Concept explainers

Fanning Corporation estimated its

Required

-

Calculate a predetermined overhead rate based on direct labor hours.

-

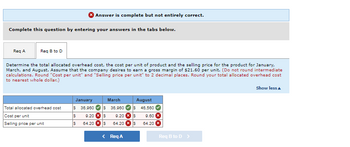

Determine the total allocated overhead cost for January, March, and August.

-

Determine the cost per unit of product for January, March, and August.

-

Determine the selling price for the product, assuming that the company desires to earn a gross margin of $21.60 per unit.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

- Harris Fabrics computes its plantwide predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 43,000 direct labor-hours would be required for the period's estimated level of production. The company also estimated $537,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $2.00 per direct labor-hour, Harris's actual manufacturing overhead cost for the year was $702,019 and its actual total direct labor was 43,500 hours. Required: Compute the company's plantwide predetermined overhead rate for the year. (Round your answer to 2 decimal places.) Predetermined overhead rate per DLHarrow_forwardGibson Manufacturing Co. expects to make 30,800 chairs during the year 1 accounting period. The company made 3,300 chairs in January. Materials and labor costs for January were $17,800 and $24,500, respectively. Gibson produced 1,400 chairs in February. Material and labor costs for February were $9,400 and $12,900, respectively. The company paid the $770,000 annual rental fee on its manufacturing facility on January 1, year 1. The rental fee is allocated based on the total estimated number of units to be produced during the year. Required Assuming that Gibson desires to sell its chairs for cost plus 25 percent of cost, what price should be charged for the chairs produced in January and February? (Round intermediate calculations and final answers to 2 decimal places.)arrow_forwardBenson Corporation expects to incur indirect overhead costs of $98,000 per month and direct manufacturing costs of $13 per unit. The expected production activity for the first four months of the year are as follows. Estimated production in units January 5,300 Required a. Calculate a predetermined overhead rate based on the number of units of product expected to be made during the first four months of the year. Required A Required B b. Allocate overhead costs to each month using the overhead rate computed in Requirement a. c. Calculate the total cost per unit for each month using the overhead allocated in Requirement b. Complete this question by entering your answers in the tabs below. Required C February March 8,500 4,600 April 6,100 per unit Calculate a predetermined overhead rate based on the number of units of product expected to be made during the first four months of the year. Predetermined overhead ratearrow_forward

- Harris Fabrics computes its plantwide predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 20,000 direct labor-hours would be required for the period’s estimated level of production. The company also estimated $94,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $2.00 per direct labor-hour. Harris's actual manufacturing overhead cost for the year was $123,900 and its actual total direct labor was 21,000 hours. Required: Compute the company's plantwide predetermined overhead rate for the year. Note: Round your answer to 2 decimal places.arrow_forwardCavy Company estimates that the factory overhead for the following year will be $2,829,000. The company has determined that the basis for applying factory overhead will be machine hours, which is estimated to be 34,500 hours. There are 4,690 machine hours for all of the jobs in the month of April. What amount will be applied to all of the jobs for the month of April?arrow_forwardPocono Cement Forms expects $700,000 in overhead during the next year. It does not know whether it should apply overhead on the basis of its anticipated direct labor hours of 50,000 or its expected machine hours of 25,000. Determine the product cost under each predetermined allocation rate if the last job incurred $1,560 in direct material cost, 102 direct labor hours, and 85 machine hours. Wages are paid at $15 per hour. Labor Hours Machine Hours Cost of the job $ $arrow_forward

- Baird Manufacturing Co. expects to make 30,500 chairs during the year 1 accounting period. The company made 4,600 chairs in January. Materials and labor costs for January were $16,600 and $24,200, respectively. Baird produced 1,800 chairs in February. Material and labor costs for February were $9,900 and $13,700, respectively. The company paid the $518,500 annual rental fee on its manufacturing facility on January 1, year 1. The rental fee is allocated based on the total estimated number of units to be produced during the year. Required Assuming that Baird desires to sell its chairs for cost plus 30 percent of cost, what price should be charged for the chairs produced in January and February? (Round intermediate calculations and final answers to 2 decimal places.) January February Price per unitarrow_forwardRasmussen Corporation expects to incur indirect overhead costs of $80,000 per month and direct manufacturing costs of $12 per unit. The expected production activity for the first four months of the year are as follows. January February March April Estimated production in units 6,000 7,000 3,000 4,000 Required Calculate a predetermined overhead rate based on the number of units of product expected to be made during the first four months of the year. Allocate overhead costs to each month using the overhead rate computed in Requirement a. Calculate the total cost per unit for each month using the overhead allocated in Requirement b.arrow_forwardThe Production Department of Hruska Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Units to be produced 10,800 9,800 11,800 12,800 Each unit requires 0.25 direct labor-hours and direct laborers are paid $13.00 per hour. In addition, the variable manufacturing overhead rate is $1.90 per direct labor-hour. The fixed manufacturing overhead is $88,000 per quarter. The only noncash element of manufacturing overhead is depreciation, which is $28,000 per quarter. Required: 1. Calculate the company’s total estimated direct labor cost for each quarter of the upcoming fiscal year and for the year as a whole. 2. and 3. Calculate the company’s total estimated manufacturing overhead cost and the cash disbursements for manufacturing overhead for each quarter of the upcoming fiscal year and for the year as a whole.arrow_forward

- Winston Company estimates that total factory overhead for the following year will be $1,347,500. The company has decided that the basis for applying factory overhead should be machine hours, which are estimated to be 38,500 hours. The actual total machine hours for the year were 54,300 hours. The actual factory overhead for the year was $1,927,000. Enter the amount as a positive number. a. Determine the total factory overhead applied. Round to the nearest dollar. b. Compute the over- or underapplied factory overhead for the year. c. Journalize the entry to transfer the over- or underapplied factory overhead to cost of goods sold. If an amount box does not require an entry, leave it blank.arrow_forwardThe Production Department of Hruska Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: 2nd Quarter 1st Quarter 10,400 3rd Quarter 11,400 4th Quarter 12,400 Units to be produced 9,400 Each unit requires 0.25 direct labor-hours and direct laborers are paid $12.00 per hour. In addition, the variable manufacturing overhead rate is $1.70 per direct labor-hour. The fixed manufacturing overhead is $84,000 per quarter. The only noncash element of manufacturing overhead is depreciation, which is $24,000 per quarter. Required: 1. Calculate the company's total estimated direct labor cost for each quarter of the the upcoming fiscal year and for the year as a whole. 2&3. Calculate the company's total estimated manufacturing overhead cost and the cash disbursements for manufacturing overhead for each quarter of the upcoming fiscal year and for the year as a whole.arrow_forwardThe Production Department of Hruska Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: 1st Quarter 3rd Quarter 12,400 4th Quarter 13,400 2nd Quarter Units to be produced 11,400 10,400 Each unit requires 0.30 direct labor-hours and direct laborers are paid $12.50 per hour. In addition, the variable manufacturing overhead rate is $1.50 per direct labor-hour. The fixed manufacturing overhead is $94,000 per quarter. The only noncash element of manufacturing overhead is depreciation, which is $34,000 per quarter. Required: 1. Calculate the company's total estimated direct labor cost for each quarter of the the upcoming fiscal year and for the year as a whole. 2&3. Calculate the company's total estimated manufacturing overhead cost and the cash disbursements for manufacturing overhead for each quarter of the upcoming fiscal year and for the year as a whole. Complete this question by entering your answers in the tabs below. Req 1…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education