FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

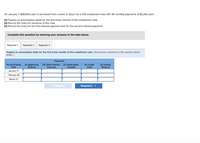

Transcribed Image Text:On January 1, $38,000 cash is borrowed from a bank in return for a 12% installment note with 36 monthly payments of $1,262 each.

(1) Prepare an amortization table for the first three months of this installment note.

(2) Record the entry for issuance of the note.

(3) Record the entry for the first interest payment and for the second interest payment.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Prepare an amortization table for the first three months of this installment note. (Round your answers to the nearest whole

dollar.)

Payments

(C) Debit Notes

Payable

Period Ending

(A) Beginning

Balance

(B) Debit Interest

Expense

(D) Credit

Cash

(E) Ending

Balance

Date

January 31

February 28

March 31

< Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- I was needing help with the following accounting problem.arrow_forwardFollowing are transactions for Vitalo Company. 1 Accepted a $3,000, 180-day, 5% note from Kelly White in granting a time extension on her past-due account receivable. Nov. Dec. 31 Adjusted the year-end accounts for the accrued interest earned on the White note. Apr. 30 White honored her note when presented for payment. Complete the table to calculate the interest amounts at December 31s and April 30" and use those calculated values to prepare your journal entries. (Do not round intermediate calculations. Use 360 days a year.) Complete this question by entering your answers in the tabs below. Interest General Journal Amounts Complete the table to calculate the interest amounts at December 31st and April 30th. November 1 January 1 Total Through Through Through Maturity December 31 April 30 Principal Rate (%) Time Total interestarrow_forwardPlease help mearrow_forward

- Proceeds from Notes Payable On May 15, Franklin Co. borrowed cash from Dakota Bank by issuing a 30-day note with a face amount of $96,000. Assume a 360-day year. Required: a. Determine the proceeds of the note, assuming that the note carries an interest rate of 6%. $ b. Determine the proceeds of the note, assuming that the note is discounted at 6%.arrow_forwardOn November 7, Mura Company borrows $190,000 cash by signing a 90-day, 7%, $190,000 note payable. 1. Compute the accrued interest payable on December 31. 2. & 3. Prepare the journal entries to record the accrued interest expense at December 31 and payment of the note at maturity on February 5. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Compute the accrued interest payable on December 31. Note: Use 360 days a year. Do not round your intermediate calculations. Total through maturity Year end interest accrual Interest recognized February 5. Principal x Rate (%) × Time - Interest % % %arrow_forwardOn January 2nd, Mobile Sales borrows $20,000 cash on a note payable from Ethical Lenders with terms 90 days, 5%. Mobile Sales and Ethical Lenders uses a 360-day year for interest calculations. Mobile Sales makes adjusting entries at the end of each calendar quarter. Journalize the initiation of the loan, the recognition of interest expense for the quarter and the payment of the note on its due date (round to the even dollar).arrow_forward

- need help with 1D, Feb 14.! Received Todd’s payment of principal and interest on the note dated December 16. The following transactions are from Ohlm Company. (Use 360 days a year.) Year 1 Dec. 16 Accepted a $10,700, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. 31 Made an adjusting entry to record the accrued interest on the Todd note. Year 2 Feb. 14 Received Todd’s payment of principal and interest on the note dated December 16. Mar. 2 Accepted a(n) $6,600, 8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Co. 17 Accepted a(n) $3,300, 30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. Apr. 16 Privet dishonored her note. May 31 Midnight Co. dishonored its note. Aug. 7 Accepted a(n) $7,900, 90-day, 10% note in granting a time extension on the past-due account receivable of Mulan Co. Sep. 3…arrow_forwardon november 1, 2018, Downtown Jewelers accepted a 3-month, 15% note for $6,000 in sttlement of an averdue account receivable. the account period ends on december 31. prepare the journal entry to record the accrued interest at the year end.arrow_forwardDanali Corporation borrowed $400,000 on October 1. The note carried a 13 percent interest rate with the principal and interest payable on May 1 of next year. Prepare the following journal entries. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheetarrow_forward

- Jason and Matthew borrowed $38.400 on a 7-month, 5% note from Gem State Bank to open their business, Blossom's Coffee House The money was borrowed on June 1, 2025, and the note matures January 1, 2026. (a) ✓ Your answer is correct. Prepare the entry to record the receipt of the funds from the loan. (List all debit entries before credit entries, Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts) Date ne 1, 2025 Account Titles and Explanation (b) Question 5 of 12 Cash Date Notes Payable eTextbook and Medial Prepare the entry to accrue the interest on June 30, (List all debit entries before credit entries. Credit account titles are automatically Indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts) Account Titles and Explanation Debit 38400 Credit Debit…arrow_forwardOn July 1st 2018, Ponds received a 9%, six-month note receivable from Saeed Ghani, in defrayalof a Rs. 1,000,000 account receivable. Prepare journal entries to record the followingtransactions:a. The receipt of the note receivable on July 1st 2018.b. To record an accrued interest revenue on December 31, 2018.c. The collection of the principal and interest on December 31, 2018.arrow_forward10arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education