FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

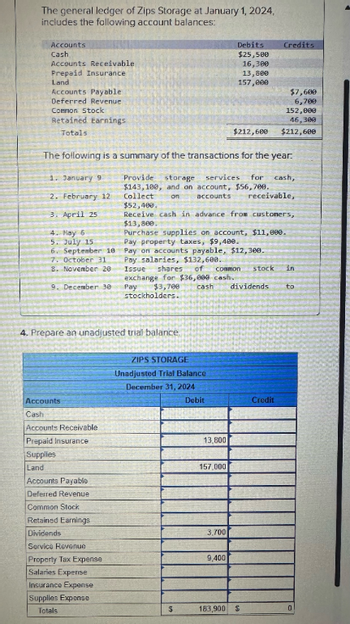

Transcribed Image Text:The general ledger of Zips Storage at January 1, 2024,

includes the following account balances:

Accounts

Cash

Accounts Receivable

Prepaid Insurance

Land

Accounts Payable

Debits

Credits

$25,500

16,300

13,800

157,000

$7,600

6,700

Deferred Revenue

Common Stock

Retained Earnings

Totals

152,000

46,300

$212,600

$212,600

The following is a summary of the transactions for the year.

1. January 9

Provide

storage services for cash,

$143,100, and on account, $56,700.

2. February 12

Collect on

accounts receivable,

$52,400.

3. April 25

4. May 6

5. July 15.

6. September 10

7. October 31

8. November 20

9. December 30

Receive cash in advance from customers,

$13,800.

Purchase supplies on account, $11,000.

Pay property taxes, $9,400.

Pay on accounts payable, $12,300.

Pay salaries, $132,600.

stock

in

dividends

to

Issue shares of Common

exchange for $36,000 cash.

Pay $3,700 cash

stockholders.

4. Prepare an unadjusted trial balance

ZIPS STORAGE

Unadjusted Trial Balance

December 31, 2024

Debit

Credit

Accounts

Cash

Accounts Receivable

Prepaid Insurance

13,800

Supplies

Land

157,000

Accounts Payable

Deferred Revenue

Common Stock

Retained Earnings

Dividends

Service Revenue

Property Tax Expense

Salaries Expense

Insurance Expense

Supplies Expense

Totals

3,700

9,400

$

183,900 $

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Unmodified opinion refers to ______ opinion. a. Qualified b. Disclaim c. Unqualified d. Adversearrow_forwardDescribe the accounting treatment of anticipated uncollectible accountsreceivable.arrow_forwardA concept or principle that relates to transactions is: a. materiality b. full disclosure c. original cost d. consistencyarrow_forward

- Overapplied FOH indicates that the applied FOH amount is greater than actual FOH amount. O True O Falsearrow_forwardMake an acronym or a mnemonic on the new revenue recognition standards and make a comparison with the old standard.arrow_forwardWhat are the steps in determining whether or not to compute impairment for PP&E?arrow_forward

- A note payable is in the form of Select one: a. a contingency that is reasonably likely to occur. b. an oral agreement. a standing agreement. C. d. a written promissory note. e. The answer does not exist Prarrow_forwardWhat is the major difference between the unadjusted trial balance and the adjusted trial balance?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education