FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

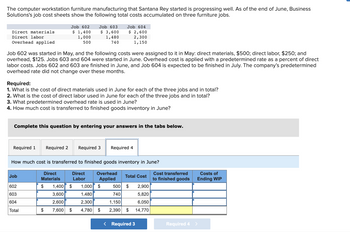

Transcribed Image Text:### Job Cost Accounting for Furniture Manufacturing

#### Overview

The computer workstation furniture manufacturing business that Santana Rey established is showing satisfactory progress. By the end of June, Business Solutions' job cost sheets detail the total costs allocated to three furniture jobs:

| Costs | Job 602 | Job 603 | Job 604 |

|-------------------------|---------|---------|---------|

| **Direct Materials** | $1,400 | $3,600 | $2,600 |

| **Direct Labor** | $1,000 | $1,480 | $2,300 |

| **Overhead Applied** | $500 | $740 | $1,150 |

#### Cost Allocation and Job Progress

- **Job 602**: Initiated in May and attributed with May-specific costs of $500 for direct materials, $250 for direct labor, and $125 for overhead.

- **Jobs 603 and 604**: Both initiated in June.

- Overhead is allocated based on a predetermined rate calculated as a percentage of direct labor costs. This rate has been consistent over the past several months.

- **Job Completion**: Jobs 602 and 603 reached completion in June, whereas Job 604 is projected to be completed in July.

#### Required Analyses

1. **Direct Materials Costs Utilized in June**:

- Job 602: $1,400 - $500 (costs in May) = $900.

- Job 603: $3,600.

- Job 604: $2,600.

- **Total**: $900 + $3,600 + $2,600 = $7,100.

2. **Direct Labor Costs Utilized in June**:

- Job 602: $1,000 - $250 (costs in May) = $750.

- Job 603: $1,480.

- Job 604: $2,300.

- **Total**: $750 + $1,480 + $2,300 = $4,530.

3. **Predetermined Overhead Rate Used in June**:

- The predetermined overhead rate is calculated as the overhead applied ($500 + $740 + $1,150 = $2,390) over the direct labor costs in June ($750 + $1,480 + $2,300 = $4,530).

-

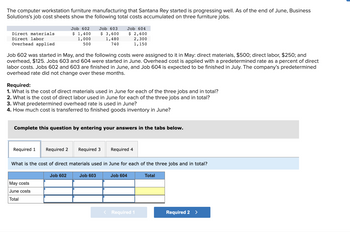

Transcribed Image Text:### Cost Accumulation for Computer Workstation Furniture Manufacturing

The computer workstation furniture manufacturing that Santana Rey started is progressing well. As of the end of June, Business Solutions's job cost sheets show the following total costs accumulated on three furniture jobs:

| Cost Type | Job 602 | Job 603 | Job 604 |

|-----------------------|---------|---------|---------|

| Direct materials | $1,400 | $3,600 | $2,600 |

| Direct labor | $1,000 | $1,480 | $2,300 |

| Overhead applied | $500 | $740 | $1,150 |

### Cost Details:

- **Job 602** was started in May, and the following costs were assigned to it in May:

- Direct materials: $500

- Direct labor: $250

- Overhead: $125

- **Job 603** and **Job 604** were started in June.

- Overhead cost is applied with a predetermined rate as a percent of direct labor costs.

- Jobs 602 and 603 are finished in June, and Job 604 is expected to be finished in July.

- The company’s predetermined overhead rate did not change over these months.

### Required Calculations:

1. **Direct Materials Used in June**

Calculate the cost of direct materials used in June for each of the three jobs and in total.

2. **Direct Labor Used in June**

Calculate the cost of direct labor used in June for each of the three jobs and in total.

3. **Predetermined Overhead Rate**

Determine the predetermined overhead rate used in June.

4. **Cost Transferred to Finished Goods Inventory**

Calculate the total cost transferred to finished goods inventory in June.

### Data Input Section:

Users are required to enter their answers in the tabs provided below for each requirement.

