FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

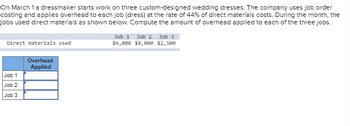

Transcribed Image Text:On March 1 a dressmaker starts work on three custom-designed wedding dresses. The company uses job order

costing and applies overhead to each job (dress) at the rate of 44% of direct materials costs. During the month, the

jobs used direct materials as shown below. Compute the amount of overhead applied to each of the three jobs.

Direct materials used

Job 1

Job 2

Job 3

Overhead

Applied

Job 1 Job 2 Job 3

$6,000 $8,000 $2,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Want helparrow_forwardApplying Overhead to Jobs, Costing Jobs Jagjit Company designs and builds retaining walls for individual customers. On August 1, there were two jobs in process: Job 93 with a beginning balance of $8,810 and Job 94 with a beginning balance of $7,320. Jagjit applies overhead at the rate of $10 per direct labor hour. Direct labor wages average $16 per hour. Data on August costs for all jobs are as follows: Job 93 Job 94 Job 95 Job 96 Direct materials $1,000 $4,550 $3,310 $1,300 Direct labor cost 1,600 4,800 2,560 800 During August, Jobs 95 and 96 were started. Job 93 was completed on August 17, and the client was billed at cost plus 40%. All other jobs remained in process. Required: 1. Calculate the number of direct labor hours that were worked on each job in August. Job 93 fill in the blank fe4a4a013fdefc1_1 DLH Job 94 fill in the blank fe4a4a013fdefc1_2 DLH Job 95 fill in the blank fe4a4a013fdefc1_3 DLH Job 96 fill in the blank fe4a4a013fdefc1_4 DLH 2.…arrow_forwardes Following are simplified job cost sheets for three custom jobs at the end of June for Custom Patios. Job Number 102 Materials Labor Overhead Materials Labor Overhead Job Number 103 Materials Labor Overhead Job Number 104 $ 15,000 8,000 4,000 $ 33,000 14,200 7,100 All jobs were started in June. Overhead is applied with a predetermined rate based on direct labor cost. Jobs 102 and 103 were finished in June, and Job 104 will be finished in July. Req 1 and 2 102 103 1. What was the total cost of direct materials requisitioned in June? 2. How much total direct labor cost was incurred in June? 3. How much total cost is transferred to Finished Goods Inventory in June? $ 27,000 21,000 10,500 Complete this question by entering your answers in the tabs below. Job How much total cost is transferred to Finished Goods Inventory in June? Direct Materials Direct Labor Req 3 $ 15,000 $ 33,000 Applied Overhead Total Cost 8,000 $ 4,000 $ 27,000 14,200 7,100 54,300 Cost Transferred to Finished Goodsarrow_forward

- Osprey Production uses job-order costing for batches of customer-printed T- shirts. For job R45, the company incurred the following costs: Direct materials used $4,235 Direct labor Applied overhead $1,300 $450 Actual overhead for Osprey for the month totaled $24,840, based on a total of 2,300 shirts for the month. If Job R45 consisted of 570 shirts, how much is the cost per shirt for this job? A. $10.50 B. $14.95 C. $15.25 D. $10.80arrow_forwardExpedition Company worked on five jobs during May: Jobs A10, B20, C30, D40, and E50. At the end of May, the job cost sheets for these five jobs contained the following data: Beginning balance Charged to the jobs during May: Direct materials Direct labor Manufacturing overhead applied Units completed Units sold during May Job A10 $ 213 $250 $ 230 $ 257 260 0 Job B20 $ 230 $ 230 $ 240 $ 270 0 0 Job C30 $ 222 $ 280 $ 150 $ 118 120 120 Job D40 $ 198 $ 180 $ 260 $212 0 0 Job E50 $255 Required: 1. What is the cost of goods sold for May? Note: Round "Unit product cost" to 2 decimal places and final answer to nearest dollar amount. 2. What is the total value of the finished goods inventory at the end of May? Note: Round "Unit product cost" to 2 decimal places and final answer to nearest dollar amount. 3. What is the total value of the work in process inventory at the end of May? $360 $290 $265 290 240 Jobs A10, C30, and E50 were completed during May. Jobs B20 and D40 were incomplete at the end…arrow_forwardK company production was working on Job 1 and Job 2 during the month. Of the $785 in direct materials, $375 in materials was requested for Job 1. Direct labor cost, including payroll taxes, are $22 per hour, and employees worked 17 hours on Job 1 and 28 hours on Job 2. Overhead is applied at the rate of $18 per direct labor hours. Prepare job order cost sheets for each job. Job 1 Hours Total Cost Direct materials $fill in the blank 1 Direct labor fill in the blank 2 fill in the blank 3 Manufacturing overhead fill in the blank 4 fill in the blank 5 Total cost $fill in the blank 6 Job 2 Hours Total Cost Direct materials $fill in the blank 7 Direct labor fill in the blank 8 fill in the blank 9 Manufacturing overhead fill in the blank 10 fill in the blank 11 Total cost $fill in the blank 12arrow_forward

- Applying Factory Overhead Instructions Chart of Accounts Factory Overhead Journal Instructions Lockmiller Company estimates that total factory overhead costs will be $867,000 for the year, Direct labor hours are estimated to be 102.000 Required: a For Lockmiller Company, determine the predetermined factory overhead rate using direct labor hours as the activity base. Round your answer to the nearest cent b. During May, Lockmiler Company accumulated 1,900 hours of direct labor costs on Job 275 and 2,600 hours on Job 310 Determine the amount of factory overhead applied to Joba 275 and 310 in May c. Prepare the journal entry on May 30 to apply factory overhead to both jobs in May according to the predetermined overhead rate. Refer to the chart of accounts for the exact wording of the account titles CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit…arrow_forwardEntries for Direct Labor and Factory Overhead Townsend Industries Inc. manufactures recreational vehicles. Townsend uses a job order cost system. The time tickets from November jobs are summarized as follows: Job 11-101 $6,240 Job 11-102 9,000 Job 11-103 7,210 Job 11-104 6,750 Factory supervision 4,000 Factory overhead is applied to jobs on the basis of a predetermined overhead rate of $18 per direct labor hour. The direct labor rate is $40 per hour. a. Journalize the entry to record the factory labor costs. If an amount box does not require an entry, leave it blank.arrow_forwardplease avoid answers in image format thank youarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education