FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

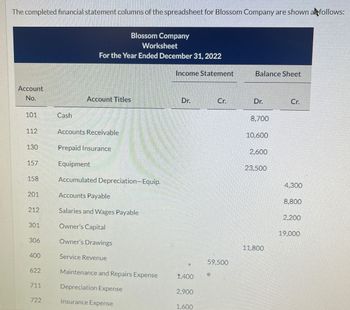

Transcribed Image Text:The completed financial statement columns of the spreadsheet for Blossom Company are shown as follows:

Blossom Company

Worksheet

For the Year Ended December 31, 2022

Account

Income Statement

Balance Sheet

No.

Account Titles

Dr.

Cr.

Dr.

Cr.

101

Cash

8,700

112

Accounts Receivable

10,600

130

Prepaid Insurance

2.600

157

Equipment

23.500

158

Accumulated Depreciation-Equip.

4,300

201

Accounts Payable

8.800

212

Salaries and Wages Payable

2.200

301

Owner's Capital

19.000

306

Owner's Drawings

11.800

400

Service Revenue

59.500

622

Maintenance and Repairs Expense

1.400

711

Depreciation Expense

2,900

722

Insurance Expense

1,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image) Tamarisk Inc. had the following balance sheet at December 31, 2024. Tamarisk Inc. Balance Sheet December 31, 2024 Cash $22,640 Accounts payable $32,640 Accounts receivable 23,840 Notes payable (long-term) 43,640 Investments 34,640 Common stock 102,640 Plant assets (net) 81,000 Retained earnings 25,840 Land 42,640 $204,760 $204,760 During 2025, the following occurred. 1. Tamarisk Inc. sold part of its debt investment portfolio for $16,327. This transaction resulted in a gain of $4,727 for the firm. The company classifies these investments as available-for-sale. 2. A tract of land was purchased for $15,640 cash. 3. Long-term notes payable in the amount of $17,327 were retired before maturity by…arrow_forwardCan you help prepare the 2 attached journal entries for this example The management of Banciu Corporation provides you with comparative balance sheets at December 31, 20X1, and December 31, 20X0, appearing below. December 31, 20X1 20X0 Assets Cash $ 174,000 $ 223,200 Accounts receivable 306,000 327,600 Allowance for uncollectible accounts (19,200 ) (20,400 ) Inventories 579,600 645,600 Machinery and equipment 1,112,400 776,400 Accumulated depreciation on machinery and equipment (499,200 ) (446,400 ) Leasehold improvements 104,400 104,400 Accumulated amortization on leasehold improvements (69,600 ) (58,800 ) Securities held for plant expansion 180,000 0 Patents 33,360 36,000 Totals $ 1,901,760 $ 1,587,600 Liabilities and stockholders’ equity Accounts payable $ 279,360 $ 126,000 Dividend payable 48,000 0 Current portion of 6% serial bonds…arrow_forwardCan you help prepare the 2 attached journal entries for this example The management of Banciu Corporation provides you with comparative balance sheets at December 31, 20X1, and December 31, 20X0, appearing below. December 31, 20X1 20X0 Assets Cash $ 174,000 $ 223,200 Accounts receivable 306,000 327,600 Allowance for uncollectible accounts (19,200 ) (20,400 ) Inventories 579,600 645,600 Machinery and equipment 1,112,400 776,400 Accumulated depreciation on machinery and equipment (499,200 ) (446,400 ) Leasehold improvements 104,400 104,400 Accumulated amortization on leasehold improvements (69,600 ) (58,800 ) Securities held for plant expansion 180,000 0 Patents 33,360 36,000 Totals $ 1,901,760 $ 1,587,600 Liabilities and stockholders’ equity Accounts payable $ 279,360 $ 126,000 Dividend payable 48,000 0 Current portion of 6% serial bonds…arrow_forward

- Use the following selected data from Business Solutions's income statement for the three months ended March 31, 2022, and from its March 31, 2022, balance sheet to complete the requirements. Computer services revenue $ 25, 364 Net sales (of goods) 18, 138 Total sales and revenue 43, 502 Cost of goods sold 15, 644 Net income 19, 551 Quick assets 90, 356 Current assets 97, 288 Total assets 121, 816 Current liabilities 820 Total liabilities 820 Total equity 120, 996 Required: Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. Compute the current ratio and acid - test ratio. Compute the debt ratio and equity ratio. What percent of its assets are current? What percent are long term?arrow_forwardPlease help me.arrow_forwardConsider the following account balances of Evan McGruder, Incorporated, as of December 31, Year 3: Accounts Payable $ 113,420 Retained Earnings $ 56,000 Equipment 422,900 Notes Payable, due Year 5 344,500 Common Stock 206,500 Accounts Receivable 203,800 Income Tax Payable 4,030 Cash 97,750 Required:Prepare a classified balance sheet at December 31, Year 3.arrow_forward

