FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

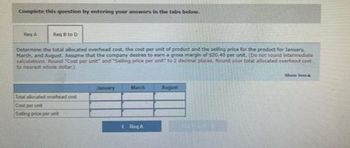

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Reg A

Reg 8 to D

Determine the total allocated overhead cost, the cost per unit of product and the selling price for the product for January,

March, and August. Assume that the company desires to earn a gross margin of $20.40 per unit. (Do not round intermediate

calculations. Round "Cost per unit" and "Selling price per unit to 2 decimal places. Round your total allocated overhead cont

to nearest whole dollar)

Total allocated overhead cost

Cost per unit

Selling price per unit

January

RA

August

Show less&

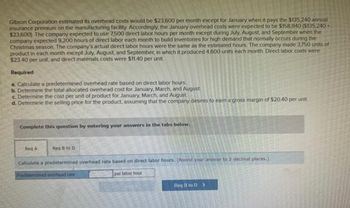

Transcribed Image Text:Gibson Corporation estimated its overhead costs would be $23,600 per month except for January when it pays the $135,240 annual

insurance premium on the manufacturing facility. Accordingly, the January overhead costs were expected to be $158,840 ($135,240+

$23,600). The company expected to use 7,500 direct labor hours per month except during July, August, and September when the

company expected 9,200 hours of direct labor each month to build inventories for high demand that normally occurs during the

Christmas season. The company's actual direct labor hours were the same as the estimated hours. The company made 3,750 units of

product in each month except July, August, and September, in which it produced 4,600 units each month. Direct labor costs were

$23.40 per unit, and direct materials costs were $11.40 per unit.

Required

a. Calculate a predetermined overhead rate based on direct labor hours.

b. Determine the total allocated overhead cost for January, March, and August

c. Determine the cost per unit of product for January, March, and August.

d. Determine the selling price for the product, assuming that the company desires to earn a gross margin of $20.40 per unit.

Complete this question by entering your answers in the tabs below.

Req B to D

Calculate a predetermined overhead rate based on direct labor hours. (Round your answer to 2 decimal places.)

Predetermined overhead rate

per labor hour

Req A

Toad

REST

2007

TROLLS

#love

man

Req B to D >

A

PO

PLE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tannin Products Inc. prepared the following factory overhead cost budget for the Trim Department for July of the current year, during which it expected to use 14,000 hours for production: Variable overhead cost: Indirect factory labor $44,800 Power and light 10,360 Indirect materials 21,000 Total variable overhead cost $ 76,160 Fixed overhead cost: Supervisory salaries $54,380 Depreciation of plant and equipment 14,310 Insurance and property taxes 26,710 Total fixed overhead cost 95,400 Total factory overhead cost $171,560 Tannin has available 18,000 hours of monthly productive capacity in the Trim Department under normal business conditions. During July, the Trim Department actually used 13,000 hours for production. The actual fixed costs were as budgeted. The actual variable overhead for July was as follows: Actual variable factory overhead cost: Indirect factory labor $40,560…arrow_forwardStuart Corporation expects to incur indirect overhead costs of $102,000 per month and direct manufacturing costs of $13 per unit. The expected production activity for the first four months of the year are as follows. Estimated production in units Required a. Calculate a predetermined overhead rate based on the number of units of product expected to be made during the first four months of the year. b. Allocate overhead costs to each month using the overhead rate computed in Requirement a. c. Calculate the total cost per unit for each month using the overhead allocated in Requirement b. Required A Required B Complete this question by entering your answers in the tabs below. January February March 4,500 8,200 5,000 Required C Predetermined overhead rate $ Answer is complete but not entirely correct. Calculate a predetermined overhead rate based on the number of units of product expected to be made during the first four months of the year. April 6,300 4 X per unit Required A Required B >arrow_forwardThe Production Department of Hruska Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: 2nd Quarter 1st Quarter 10,400 3rd Quarter 11,400 4th Quarter 12,400 Units to be produced 9,400 Each unit requires 0.25 direct labor-hours and direct laborers are paid $12.00 per hour. In addition, the variable manufacturing overhead rate is $1.70 per direct labor-hour. The fixed manufacturing overhead is $84,000 per quarter. The only noncash element of manufacturing overhead is depreciation, which is $24,000 per quarter. Required: 1. Calculate the company's total estimated direct labor cost for each quarter of the the upcoming fiscal year and for the year as a whole. 2&3. Calculate the company's total estimated manufacturing overhead cost and the cash disbursements for manufacturing overhead for each quarter of the upcoming fiscal year and for the year as a whole.arrow_forward

