FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

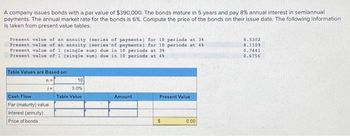

A company issues bonds with a par value of $390,000. The bonds mature in 5 years and pay 8% annual interest in semiannual payments. The annual market rate for the bonds is 6%. Compute the price of the bonds on their issue date. The following information is taken from present value tables: Present value of an annuity (series of payments) for 10 periods at 3% Present value of an annuity (series of payments) for 10 periods at 4% Present value of 1 (single sum) due in 10 periods at 3% Present value of 1 (single sum) due in 10 periods at 4% Table Values are Based on: n= /=; Cash Flow Par (maturity) value Interest (annuity) Price of bonds 10 3.0% Table Value Amount Present Value $ 0.00 8.5302 8.1109 0.7441 0.6756

Please help me inderstand.

Note:-

Do not provide handwritten solution. Maintain accuracy and quality in your answer.

Take care of plagiarism.

Answer completely.

You will get up vote for sure.

Transcribed Image Text:A company issues bonds with a par value of $390,000. The bonds mature in 5 years and pay 8% annual interest in semiannual

payments. The annual market rate for the bonds is 6%. Compute the price of the bonds on their issue date. The following information

is taken from present value tables:

Present value of an annuity (series of payments) for 10 periods at 34

Present value of an annuity (series of payments) for 10 periods at 48

Present value of 1 (single sum) due in 10 periods at 3

Present value of 1 (single sum) due in 10 periods at 4

Table Values are Based on:

n=

i=1

Cash Flow

Par (maturity) value

Interest (annuity)

Price of bonds

10

3.0%

Table Value

Amount

Present Value

0.00

8.5302

8.1109

0.7441

0.6756

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Marwick Corporation issues 12%, 5-year bonds with a par value of $1,230,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 10%. What is the bond's issue (selling) price, assuming the following Present Value factors: number of periods (n)- 5 10 5 10 Multiple Choice Present Value of an interest rate Annuity (series of $1,019,244 $1,324,958 $1,230,000 $660,139 $1,799,861 12% 10% 5% payments) 3.6048 7.3601 3.7908 7.7217 Present value of 1 (single sum) 0.5674 0.5584 0.6209 0.6139arrow_forwardPearson Co issue its $140,000 at a price of 94, the stated rate is 6%, the bond term is 4 years, and the market rate is 9%. Assume the term of the bonds is 4 years. The annual interest payment on the bond will be $_______arrow_forward1. Beluga Inc. issued 10-year bonds with a face value of $100,000 and a stated rate of 4% when the market rate was 6%. Interest was paid semi-annually. What is the amount of interest payments every 6 months? PLEASE NOTE: All dollar amounts will be rounded to whole dollars with "$" and commas as needed (i.e. $12,345).arrow_forward

- A company issued 9%, 15-year bonds with a face amount of $100 million. The market yield for bonds of similar risk and maturity is 8%. Interest is paid semiannually. At what price did the bonds sell?arrow_forwardA company issues bonds with a par value of $370,000. The bonds mature in 5 years and pay 8% annual interest in semiannual payments. The annual market rate for the bonds is 6%. Compute the price of the bonds on their issue date. The following information is taken from present value tables: Present value of an annuity (series of payments) for 10 periods at 3% Present value of an annuity (series of payments) for 10 periods at 4% Present value of 1 (single sum) due in 10 periods at 3% Present value of 1 (single sum) due in 10 periods at 4% Table Values are Based on: n = i = Cash Flow Par (maturity) value Interest (annuity) Price of bonds Table Value Amount Present Value 8.5302 8.1109 0.7441 0.6756arrow_forwardWhat is the present worth of a $25,000 bond that was purchased for $23,750 and has an interest of 10% per year, payable semiannually? The bond matures in 15 years. The interest rate in the marketplace is 8% per year, compounded quarterly.arrow_forward

- On January 1, 2021, LMN Company issued 10-year bonds with a face amount of P3,000,000 at a stated interest rate of 8% payable annually on January 1. The bonds were priced to yield 10%. Present value factors are as follows: Present value of P1 for 10 periods Present value of an ordinary annuity of P1 for 10 periods At 8%. 0.46326.7101 At 10%0.38556.1446 The total issue price of the bonds was:arrow_forwardCompute the selling price of 10%, 15-year bonds with a par value of $240,000 and semiannual interest payments. The annual market rate for these bonds is 8%.arrow_forward2. A 10-year, P20,000 bond was issued at a nominal interest rate of 8% with semiannual compounding. Just after the fourth interest payment, the bond will be sold. Assume that an effective interest rate of 10 % % will apply, and calculate the price of the bond.arrow_forward

- Monty Corp. invested in a three-year, $100 face value 9% bond, paying $95.11. At this price, the bond will yield a 11% return. Interest is payable annually. Prepare a bond discount amortization table for Monty Corp., assuming Monty uses the effective interest method required by IFRS. (Round answers to 2 decimal places, e.g. 52.75.) Bond Discount Amortization Table Date Cash Received Interest Income Bond Discount Amortization Amortized Cost of Bond Day 1 $enter a dollar amount End Year 1 $enter a dollar amount $enter a dollar amount $enter a dollar amount enter a dollar amount End Year 2 enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount End Year 3 enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount $enter a total amount $enter a total amount $enter a total amount Prepare journal entries to record the initial…arrow_forwardMetlock Inc. issues $4,200,000 of 7% bonds due in 10 years with interest payable at year-end. The current market rate of interest for bonds of similar risk is 12%. What amount will Metlock receive when it issues the bonds?arrow_forwardA company has issued 14%, 10 year bond that pays interest semiannually. If the market price of the bond to yield an effective annual rate 13%. What is the price the bond? Please show your calcilation in a handwritten format.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education