- The completed financial statement columns of the spreadsheet for Oriole Company are shown as follows: The completed financial statement columns of the worksheet for Oriole Company are shown as follows: Oriole Company Worksheet For the Year Ended December 31, 2022 Income Statement Balance Sheet Account Account Titles Dr. Cr. Dr. Cr. No. 101 Cash 9,100 112 Accounts Receivable 11,000 130 Prepaid Insurance 2,800 157 Equipment 24,300 158 Accumulated Depreciation-Equip. 4,500 201 Accounts Payable 9,200 212 Salaries and Wages Payable 2,500 301 Owner's Capital 19,500 306 Owner's Drawings 11,000 400 Service Revenue 60,500 622 Maintenance and Repairs Expense 1,700 711 Depreciation Expense 2,900 722 Insurance Expense 2,000 726 Salaries and Wages Expense 29,900 732 Utilities Expense 1,500 Totals 38,000 60,500 58,200 35,700 22,500 22,500 Net Income 60,500 60,500 58,200 58,200arrow_forwardReturn on Total Assets A company reports the following income statement and balance sheet information for the current year: Net income $157,080 Interest expense 27,720 Average total assets 2,800,000 Determine the return on total assets? If required, round the answer to one decimal place.arrow_forwardCurrent Attempt in Progress From the ledger balances below, prepare a trial balance for Sheridan Company at June 30, 2022. All account balances are normal. Accounts Payable $1,700 Cash Common Stock Dividends Equipment 5,700 17,600 1,540 13,350 Service Revenue Accounts Receivable Salaries and Wages Expense Rent Expense $ Debit $ $8,950 $ 2,690 SHERIDAN COMPANY Trial Balance 3,660 1,310 Debit Credit Credit PIC COLLAGarrow_forward

- Quick and EZ Delivery Income Statement Year Ended December 31, 2018 Revenues: Service Revenue $192,000 Expenses: Salaries Expense $65,000 Rent Expense 9,000 Interest Expense 7,600 Insurance Expense 2,600 Total Expenses Net Income Choose from any list or enter any number in the input fields and then click Check Answer. 2 parts remaining Clear All Final Check Data Table Land $12,000 Common Stock $20,000 Notes Payable 34,000 Accounts Payable 9,000 Property Tax Expense 3,100 Accounts Receivable 1,300 Dividends 35,000 Advertising Expense 10,000 Rent Expense 9,000 Building 139,600 Salaries Expense 65,000 Cash 2,200…arrow_forwardThe general ledger of Zips Storage at January 1, 2024, includes the following account balances: Credits Accounts Cash Accounts Receivable Prepaid Insurance Land Accounts Payable Deferred Revenue Common Stock Retained Earnings Totals 8. November 20 9. December 30 Requirement The following is a summary of the transactions for the year: 1. January 9 2. February 12 3. April 25 4. May 6 5. July 15 6. September 10 7. October 31 Provide storage services for cash, $144,100, and on account, $57,200. Collect on accounts receivable, $52,500. General Journal Receive cash in advance from customers, $13,900. Purchase supplies on account, $11,200. Pay property taxes, $9,500. Pay on accounts payable, $12,400. Pay salaries, $133,600. Issue shares of common stock in exchange for $37,000 cash. Pay $3,800 cash dividends to stockholders. Insurance expired during the year is $8,000. Supplies remaining on hand at the end of the year equal $3,900. Provide services of $12,800 related to cash paid in advance by…arrow_forwardPrepare a horizontal analysis of both the balance sheet and income statement. Complete this question by entering your answers in the tabs below. Analysis Bal Sheet Analysis Inc Stmt Prepare a horizontal analysis of the balance sheet. (Negative answers should be indicated by a minus sign. Round your answers to 1 decimal place. (i.e., .234 should be entered as 23.4).) THORNTON COMPANY Horizontal Analysis of Balance Sheets Year 4 Year 3 % Change Assets Current assets Cash $ 17,200 $ 12,200 % Marketable securities 21,600 6,800 Accounts receivable (net) 55,800 46,600 Inventories 135,100 143,000 Prepaid items 26,700 11,700 Total current assets 256,400 220,300 Investments 27,700 21,700 Plant (net) 271,900 256,700 Land 30,600 25,800 Total long-term assets 330,200 304,200 Total assets $ 586,600 $ 524,500 Liabilities and Stockholders' Equity Liabilities Current liabilities Notes payable $ 15,300 $ 4,900 Accounts payable 112,900 98,300 Salaries payable 20,900 13,300 Total current liabilities…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education