FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

What is the cost of goods manufactured in October?

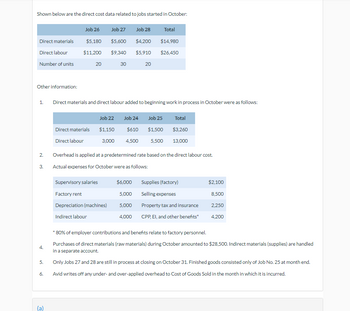

Transcribed Image Text:Shown below are the direct cost data related to jobs started in October:

Job 26

Job 27

Job 28

Total

Direct materials

$5,180

$5,600

$4,200

$14,980

Direct labour

$11,200

$9,340 $5,910

$26,450

Number of units

20

30

20

Other information:

1. Direct materials and direct labour added to beginning work in process in October were as follows:

Job 22 Job 24

Job 25

Total

Direct materials

$1,150

$610 $1,500

$3,260

Direct labour

3,000

4,500 5,500 13,000

2.

Overhead is applied at a predetermined rate based on the direct labour cost.

3.

Actual expenses for October were as follows:

Supervisory salaries

$6,000

Supplies (factory)

$2,100

Factory rent

5,000

Selling expenses

8,500

Depreciation (machines)

5,000

Property tax and insurance

2,250

Indirect labour

4,000

CPP, EI, and other benefits*

4,200

* 80% of employer contributions and benefits relate to factory personnel.

4.

Purchases of direct materials (raw materials) during October amounted to $28,500. Indirect materials (supplies) are handled

in a separate account.

5.

Only Jobs 27 and 28 are still in process at closing on October 31. Finished goods consisted only of Job No. 25 at month end.

6.

Avid writes off any under- and over-applied overhead to Cost of Goods Sold in the month in which it is incurred.

(a)

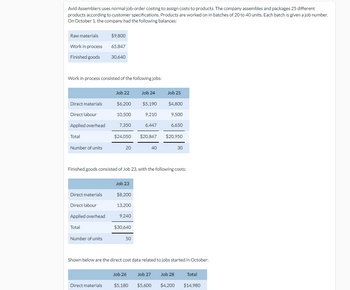

Transcribed Image Text:Avid Assemblers uses normal job-order costing to assign costs to products. The company assembles and packages 25 different

products according to customer specifications. Products are worked on in batches of 20 to 40 units. Each batch is given a job number.

On October 1, the company had the following balances:

Raw materials

$9,800

Work in process

65.847

Finished goods

30,640

Work in process consisted of the following jobs:

Job 22

Job 24

Job 25

Direct materials

$6,200

$5,190

$4,800

Direct labour

10,500

9,210

9,500

Applied overhead

7,350

6,447

6,650

Total

$24,050

$20,847 $20,950

Number of units

20

40

30

Finished goods consisted of Job 23, with the following costs:

Job 23

Direct materials

$8,200

Direct labour

13,200

Applied overhead

9.240

Total

$30,640

Number of units

50

Shown below are the direct cost data related to jobs started in October:

Job 27 Job 28

Total

Job 26

$5,180

Direct materials

$5,600

$4,200

$14,980

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Windsor Company reports the following costs and expenses in May. Factory utilities Depreciation on factory equipment Depreciation on delivery trucks Indirect factory labor Indirect materials Direct materials used Factory manager's salary From the information: (a) Manufacturing overhead $ LA $18,700 15,370 5,140 60,120 98,240 168,880 10,600 Office supplies used Determine the total amount of manufacturing overhead. Direct labor Sales salaries Property taxes on factory building Repairs to office equipment Factory repairs Advertising $84,680 56,020 3,050 1,670 2,440 18,300 3,160arrow_forwardHello, I need help solving this accounting problem.arrow_forwardPrimare Corporation has provided the following data concerning last month's manufacturing operations. Purchases of raw materials Indirect materials used in production $ 31,000 $ 4,570 Direct labor $ 59,000 Manufacturing overhead applied to work in process Underapplied overhead $ 88,200 $ 4,150 Inventories Beginning Raw materials $ 11,300 Ending $ 18,200 Work in process $ 54,200 $ 65,000 Finished goods $ 33,200 $ 42,900 Required: 1. Prepare a schedule of cost of goods manufactured for the month. 2. Prepare a schedule of cost of goods sold for the month. Assume the underapplied or overapplied overhead is closed to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a schedule of cost of goods manufactured for the month. Primare Corporation Schedule of Cost of Goods Manufactured Direct materials: Total raw materials available Raw materials used in production Direct materials used in production Total manufacturing costs added…arrow_forward

- What is the cafeteria’s labor cost for June?arrow_forwardThe unadjusted cost of goods sold is calculated using which of the following equations? Multiple Choice O Beginning finished goods inventory + Cost of goods manufactured + Ending finished goods inventory Beginning finished goods inventory + Cost of goods manufactured - Ending finished goods inventory Beginning finished goods inventory - Cost of goods manufactured - Ending finished goods inventory Beginning finished goods inventory - Cost of goods manufactured + Ending finished goods inventoryarrow_forwardeBook Show Me How Calculator E Print Item Cost of Goods Sold, Cost of Goods Manufactured Timbuk 3 Company has the following information for March: Cost of direct materials used in production $65,000 Direct labor 75,000 Factory overhead 27,000 Work in process inventory, March 1 54,000 Work in process inventory, March 31 41,990 Finished goods inventory, March 1 24,000 Finished goods inventory, March 31 16,000 a. For March, determine the cost of goods manufactured. く Using the data given, prepare a statement of Cost of Goods Manufactured. Timbuk 3 Company Statement of Cost of Goods Manufactured KSHEET.A... 24 $4 Total manufacturing costs incurred during March Total manufacturing costs NKSHEET.A... LANKSHEET Cost of goods manufactured CEL.ALGO Check My Work 5 more Check My Work uses remaining. D items : 30% All work saved. MacBook Pro 20 F1 F2 F3 F4 F5 F6 F7 F8 %23 LCarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education