Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

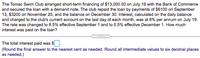

Transcribed Image Text:The Tomac Swim Club arranged short-term financing of $13,000.00 on July 19 with the Bank of Commerce

and secured the loan with a demand note. The club repaid the loan by payments of $6100 on September

13, $3200 on November 25, and the balance on December 30. Interest, calculated on the daily balance

and charged to the club's current account on the last day of each month, was at 6% per annum on July 19.

The rate was changed to 6.5% effective September 1 and to 5.5% effective December 1. How much

interest was paid on the loan?

The total interest paid was S

(Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places

as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Tomac Swim Club arranged short-term financing of $14,900.00 on July 18 with the Bank of Commerce and secured the loan with a demand note. The club repaid the loan by payments of $6600 on September 23, $4200 on November 15, and the balance on December 30. Interest, calculated on the daily balance and charged to the club's current account on the last day of each month, was at 6% per annum on July 18. The rate was changed to 5% effective September 1 and to 4.5% effective December 1. How much interest was paid on the loan? The total interest paid was $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardThe Tomac Swim Club arranged short-term financing of $13,100.00 on July 5 with the Bank of Commerce and secured the loan with a demand note The club repaid the loan by payments of $5900 on September 25, $3400 on November 11, and the balance on December 3o Interest, calculated on the daily balance and charged to the club's current account on the last day of each month, was at 10% per annum on July 5 The rate was changed to 9 5% effective September 1 and to 10 5% effective December 1. How much interest was paid on the loan?arrow_forwardBoyd Company has a line of credit with State Bank. Boyd can borrow up to $520,000 at any time over the course of the Year 1 calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and repaid during Year 1. Boyd agreed to pay interest at an annual rate equal to 1 percent above the bank’s prime rate. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month. The interest rate is applied to the outstanding monthly balance. For example, Boyd pays 6 percent (5 percent + 1 percent) annual interest on $72,000 for the month of January. Month Amount Borrowed or (Repaid) Prime Rate for the Month January $ 72,000 5% February 52,000 5 March (46,000) 6 April through October No change No change November (36,000) 6 December (22,000) 5 Boyd earned $37,000 of cash revenue during Year 1.Required Prepare an income statement, balance sheetand statement of cash…arrow_forward

- Boyd Company has a line of credit with State Bank. Boyd can borrow up to $500,000 at any time over the course of the Year 1 calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and repaid during Year 1. Boyd agreed to pay interest at an annual rate equal to 1 percent above the bank's prime rate. Funds are borrowed or repaid on the first day of each month, Interest is payable in cash on the last day of the month. The interest rate is applied to the outstanding monthly balance. For example, Boyd pays 6 percent (5 percent +1 percent) annual interest on $70,000 for the month of January. Amount Borrowed or (Repaid) $ 70,000 50,000 (42,000) No change (30,000) (20,000) Boyd earned $35,000 of cash revenue during Year 1. Month January February March April through October November December Income Statement Required Prepare an income statement, balance sheet, and statement of cash flows for Year 1. Service revenue Expenses…arrow_forwardBarton Company has a line of credit with Sea View Bank. Barton can borrow up to $200,000 at any time over the course of Year 2. The following table shows the interest rate expressed as an annual percentage along with the amounts borrowed and repaid during the first three months of Year 2. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month. The interest rate is applied to the outstanding monthly balance. Month January February March Multiple Choice $1,500. Borrowed/ (Repaid) $25,000 (5,000) 20,000 Based on this information, the amount of interest expense Barton would recognize in February is $1,800. $150. Amount $125. Annual Interest Rate 6% 9% 9%arrow_forwardSinger Company has a line of credit with United Bank. Singer can borrow up to $400,000 at any time over the course of the Year 1 calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and repaid during the first three months of Year 1. Singer agreed to pay interest at an annual rate equal to 2 percent above the bank’s prime rate. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month. The interest rate is applied to the outstanding monthly balance. For example, Singer pays 6.5 percent (4.5 percent + 2 percent) annual interest on $140,000 for the month of February. Month Amount Borrowed or (Repaid) Prime Rate for the Month January $80,000 4.0% February 60,000 4.5 March (20,000) 4.0 Required Provide all journal entries pertaining to Singer’s line of credit for the first three months of Year 1.arrow_forward

