FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

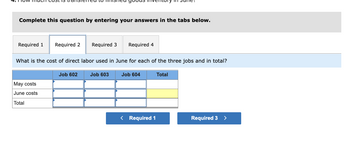

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1 Required 2

What is the cost of direct labor used in June for each of the three jobs and in total?

May costs

June costs

Total

Required 3 Required 4

Job 602

Job 603

Job 604

< Required 1

Total

Required 3 >

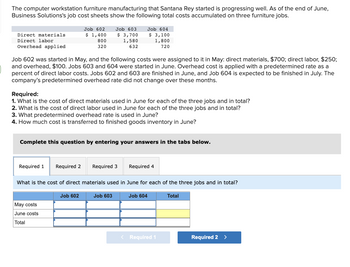

Transcribed Image Text:The computer workstation furniture manufacturing that Santana Rey started is progressing well. As of the end of June,

Business Solutions's job cost sheets show the following total costs accumulated on three furniture jobs.

Direct materials

Direct labor

Overhead applied

Job 602

$ 1,400

800

320

Job 602 was started in May, and the following costs were assigned to it in May: direct materials, $700; direct labor, $250;

and overhead, $100. Jobs 603 and 604 were started in June. Overhead cost is applied with a predetermined rate as a

percent of direct labor costs. Jobs 602 and 603 are finished in June, and Job 604 is expected to be finished in July. The

company's predetermined overhead rate did not change over these months.

Required 1

Required:

1. What is the cost of direct materials used in June for each of the three jobs and in total?

2. What is the cost of direct labor used in June for each of the three jobs and in total?

3. What predetermined overhead rate is used in June?

4. How much cost is transferred to finished goods inventory in June?

Job 603

$ 3,700

1,580

632

Complete this question by entering your answers in the tabs below.

May costs

June costs

Total

Job 604

$ 3,100

1,800

720

Required 2 Required 3

Job 602

What is the cost of direct materials used in June for each of the three jobs and in total?

Job 603

Required 4

Job 604

< Required 1

Total

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The weekly time records indicate the following distribution of labor hours for three direct labor employees: Hours Hours Hours Hours Process Job 560A Job 560B Job 560C Improvement Eva Leavitt 23 14 9 Micah Stone 10 18 11 Travis Hendrix 11 13 11 The direct labor rate earned per hour by the three employees is as follows: Leavitt Stone $18 25 21 4 N 3 Hendrix The process improvement category includes training, quality improvement, housekeeping, and other indirect tasks. a. Determine the amounts of factory labor costs transferred to Work in Process and Factory Overhead for the week. Factory labor costs transferred to Work in Process Factory labor costs transferred to Factory Overhead 2,568 X 155 Xarrow_forwardApplying Overhead to Jobs, Costing Jobs Jagjit Company designs and builds retaining walls for individual customers. On August 1, there were two jobs in process: Job 93 with a beginning balance of $8,810 and Job 94 with a beginning balance of $7,320. Jagjit applies overhead at the rate of $10 per direct labor hour. Direct labor wages average $16 per hour. Data on August costs for all jobs are as follows: Job 93 Job 94 Job 95 Job 96 Direct materials $1,000 $4,550 $3,310 $1,300 Direct labor cost 1,600 4,800 2,560 800 During August, Jobs 95 and 96 were started. Job 93 was completed on August 17, and the client was billed at cost plus 40%. All other jobs remained in process. Required: 1. Calculate the number of direct labor hours that were worked on each job in August. Job 93 fill in the blank fe4a4a013fdefc1_1 DLH Job 94 fill in the blank fe4a4a013fdefc1_2 DLH Job 95 fill in the blank fe4a4a013fdefc1_3 DLH Job 96 fill in the blank fe4a4a013fdefc1_4 DLH 2.…arrow_forwardComfy Backpacks started and finished job number TK474, a batch of 300 backpacks, during July. The job required $7 890 of direct material and 100 hours of labour at $30 per hour. The predetermined overhead rate is $15.00 per direct labour hour. Required: a. Prepare the journal entries to record the incurrence of production costs and the completionof job TK474. Correct answr from experts please############$$$$###arrow_forward

