interest rate of 9% plus principal repayments of $5,600 each year. Interest is paid at the end of the second and fourth quarters, whereas principal payments are due at the end of each year. How does this new promissory note affect the current and non-current liability amounts reported on the classified balance sheet prepared at the end of the first quarter? 10 Multiple Choice Increase current llabilities by $6,356.00; increase non-current llablities by $33,600 Increase current liabilities by $3,024; increase non-current liabilities by $33,600 Increase current liabilities by $6,356.00; Increase non-current liabilities by $28,000 Increase current liabilities by $756.00, increase non-current labilities by $33,600arrow_forwardSinger Company has a line of credit with United Bank. Singer can borrow up to $400,000 at any time over the course of the Year 1 calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and repaid during the first three months of Year 1. Singer agreed to pay interest at an annual rate equal to 2 percent above the bank’s prime rate. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month. The interest rate is applied to the outstanding monthly balance. For example, Singer pays 6.5 percent (4.5 percent + 2 percent) annual interest on $140,000 for the month of February. Month Amount Borrowed or (Repaid) Prime Rate for the Month January $80,000 4.0% February 60,000 4.5 March (20,000) 4.0 Required Provide all journal entries pertaining to Singer’s line of credit for the first three months of Year 1.arrow_forward

- Campus Flights takes out a bank loan in the amount of $145,847 on March 1. The terms of the loan include a repayment of principal in 7 equal installments, paid annually from March 1. The annual interest rate on the loan is 10%, recognized at the end of the 7 equal installments. Compute the interest recognized in year 1 rounded to the whole dollar.arrow_forwardThe company has a mortgage note payable for $1,500,000 that comes due in year 3. this note is paid by the signing of a new 14% note for the amount due. how do I prepare the journal entry to record this refinancing of the old note?arrow_forwardSwathmore Clothing Corporation grants its customers 30 days' credit. The company uses the allowance method for its uncollectible accounts receivable. During the year, a monthly bad debt accrual is made by multiplying 2% times the amount of credit sales for the month. At the fiscal year-end of December 31, an aging of accounts receivable schedule is prepared and the allowance for uncollectible accounts is adjusted accordingly. At the end of 2023, accounts receivable were $610,000 and the allowance account had a credit balance of $74,000. Accounts receivable activity for 2024 was as follows: Beginning balance Credit sales Collections Write-offs Ending balance The company's controller prepared the following aging summary of year-end accounts receivable: Summary Age Group $ 610,000 2,800,000 (2,663,000) (57,000) $ 690,000 0-60 days 61-90 days 91-120 days over 120 days Total Amount $ 460,000 78,000 67,000 85,000 $ 690,000 Percent Uncollectible 44 15 26 41 Required: 1. Prepare a summary…arrow_forward

- On February 20th, a 5 month note for $2,900 was received by Lucky Company to settle an amount owing from a customer. It bears interest at the rate of 8% per annum. Assume the note is settled on maturity and Lucky makes the appropriate entry. A year has 364 days or 52 weeks. Required 1: The amount (simple interest plus principal) received by Lucky at maturity is: $ Required 2: If the note has monthly compounded interest, the total amount of interest received by Lucky at maturity is: $ Required 3: If the note has biweekly compounded interest, the total amount of principal received by Lucky at maturity is: $ Required 4: If the note is sold on March 20th, the total amount of interest accrued by Lucky is: $ Required 5: If the note has biweekly compounded interest and it is sold on March 20th, the total amount of interest accrued by Lucky is: $arrow_forwardOn January 2nd, Mobile Sales borrows $20,000 cash on a note payable from Ethical Lenders with terms 90 days, 5%. Mobile Sales and Ethical Lenders uses a 360-day year for interest calculations. Mobile Sales makes adjusting entries at the end of each calendar quarter. Journalize the initiation of the loan, the recognition of interest expense for the quarter and the payment of the note on its due date (round to the even dollar).arrow_forwardAn automotive dealer borrowed $8200.00 from the Bank of Montreal on a demand note on May 8. Interest on the loan, calculated on the daily balance, is charged to the dealer's current account on the 8th of each month. The automotive dealer made a payment of $2300 on July 12, a payment of $3900 on October 1, and repaid the balance on December 1. The rate of interest on the loan on May 8 was 8% per annum. The rate was changed to 8.6% on August 1 and to 8.95% on October 1. What was the total interest cost for the loan?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education