- Colson Company has a line of credit with Federal Bank. Colson can borrow up to $315,500 at any time over the course of the calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and repaid during the first four months of the year. Colson agreed to pay interest at an annual rate equal to 2.00 percent above the bank's prime rate. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month. The interest rate is applied to the outstanding monthly balance. For example, Colson pays 6.25 percent (4.25 percent + 2.00 percent) annual interest on $76.000 for the month of January. Month January February March April Amount Borroed or (Repaid) $ 76,000 121,200 (20,900) 27,500 Prime Rate for the Month 4.25% 3.25 3.75 4.25 Required a. Compute the amount of interest that Colson will pay on the line of credit for the first four months of the year. b. Compute the amount of…arrow_forwardCampus Flights takes out a bank loan in the amount of $210,000 on March 1. The terms of the loan include a repayment of principal in ten equal installments, paid annually from March 1. The annual interest rate on the loan is 9 percent, recognized on December 31 A. Compute the interest recognized as of December 31 in year 1. $15,750 ✓✔ B. Compute the principal due in year 1.arrow_forwardBridgeport Company has a line of credit with National Bank. Bridgeport can borrow up to $1,040,000 at any time over the course of the Year 1 calendar year. The following table shows the prime rate expressed as an annual percentage, along with the amounts borrowed and repaid during the first two months of Year 1. Bridgeport agreed to pay interest at an annual rate equal to 1 percent above the bank's prime rate. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month. The interest rate is applied to the outstanding monthly balance. For example, Bridgeport pays 4 percent (3 percent + 1 percent) annual interest on $154,800 for the month of January. Month January February Month Amount borrowed or (repaid) January February $154,800 (31,600) Required: Compute the amount of (a) interest paid and (b) Bridgeport's liability balance at the end of each of the first two months. Prime rate for the (a) Interest Paid month 3% 3.5% (b)…arrow_forward

- An automotive dealer borrowed $8200.00 from the Bank of Montreal on a demand note on May 8. Interest on the loan, calculated on the daily balance, is charged to the dealer's current account on the 8th of each month. The automotive dealer made a payment of $2300 on July 12, a payment of $3900 on October 1, and repaid the balance on December 1. The rate of interest on the loan on May 8 was 8% per annum. The rate was changed to 8.6% on August 1 and to 8.95% on October 1. What was the total interest cost for the loan?arrow_forwardColson Company has a line of credit with Federal Bank. Colson can borrow up to $436,000 at any time over the course of the calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and repaid during the first four months of the year. Colson agreed to pay interest at an annual rate equal to 2.00 percent above the bank's prime rate. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month. The interest rate is applied to the outstanding monthly balance. For example, Colson pays 6.25 percent (4.25 percent +2.00 percent) annual interest on $77,700 for the month of January. Amount Borrowed Prime Rate for the Month Month January February March April or (Repaid) $ 77,700 4.25% 120,700 (16,500) 28,400 3.25 3.75 4.25 Required a. Compute the amount of interest that Colson will pay on the line of credit for the first four months of the year. b. Compute the amount of…arrow_forwardFranklin Company obtained a $110,000 line of credit from the State Bank on January 1, Year 1. The company agreed to accept a variable interest rate that was set at 2% above the bank's prime lending rate. The bank's prime rate of interest and the amounts borrowed or repaid during the first three months of Year 1 are shown in the following table. Assume that Franklin borrows or repays on the first day of each month. Borrowing is shown as a positive amount and repayments are shown as negative amounts indicated by parentheses. 1-January 1-February 1-Marchi Amount Borrowed Prime Rate for the Month 4.08 4.58 5.08 Based on this information alone, the amount of interest expense recognized in March would be closest to: (Do not round intermediate calculations. Round your answer to the nearest whole number.) Multiple Choice $177, $309. (Repaid) $ 32,000 (11,000) 32,000 $199.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning