EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

General accounting

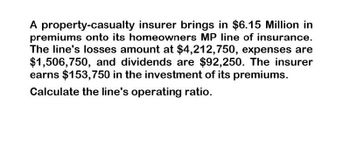

Transcribed Image Text:A property-casualty insurer brings in $6.15 Million in

premiums onto its homeowners MP line of insurance.

The line's losses amount at $4,212,750, expenses are

$1,506,750, and dividends are $92,250. The insurer

earns $153,750 in the investment of its premiums.

Calculate the line's operating ratio.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- An insurance policy sells for $1200. Based on past data, an average of 1 in 50 policyholders will file a $10,000 claim, an average of 1 in 100 policyholders will file a $50,000 claim, and an average of 1 in 250 policyholders will file an $80,000 claim. Find the expected value (to the company) per policy sold. If the company sells 20,000 policies, what is the expected profit or loss? The expected value is $ (Simplify your answer.) The expected (Simplify your answer.) is $arrow_forwardcalculate total loan costs on a 7.5%, $145,000, 25-year mortgage loan with 1/2% origination fee, 3/4 of a point, $550 mortgage insurance fee, $360 document preparation fee, $395 appraisal fee, $663 title insurance fee, $125 credit report fee, $75 recording fee, and 500$ to be placed in escrow...arrow_forwardFind the annual homeowners insurance premium on a masonry home located in zone 1 if the home is insured for $237,000. The owner chooses a $1,500 deductible and has good credit. E Click the icon to see a hypothetical table of Estimated Annual Homeowners Insurance Premium Rates per $100 of Face Value. The annual homeowners insurance premium is $ (Simplify your answer. Type an integer or a decimal.)arrow_forward

- If Carissa has a $140,000 home insured for $110,000, based on the 80 percent coinsurance provision, how much would the insurance company pay on a $14,200 claim?arrow_forwardCalculate the housing expense ratio and the total obligation ratio (in %) for the following mortgage applications. (Round your answers t Monthly Gross Income Monthly PITI Other Monthly Financial Obligations Housing Expense Ratio (%) Total Obligations Ratio (%) Applicant Expense Emerson $2,900 $777 $290 %arrow_forwardPlease solve thisarrow_forward

- Based on the following data, calculate the items requested: Buying Costs Annual mortgage payments Property taxes Down payment/closing costs Growth in equity Insurance/maintenance Estimated annual appreciation Rental Costs Annual rent Insurance Security deposit $ 8,230 $ 230 $ 1,075 Assume an after-tax savings interest rate of 7 percent and a tax rate of 32 percent. Assume this individual has other tax deductions that exceed the standard deduction amount. Rental cost Buying cost a. Calculate total rental cost and total buying cost. (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) $ 10,450 (10,000 is interest) $ 2,120 $ 5,150 $ 450 $1,900 $ 2,550 b. Would you recommend buying or renting? O Renting O Buyingarrow_forwardConsider a 7.5%, $145,000, 25-year mortgage loan with 1/2% origination fee, 3/4 of a point, $550 mortgage insurance fee, $360 document prep fee, $395 appraisal fee, $663 title insurance fee, $125 credit report fee, $75 recording fee, and $500 to be placed in escrow. Calculate the reportable APR%arrow_forwardLive Forever Insurance Company is selling a perpetual annuity contract that pays $2,700 monthly. The contract currently sells for $329,000. a. What is the monthly return on this investment vehicle? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. What is the APR? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. c. What is the effective annual return? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Monthly return b. Annual percentage rate c. Effective annual return % % %arrow_forward

- Jamison is looking at the historical prepayment for a passthrough security. He finds the following: mortgage balance in month 42 = $260,000,000 scheduled principal payment in month 42 = $1,000,000 prepayment in month 42 = $2,450,000 What is the SMM for month 42? How should Mr. Jamison interpret the SMM computed? What is the CPR for month 42?arrow_forwardCalculate the housing expense ratio and the total obligation ratio (in %) for the following mortgage applications. (Round your answers to two decimal places.) Applicant MonthlyGrossIncome MonthlyPITIExpense Other MonthlyFinancialObligations HousingExpenseRatio (%) TotalObligationsRatio (%) Martin $3,700 $705 $720 % %arrow_forwardA company plans to make four annual deposits of $6,250 each to a special building fund. The fund's assets will be invested in mortgage instruments expected to pay interest at 12% on the fund's balance. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: Determine how much will be accumulated in the fund after four years under each of the following situations: 1. The $6,250 annual deposit are made at the end of each of the four years and interest is compounded annually.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT