FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

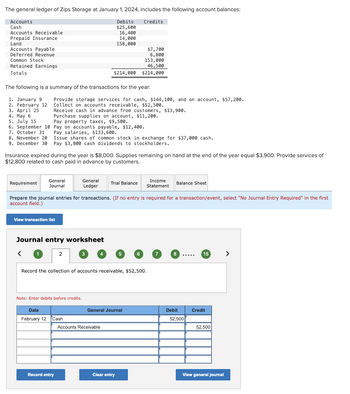

Transcribed Image Text:The general ledger of Zips Storage at January 1, 2024, includes the following account balances:

Credits

Accounts

Cash

Accounts Receivable

Prepaid Insurance

Land

Accounts Payable

Deferred Revenue

Common Stock

Retained Earnings

Totals

8. November 20

9. December 30

Requirement

The following is a summary of the transactions for the year:

1. January 9

2. February 12

3. April 25

4. May 6

5. July 15

6. September 10

7. October 31

Provide storage services for cash, $144,100, and on account, $57,200.

Collect on accounts receivable, $52,500.

General

Journal

Receive cash in advance from customers, $13,900.

Purchase supplies on account, $11,200.

Pay property taxes, $9,500.

Pay on accounts payable, $12,400.

Pay salaries, $133,600.

Issue shares of common stock in exchange for $37,000 cash.

Pay $3,800 cash dividends to stockholders.

Insurance expired during the year is $8,000. Supplies remaining on hand at the end of the year equal $3,900. Provide services of

$12,800 related to cash paid in advance by customers.

View transaction list

Journal entry worksheet

<

Debits

$25,600

16,400

14,000

158,000

$214,000

2

General

Ledger

Note: Enter debits before credits.

Date

February 12 Cash

Record entry

Prepare the journal entries for transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first

account field.)

$7,700

6,800

153,000

46,500

$214,000

Record the collection of accounts receivable, $52,500.

Trial Balance

Accounts Receivable

General Journal

Clear entry

Income

Statement

Balance Sheet

8

Debit

52,500

15

Credit

52,500

View general journal

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The January 1 balance in accounts receivable was $22,000. All sales during the period were on credit and totaled $647,000. Collections on account were $631,000. Write-offs during the year totaled $28,000. What is the ending balance in accounts receivable? A. $10,000 Dr balance B. $18,000 Cr balance C. $6,000 Dr balance D. $34,000 Dr balancearrow_forwardOn January 1, 2021, the general ledger of Big Blest Fireworks includes the following account balances: Accounts Cash Debit Credit $ 23,300 48, e00 Accounts Receivable Allowance for Uncollectible Accounts $ 4, See Inventory Land 37,800 72,108 Accounts Payable Notes Payable (6%, due in 3 years) Comnon Stack 28,9ee 37,000 63, 0e0 Retained Earnings 39,0e0 Totals $172,400 $172,48e The $37,000 beginning balance of inventory consists of 370 units, eoch costing $100. During Janusry 2021, Big Blast Fireworks had the following inventory transections: January 3 Purchase 1,6e0 units for $168,80e on account ($18s cach). January 8 Purchase 1,78e units for $187,000 on account ($11e cach). January 12 Purchase 1,8e0 units for $287, B0e on account ($115 cach). January 15 Return 135 of the units purchased on 3anuary 12 because of defcects. January 19 sell 5,280 units on account for $788,eee. The cost of the units sold is deternined using a FIFO perpetual inventory systen. January 22 Receive $753, eee…arrow_forwardPlease Solve in 20minsarrow_forward

- After the accounts are adjusted and closed at the end of the fiscal year, Accounts Receivable has a balance of $622,324 and Allowance for Doubtful Accounts has a balance of $20,510. What is the net realizable value of the accounts receivable? a.$601,814 b.$642,834 c.$20,510 d.$622,324arrow_forwardAccounts receivable turnover and days' sales in receivables Financial statement data for years ending December 31 for Cinderella Company follow: 20Y9 20YS Sales $9,525,000 $7,616,000 Accounts receivable: Beginning of year 715,000 645,000 End of year 785,000 715,000 a. Determine the accounts receivable turnover for 20Y9 and 20Y8. If required, round the final answers to one decimal place. Accounts Receivable Turnover 20Y9 20Y8 b. Determine the days' sales in receivables for 20Y9 and 20YS. Use 365 days, if required round the final answers to one decimal place. Days' Sales in Receivables 20Y9 days 20YS daysarrow_forwardThe following data are taken from the financial statements of Colby Company. Accounts receivable (net), end of year Net sales on account Terms for all sales are 1/10, n/45 Accounts Receivable turnover Average collection period (b) 2022 $550,000 2022 2021 4,300,000 4,000,000 7.9 times $540,000 2021 7.5 times 46.2 days 48.7 days What conclusions about the management of accounts receivable can be drawn from the accounts receivable turnover and the average collections period.arrow_forward