#### Example Table for Direct Materials Used in June:

| | Job 602 | Job 603 | Job 604 | Total |

|-----------------|---------|---------|---------|--------|

| **May Costs** | $500 | - | - | $500 |

| **June Costs** | | | | |

| **Total** | $1,400 | $3,600 | $2,600 | $7,600 |

### Instruction to Users

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Delph Company uses job-order costing with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that 54,000 machine-hours would be required for the period's estimated level of production. It also estimated $1,040,000 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $5.00 per machine-hour. Because Delph has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following information to enable calculating departmental overhead rates: Machine-hours Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Job D-70 Direct materials cost Direct labor cost Machine-hours Job C-200 Direct materials cost Direct labor cost Machine-hours During the year, the company had no beginning or ending inventories and it…arrow_forwardAirQual Test Corporation provides on-site air quality testing services. The company has provided the following cost formulas and actual results for the month of February: Fixed Component per Month Variable Component Revenue per Job $ 278 Actual Total for February $ 33,390 Technician wages $ 8,600 $ 8,450 Mobile lab operating expenses $ 5,000 $ 33 $ 9,130 Office expenses $ 2,700 $ 2 $ 2,810 Advertising expenses $ 1,570 $ 1,640 Insurance $ 2,860 Miscellaneous expenses $ 930 $ 1 $ 2,860 $ 365 The company uses the number of jobs as its measure of activity. For example, mobile lab operating expenses should be $5,000 plus $33 per job, and the actual mobile lab operating expenses for February were $9,130. The company expected to work 130 jobs in February, but actually worked 136 jobs. Required: Prepare a flexible budget performance report showing AirQual Test Corporation's revenue and spending variances and activity variances for February. (Indicate the effect of each variance by selecting…arrow_forwardOld School Publishing Inc. began printing operations on January 1. Jobs 301 and 302 were completed during the month, and all costs applicable to them were recorded on the related cost sheets. Jobs 303 and 304 are still in process at the end of the month, and all applicable costs except factory overhead have been recorded on the related cost sheets. In addition to the materials and labor charged directly to the jobs, $7,900 of indirect materials and $13,200 of indirect labor were used during the month. The cost sheets for the four jobs entering production during the month are as follows, in summary form: Job 301 Job 302 Direct materials $10,900 Direct materials $18,300 Direct labor 8,900 Direct labor 17,700 Factory overhead 5,785 Factory overhead 11,505 Total $25,585 Total $47,505 Job 303 Job 304 Direct materials $26,000 Direct materials $13,700 Direct labor 16,000 Direct labor 12,300 Factory overhead — Factory overhead — Required:…arrow_forward

- Job Costs At the end of April, Almerinda Company had completed Jobs 50 and 51. Job 50 is for 23,040 units, and Job 51 is for 26,000 units. The following data relate to these two jobs: On April 6, Almerinda Company purchased on account 60,000 units of raw materials at $12 per unit. On April 21, raw materials were requisitioned for production as follows: 25,000 units for Job 50 at $10 per unit and 27,000 units for Job 51 at $12 per unit. During April, Almerinda Company accumulated 20,000 hours of direct labor costs on Job 50 and 24,000 hours on Job 51. The total direct labor was incurred at a rate of $20.00 per direct labor hour for Job 50 and $22.00 per direct labor hour for Job 51. Almerinda Company estimates that total factory overhead costs will be $1,750,000 for the year. Direct labor hours are estimated to be 500,000. a. Determine the balance on the job cost sheets for Jobs 50 and 51 at the end of April. Job 50 Job 51 b. Determine the cost per unit for Jobs 50 and 51 at the end of…arrow_forwardJohn at Tim's Toys was working on a custom-made miniature car for a customer. The job, BCB101, was started in March. At the end of March, the job cost sheet for BCB101 showed direct materials of $6,000, direct labor of 200 hours at $75 per hour, and overhead of 80% of direct labor cost. During April, direct materials of $1,700 were added, and John's time ticket showed 50 hours on Job BCB101, 25 hours on Job BCB102, and 40 hours on a new job, BCB103. Job BCB101 was completed on April 29. What is the total cost of Job BCB101 as of April 29? $26,450 $33,000 $41,450 $8,450arrow_forwardJob Costs At the end of August, Carrothers Company had completed Jobs 50 and 56. Job 50 is for 1,000 units, and Job 56 is for 500 units. The following data relate to these two jobs: On August 4, raw materials were requisitioned for production as follows: 400 units for Job 50 at $20 per unit and 1,400 units for Job 56 at $16 per unit. During August, Carrothers Company accumulated 200 hours of direct labor costs on Job 50 and 1,200 hours on Job 56. The total direct labor was incurred at a rate of $12 per direct labor hour for Job 50 and $14 per direct labor hour for Job 56. The predetermined factory overhead rate is $4.00 per direct labor hour. a. Determine the balance on the job cost sheets for Jobs 50 and 56 at the end of August. Job 50 $ Job 56 b. Determine the cost per unit for Jobs 50 and 52 at the end of August. If required, round your answers to the nearest cent. Job 50 $ Job 56 $ $arrow_forward