- sarrow_forwardTiger Equipment Inc., a manufacturer of construction equipment, prepared the following factory overhead cost budget for the Welding Department for May of the current year. The company expected to operate the department at 100% of normal capacity of 7,700 hours. Variable costs: Indirect factory wages $22,330 Power and light 15,862 Indirect materials 13,552 Total variable cost $51,744 Fixed costs: Supervisory salaries $14,700 Depreciation of plant and equipment 37,710 Insurance and property taxes 11,500 Total fixed cost 63,910 Total factory overhead cost $115,654 During May, the department operated at 8,200 standard hours. The factory overhead costs incurred were indirect factory wages, $24,020; power and light, $16,590; indirect materials, $14,700; supervisory salaries, $14,700; depreciation of plant and equipment, $37,710; and insurance and property taxes, $11,500. Required: Prepare a factory overhead cost…arrow_forwardHarris Fabrics computes its plantwide predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 33,000 direct labor-hours would be required for the period's estimated level of production. The company also estimated $525,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per direct labor-hour. Harris's actual manufacturing overhead cost for the year was $688,730 and its actual total direct labor was 33,500 hours. Required: Compute the company's plantwide predetermined overhead rate for the year. (Round your answer to 2 decimal places.) Predetermined overhead rate per DLHarrow_forward

- The Production Department of Hruska Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: Units to be produced Each unit requires 0.25 direct labor-hours and direct laborers are paid $14.00 per hour. In addition, the variable manufacturing overhead rate is $1.60 per direct labor-hour. The fixed manufacturing overhead is $95,000 per quarter. The only noncash element of manufacturing overhead is depreciation, which is $35,000 per quarter. Required: 1. Calculate the company's total estimated direct labor cost for each quarter of the upcoming fiscal year and for the year as a whole. 2. and 3. Calculate the company's total estimated manufacturing overhead cost and the cash disbursements for manufacturing overhead for each quarter of the upcoming fiscal year and for the year as a whole. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 11,500 10,500 12,500 13,500 Complete this question by entering your answers in the tabs below. Req 1…arrow_forwardWalton Corporation estimated its overhead costs would be $23,400 per month except for January when it pays the $135,870 annual insurance premium on the manufacturing facility. Accordingly, the January overhead costs were expected to be $159,270 ($135,870 + $23,400). The company expected to use 7,500 direct labor hours per month except during July, August, and September when the company expected 9,800 hours of direct labor each month to build inventories for high demand that normally occurs during the Christmas season. The company's actual direct labor hours were the same as the estimated hours. The company made 3,750 units of product in each month except July, August, and September, in which it produced 4,900 units each month. Direct labor costs were $24.90 per unit, and direct materials costs were $11.10 per unit. Required a. Calculate a predetermined overhead rate based on direct labor hours. b. Determine the total allocated overhead cost for January, March, and August. c. Determine…arrow_forwardCampbell Manufacturing Company produced 1,400 units of inventory in January Year 2. It expects to produce an additional 9,000 units during the remaining 11 months of the year. In other words, total production for Year 2 is estimated to be 10,400 units. Direct materials and direct labor costs are $74 and $71 per unit, respectively. Campbell expects to incur the following manufacturing overhead costs during the Year 2 accounting period. Production supplies Supervisor salary Depreciation on equipment Utilities Rental fee on manufacturing facilities Required a. Combine the individual overhead costs into a cost pool and calculate a predetermined overhead rate assuming the cost driver is number of units. b. Determine the cost of the 1,400 units of product made in January. Complete this question by entering your answers in the tabs below. Required A Required B $6,500 186,000 126,000 17,000 223,500 Determine the cost of the 1,400 units of product made in January. Allocated Cost Indirect…arrow_forward

- Winston Company estimates that the factory overhead for the following year will be $1,168,000. The company has decided that the basis for applying factory overhead should be machine hours, which is estimated to be 36,500 hours. The total machine hours for the year were 54,400 hours. The actual factory overhead for the year was $1,765,000. Enter the amount as a positive number. a. Determine the total factory overhead amount applied. Round to the nearest dollar.$fill in the blank f3300e016fa0008_1 b. Compute the over- or underapplied amount for the year.$fill in the blank f3300e016fa0008_2 c. Journalize the entry to transfer the over- or underapplied factory overhead to cost of goods sold. If an amount box does not require an entry, leave it blank. - Select - - Select - - Select - - Select -arrow_forwardProduction workers for Zachary Manufacturing Company provided 4,300 hours of labor in January and 3,400 hours in February. The company, whose operation is labor intensive, expects to use 48,300 hours of labor during the year. Zachary paid a $111,090 annual premium on July 1 of the prior year for an insurance policy that covers the manufacturing facility for the following 12 months. Required Based on this information, how much of the insurance cost should be allocated to the products made in January and to those made in February? (Do not round intermediate calculations.)arrow_forwardHarris Fabrics computes its plantwide predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the year, it estimated that 42,000 direct labor-hours would be required for the period's estimated level of production. The company also estimated $571,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $3.00 per direct labor-hour. Harris's actual manufacturing overhead cost for the year was $773,298 and its actual total direct labor was 42,500 hours. Required: Compute the company's plantwide predetermined overhead rate for the year. (Round your answer to 2 decimal places.) Predetermined overhead rate per DLHarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education