Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

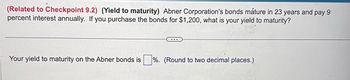

Transcribed Image Text:(Related to Checkpoint 9.2) (Yield to maturity) Abner Corporation's bonds mature in 23 years and pay 9

percent interest annually. If you purchase the bonds for $1,200, what is your yield to maturity?

Your yield to maturity on the Abner bonds is%. (Round to two decimal places.)

Expert Solution

arrow_forward

Step 1: Background

YTM is the rate at which the present value of all future payments is equal to the bond purchase price.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- (Bond valuation) Flora Co.'s bonds, maturing in 11 years, pay 8 percent interest on a $1,000 face value. However, interest is paid semiannually. If your required rate of return is 14 percent, what is the value of the bond? How would your answer change if the interest were paid annually? SETIS a. If the interest is paid semiannually, the value of the bond is $. (Round to the nearest cent.)arrow_forwardABC Corporation’s recently issued bonds paying interest semiannually and maturing in 10 years. The face value of each bond is $1000, and 8% is the nominal interest rate. (a) What is the effective interest rate an investor receives if $1000 is paid for the bond? (b) If a 1.75% fee is deducted by the brokerage firm from the initial $1000, what is the effective annual interest rate paid by ABC Corporation?arrow_forwardFingen's 16-year,$1,000 par value bonds pay14 percent interest annually. The market price of the bonds is $950 and the market's required yield to maturity on a comparable-risk bond is16 percent. What is your yield to maturity on the Fingen bonds given the market price of the bonds? (Round to two decimal places.)arrow_forward

- F1. Please answer fastarrow_forwardUrmilaarrow_forwardBushman, Inc., issues $200,000 of 9% bonds that pay interest semiannually and mature in 10 years. Compute the bond issue price assuming that the bonds' market rate is:a. 6% per year compounded semiannually.Round your answers to the nearest dollar. Present value of principal repayment Present value of interest payments Selling price of bonds b. 8% per year compounded semiannually.Round your answers to the nearest dollar. Present value of principal repayment Present value of interest payments Selling price of bondsarrow_forward

- Harrimon Industries bonds have 5 years left to maturity. Interest is paid annually, and the bonds have a $ 1,000 par value and a coupon rate of 8%. What is the yield to maturity at a current market price of $812? Round your answer to two decimal places. % $1,097? Round your answer to two decimal places. %arrow_forwardHarrimon Industries bonds have 5 years left to maturity. Interest is paid annually, and the bonds have a $1,000 par value and a coupon rate of 8%. What is the yield to maturity at a current market price of $798? Round your answer to two decimal places. % $1,074? Round your answer to two decimal places.arrow_forward(Related to Checkpoint 9.2) (Yield to maturity) Hoyden Co.'s bonds mature in 13 years and pay 8 percent interest annually. If you purchase the bonds for $700, what is their yield to maturity? Question content area bottom Part 1 The yield to maturity on the Hoyden bonds is enter your response here%. (Round to two decimal places.)arrow_forward

- Harrimon Industries bonds have 5 years left to maturity. Interest is paid annually, and the bonds have a $1,000 par value and a coupon rate of 8%. What is the yield to maturity at a current market price of $785? Round your answer to two decimal places. % $1,082? Round your answer to two decimal places. %arrow_forwardKilgore Natural Gas has a $1,000 par value bond outstanding that pays 19 percent annual interest. The current yield to maturity on such bonds in the market is 11 percent. Compute the price of the bonds for these maturity dates: (Do not round intermediate calculations. Round your final answers to 2 decimal places. Assume interest payments are annual.) a. 25 years b. 19 years c. 5 yeararrow_forwardNikita Enterprises has bonds on the market making annual payments, with eleven years to maturity, a par value of $1,000, and selling for $970. At this price, the bonds yield 7 percent. What must the coupon rate be on the bonds? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Coupon rate I%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education