- 9.arrow_forwardUse this information about the Assembly Department to answer the question that follows. The debits to Work in Process-Assembly Department for April, together with data concerning production, are as follows: April 1, work in process: Materials cost, 3,000 units $ 7,500 Conversion costs, 3,000 units, 80% completed 6,000 Materials added during April, 10,000 units 29,000 Conversion costs during April 35,000 Goods finished during April, 11,500 units — April 30 work in process, 1,500 units, 60% completed — All direct materials are added at the beginning of the process, and the average cost method is used to cost inventories. The cost per equivalent unit for April is a.$2.70 b.$6.74 c.$6.25 d.$6.40arrow_forwardThe following information is available for Department Z for the month of July: Work in process, July 1 (70% complete) Direct materials Direct labor Units 2,000 Cost $ 6,000 3,000 Manufacturing overhead 4,000 Total work in process, July 1 $13,000 Started in July 20,000 Costs added: Direct materials Direct labor Manufacturing overhead Total costs added during July Work in process, July 31 (7.5% complete) $18,000 8,000 10,000 $36,000 2,000 Materials are added at the beginning of the process. Department Z's cost of goods transferred out using the FIFO method would be: O a. $44,500. O b. $40,250. Oc. $45,540. Od. $47,056arrow_forward

- Production Information shows the following costs and units for the smoothing department in August. Units Work in process Beginning balance: materials $1,550 Beginning units 640 Beginning balance: conversion 2,500 Transferred in 1,790 Materials Labor Overhead 7,135 All materials are added at the beginning of the period. The ending work in process is 20% complete as to conversion. What is the value of the inventory transferred to finished goods and the value of the WIP Inventory at the end of the month? Transferred out Cost Ending Inventory 6,955 Transferred out 1,810 14,540arrow_forwardAirQual Test Corporation provides on-site air quality testing services. The company has provided the following cost formulas and actual results for the month of February: Fixed Componentper Month VariableComponent per Job Actual Totalfor February Revenue $ 275 $ 27,500 Technician wages $ 8,300 $ 8,150 Mobile lab operating expenses $ 4,700 $ 33 $ 8,170 Office expenses $ 2,700 $ 2 $ 2,770 Advertising expenses $ 1,610 $ 1,680 Insurance $ 2,890 $ 2,890 Miscellaneous expenses $ 930 $ 2 $ 455 The company uses the number of jobs as its measure of activity. For example, mobile lab operating expenses should be $4,700 plus $33 per job, and the actual mobile lab operating expenses for February were $8,170. The company expected to work 110 jobs in February, but actually worked 114 jobs. Required: Prepare a flexible budget performance report showing AirQual Test Corporation’s revenue and spending variances and…arrow_forwardPrepare a cost of production report for the Cutting Department of Dalton Carpet Company for January. Use the average cost method to solve for the missing values with the following data: need help doing this report Description Dollar Amount Work in process, January 1, 3,400 units, 75% completed $32,000 Materials added during January from Weaving Department, 64,000 units 369,200 Direct labor 177,000 Factory overhead 89,710 Goods finished during January (includes goods in process, January 1), 63,500 units ? Work in process, January 31, 3,900 units, 10% completed ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education