Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

ksk

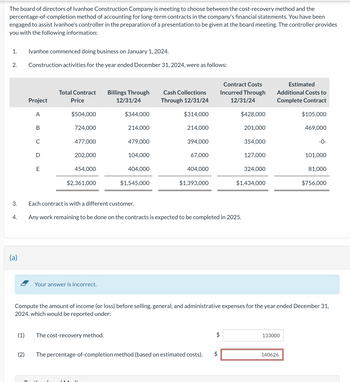

Transcribed Image Text:The board of directors of Ivanhoe Construction Company is meeting to choose between the cost-recovery method and the

percentage-of-completion method of accounting for long-term contracts in the company's financial statements. You have been

engaged to assist Ivanhoe's controller in the preparation of a presentation to be given at the board meeting. The controller provides

you with the following information:

1.

Ivanhoe commenced doing business on January 1, 2024.

2. Construction activities for the year ended December 31, 2024, were as follows:

Project

Total Contract

Price

Billings Through

12/31/24

Cash Collections

Through 12/31/24

Contract Costs

Incurred Through

Estimated

12/31/24

Additional Costs to

Complete Contract

A

$504,000

$344,000

$314,000

$428,000

$105,000

B

724,000

214,000

214,000

201,000

469,000

C

477,000

479,000

394,000

354,000

-0-

D

202,000

104,000

67,000

127,000

101,000

E

454,000

404,000

404,000

324,000

81,000

$2,361,000

$1,545,000

$1,393,000

$1,434,000

$756,000

3.

Each contract is with a different customer.

4.

Any work remaining to be done on the contracts is expected to be completed in 2025.

(a)

Your answer is incorrect.

Compute the amount of income (or loss) before selling, general, and administrative expenses for the year ended December 31,

2024, which would be reported under:

(1)

The cost-recovery method.

$

133000

(2)

The percentage-of-completion method (based on estimated costs).

$

140626

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The board of directors of Oriole Construction Company is meeting to choose between the cost-recovery method and the percentage-of-completion method of accounting for long-term contracts in the company's financial statements. You have been engaged to assist Oriole's controller in the preparation of a presentation to be given at the board meeting. The controller provides you with the following information: 1. Oriole commenced doing business on January 1, 2024. 2. Construction activities for the year ended December 31, 2024, were as follows: Contract Costs Estimated Additional Costs Incurred Total Contract Billings Through Cash Collections to Through Through Complete 12/31/24 Project Price 12/31/24 12/31/24 Contract A $494,000 $334,000 $304,000 $418,000 $95,000 B 714,000 204,000 204,000 186,000 434,000 C 472,000 469,000 384,000 344,000 -0- D 187,000 94,000 62,000 117,000 91,000 E 444,000 394,000 394,000 314,000 78,500 $2,311,000 $1,495,000 $1,348,000 $1,379,000 $698,500 3. Each contract…arrow_forwardThe board of directors of Ivanhoe Construction Company is meeting to choose between the cost-recovery method and the percentage-of-completion method of accounting for long-term contracts in the company's financial statements. You have been engaged to assist Ivanhoe's controller in the preparation of a presentation to be given at the board meeting. The controller provides you with the following information: 1. Ivanhoe commenced doing business on January 1, 2024. 2. Construction activities for the year ended December 31, 2024, were as follows: Project Total Contract Price Billings Through 12/31/24 Cash Collections Through 12/31/24 Contract Costs Incurred Through Estimated Additional Costs to 12/31/24 Complete Contract A $504,000 $344,000 $314,000 $428,000 $105,000 B 724,000 214,000 214,000 201,000 469,000 C 477,000 479,000 394,000 354,000 -0- D 202,000 104,000 67,000 127,000 101,000 E 454,000 404,000 404,000 324,000 81,000 $2,361,000 $1,545,000 $1,393,000 $1,434,000 $756,000 3. Each…arrow_forwardThe board of directors of Ogle Construction Company is meeting to choose between the completed-contract method and the percentage-of-completion method of accounting for long-term contracts in the company's financial statements. You have been engaged to assist Ogle's controller in the preparation of a presentation to be given at the board meeting. The controller provides you with the following information: Ogle commenced doing business on January 1, 2018. Construction activities for the year ended December 31, 2018, were as follows: Total Contract Billings Through Cash Collections Project Price 12/31/18 Through 12/31/18 A $ 500,000 $ 340,000 $ 310,000 B 720,000 210,000 210,000…arrow_forward