- The following data were taken from the records of Millet Corporation for the year ended December 31: Sales on account, P7,200,000; Accounts receivable written off as a result of permanentimpairment, P50,000; Notes receivable to settle accounts, P800,000; Purchases on account,P7,800,000; Payments to creditors, P6,400,000; Purchase discounts, P520,000; Sales returns,P30,000; Collections received to settle accounts, P4,900,000; Notes given to settle accounts, P500,000; Purchase returns, P140,000; Payments of notes, P200,000; Discounts taken bycustomers, P80,000; Collection on notes receivable, P360,000. What is the carrying value of the accounts receivable on December 31?arrow_forwardThe following information was taken from the books of Olmeck, Inc. Year 2 Year 1 Sales $956,000 $992,000 Accounts receivable: Beginning of the year 120,500 136,400 End of the year 110,000 120,500 a. Determine the accounts receivable turnover for Year 2 and Year 1. Round your answers to one decimal place. Accounts ReceivableTurnover Year 2 fill in the blank 1 Year 1 fill in the blank 2 b. Determine the number of days’ sales in receivables for Year 2 and Year 1. Round your answers to one decimal place. Assume 365 days per year. Number of Days' Salesin Receivables Year 2 fill in the blank 3 days Year 1 fill in the blank 4 days c. The industry average for the accounts receivable turnover is 8.0. How does Olmeck, Inc. compare? In Year 2 Olmeck was the industry average. In Year 1, Olmeck was the industry average.arrow_forwardOn the basis of the following data related to assets due within one year for Simons Co. prepare partial balance sheet in good form at December 31. Show total current assets. Cash $96,000 Notes Receivable 50,000 Accounts Receivable 275,000 Allowance for Doubtful Accounts 40,000 Interest Receivable 1,000arrow_forward

- On December 1, 2022, Blossom Company had the following account balances. Cash Notes Receivable Accounts Receivable Inventory Prepaid Insurance Equipment Dec. 7 1. 12 2. 17 During December, the company completed the following transactions. 19 22 26 31 Debit Adjustment data: $18,800 Accumulated Depreciation-Equipment 2,400 Accounts Payable Common Stock Retained Earnings 7,000 15,500 1,700 29,000 $74,400 Credit Received $3,600 cash from customers in payment of account (no discount allowed). Purchased merchandise on account from Vance Co. $12,400, terms 1/10, n/30. Sold merchandise on account $16,400, terms 2/10, n/30. The cost of the merchandise sold was $9,600. $2,900 6,200 50,100 15,200 $74,400 Paid salaries $2,100. Paid Vance Co. in full, less discount. Received collections in full, less discounts, from customers billed on December 17. Received $2,800 cash from customers in payment of account (no discount allowed). Depreciation was $200 per month. Insurance of $400 expired in December.arrow_forwardHow to calculate the total outstanding receivables?? For example if at the Dec 31 2013, total sales on account and invoiced during the year, the account receivable balance outstanding at the year end, the date when the invoice was issued and the date when the invoice was paid off was given!arrow_forwardUse the following financial statement information from Black Water Industries. BLACK WATER INDUSTRIES Ending Accounts Receivable Year Net Credit Sales 2017 $690,430 $335,250 2018 705,290 364,450 2019 770,500 406,650 A. Compute the accounts receivable turnover ratios for 2018 and 2019. Round your answers to two decimal places. 2018 times 2019 times B. Using the accounts receivable turnover, choose the statement that most closely describes the company's management of its receivables. a. The company's lending policies may be too strict. b. Collection efforts are not aggressive enough. There may be uncollectable receivables affecting the beginning and ending C. balances. d. All of the above statements may be correct. a b darrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education