- es Following are simplified job cost sheets for three custom jobs at the end of June for Custom Patios. Job Number 102 Materials Labor Overhead Materials Labor Overhead Job Number 103 Materials Labor Overhead Job Number 104 $ 15,000 8,000 4,000 $ 33,000 14,200 7,100 All jobs were started in June. Overhead is applied with a predetermined rate based on direct labor cost. Jobs 102 and 103 were finished in June, and Job 104 will be finished in July. Req 1 and 2 102 103 1. What was the total cost of direct materials requisitioned in June? 2. How much total direct labor cost was incurred in June? 3. How much total cost is transferred to Finished Goods Inventory in June? $ 27,000 21,000 10,500 Complete this question by entering your answers in the tabs below. Job How much total cost is transferred to Finished Goods Inventory in June? Direct Materials Direct Labor Req 3 $ 15,000 $ 33,000 Applied Overhead Total Cost 8,000 $ 4,000 $ 27,000 14,200 7,100 54,300 Cost Transferred to Finished Goodsarrow_forwardMarco Company shows the following costs for three jobs worked on in April. Balances on March 31 Direct materials used (in March) Direct labor used (in March) Overhead applied (March) Costs during April Direct materials used Direct labor used Overhead applied Status on April 30 Additional Information Problem 15-2A (Algo) Part 4 MARCO COMPANY Schedule of Cost of Goods Manufactured For Month Ended April 30 Total manufacturing costs Job 306 Total cost of work in process $ 33,800 24,800 14,800 Cost of goods manufactured 147,000 89,800 ? Finished (sold) $ a. Raw Materials Inventory has a March 31 balance of $84,800. b. Raw materials purchases in April are $512,000, and total factory payroll cost in April is $375,000. c. Actual overhead costs incurred in April are indirect materials, $53,000; indirect labor, $26,000; factory rent, $35,000; factory utilities, $22,000; and factory equipment depreciation, $54,000. d. Predetermined overhead rate is 50% of direct labor cost. e. Job 306 is sold for…arrow_forwardces of The standard cost card for a unit of Product AX at the Cleaning Chemicals Corp. shows the following standard cost information: Materials: 3 gallons at $3 per gallon Labor: 2 hours at $12 per hour Overhead: 80% of direct labor Total $9 24 19 $ 52 During the month of October 20X1, Job O-3 was completed. It was the only job worked on during October. Five thousand two hundred units were produced from the job. The actual costs were as shown below: Materials: 15,800 gallons at $3.10 per gallon Labor: 10,500 hours at $12.10 per hour Actual overhead Total Standard cost of materials Actual cost of materials Total variance for materials $ 48,980 127,050 101,640 $277,670 Required: Calculate the total variance for materials for the month. (Indicate the effect of the variance by selecting "Favorable", "Unfavorable", and "None" for no effect (i.e., zero variance).)arrow_forward

- Expedition Company worked on five jobs during May: Jobs A10, B20, C30, D40, and E50. At the end of May, the job cost sheets for these five jobs contained the following data: Beginning balance Charged to the jobs during May: Direct materials Direct labor Manufacturing overhead applied Units completed Units sold during May Job A10 $ 213 $250 $ 230 $ 257 260 0 Job B20 $ 230 $ 230 $ 240 $ 270 0 0 Job C30 $ 222 $ 280 $ 150 $ 118 120 120 Job D40 $ 198 $ 180 $ 260 $212 0 0 Job E50 $255 Required: 1. What is the cost of goods sold for May? Note: Round "Unit product cost" to 2 decimal places and final answer to nearest dollar amount. 2. What is the total value of the finished goods inventory at the end of May? Note: Round "Unit product cost" to 2 decimal places and final answer to nearest dollar amount. 3. What is the total value of the work in process inventory at the end of May? $360 $290 $265 290 240 Jobs A10, C30, and E50 were completed during May. Jobs B20 and D40 were incomplete at the end…arrow_forwardHaresharrow_forwardMetropolitans Manufacturing generated the following activity for July for its current jobs. Total costs accumulated in the Work-in-Process account. Manufacturing overhead was allocated at $32 per machine hour used.1. Complete the Job Costs for each job listed below. Job 123 Job 124 Job 125 Total July 1 Balance $16,230 $12,680 $11,170 $40,080 Direct Materials Used $11,710 $18,920 $11,990 $42,620 Direct Labor Assigned to Jobs $14,520 $21,460 $7,480 $43,460 Manufacturing Overhead allocated to jobs Total Cost per Job Machine Hours used per job 410 390 70 2. Prepare the journal entry for completion of jobs 123 and 124 in July.Journal Date Description Debit Credit Open a T-account for Work-in-Process Inventory.3. Post the journal entry made in above. Compute the ending balance in the Work-in-Process Inventory account on July 31.Work-in-Process Debit Credit Double line Double line 4.…arrow_forward

- 1. What is the total cost of direct materials requistioned in June? 2. What is the total cost of direct labor used in June? ( please check plagiarism)arrow_forwardsanjuarrow_forwardRequired information [The following information applies to the questions displayed below.] At the end of June, the job cost sheets at Ace Roofers show the following costs accumulated on three jobs. At June 30 Direct materials Direct labor Overhead applied Additional Information Job 5 $ 18,400 11, 400 5,700 Job 6 $ 34,700 17,600 8,800 Job 7 $ 28,700 24,400 12, 200 a. Job 5 was started in May, and the following costs were assigned to it in May: direct materials, $7,700; direct labor, $3,500; and applied overhead, $2,600. Job 5 was finished in June. b. Job 6 and Job 7 were started in June; Job 6 was finished in June, and Job 7 is to be completed in July. Total transferred cost c. Overhead cost is applied with a predetermined rate based on direct bor cost. The predetermined overhead rate did not change across these months. 4. What is the total cost transferred to Finished Goods Inventory in June?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education