- The Thompson Corporation, a manufacturer of steel products, began operations on October 1, 2019. The accounting department of Thompson has started the fixed-asset and depreciation schedule presented below. You have been asked to assist in completing this schedule. In addition to ascertaining that the data already on the schedule are correct, you have obtained the following information from the company's records and personnel: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Depreciation is computed from the first of the month of acquisition to the first of the month of disposition. Land A and Building A were acquired from a predecessor corporation. Thompson paid $792,500 for the land and building together. At the time of acquisition, the land had a fair value of $70,400 and the building had a fair value of $809,600. Land B was acquired on October 2, 2019, in exchange for 2,800 newly issued shares of…arrow_forwardAngelou Corporation was organized in 2019 and began operations at the beginning of 2020. The company is involved in interior design consulting services. The following costs were incurred prior to the start of operations. Attorney fees in connection with organization of the company $15,000 Purchase of drafting and design equipment 10,000 Costs of meetings of incorporators to discuss organizational activities 7,000 State filing fees to incorporate 1,000 $33,000 Instructions a. Compute the total amount of organization costs incurred by Angelou. b. Prepare the journal entry to record organization costs for 2020.arrow_forwardYour firm has been engaged to examine the financial statements of Almaden Corporation for the year 2020. The bookkeeper who maintains the financial records has prepared all the unaudited financial statements for the corporation since its organization on January 2, 2015. The client provides you with the following information. Almaden CorporationBalance SheetDecember 31, 2020 Assets Liabilities Current assets $1,881,100 Current liabilities $ 962,400 Other assets 5,171,400 Long-term liabilities 1,439,500 Stockholders' equity 4,650,600 $7,052,500 $7,052,500 An analysis of current assets discloses the following. Cash (restricted in the amount of $300,000 for plant expansion) $ 571,000 Investments in land 185,000 Accounts receivable less allowance of $30,000 480,000 Inventories (LIFO flow assumption) 645,100 $1,881,100 Other assets include: Prepaid expenses $ 62,400 Plant and equipment less accumulated depreciation of…arrow_forward

- Your firm has been engaged to examine the financial statements of Teal Corporation for the year 2020. The bookkeeper who maintains the financial records has prepared all the unaudited financial statements for the corporation since its organization on January 2, 2015. The client provides you with the information. Teal CorporationBalance SheetDecember 31, 2020 Assets Liabilities Current assets $1,888,000 Current liabilities $970,000 Other assets 5,114,480 Long-term liabilities 1,471,000 Stockholders’ equity 4,561,480 $7,002,480 $7,002,480 An analysis of current assets discloses the following. Cash (restricted in the amount of $301,000 for plant expansion) $582,000 Investments in land 185,000 Accounts receivable less allowance of $29,000 479,000 Inventories (LIFO flow assumption) 642,000 $1,888,000 Other assets include: Prepaid expenses $62,000 Plant and…arrow_forwardGuillen, Inc. began work on a $7,000,000 contract in 2020 to construct an office building. Guillen uses the completed-contract method. At December 31, 2020, the balances in certain accounts were Construction in Process $1,715,000, Accounts Receivable $240,000, and Billings on Construction in Process $1,000,000. Indicate how these accounts would be reported in Guillen's December 31, 2020, balance sheet.arrow_forwardSandhill, Inc. began work on a $6,473,000 contract in 2020 to construct an office building. Sandhill uses the completed-contract method. At December 31, 2020, the balances in certain accounts were Construction in Process $1,839,000, Accounts Receivable $234,000, and Billings on Construction in Process $1,063,000. Indicate how these accounts would be reported in Sandhill's December 31, 2020, balance sheet. (List assets in order of liquidity.) Sandhill, Inc. Balance Sheet %24 %24 %24arrow_forward

- Freitas Corporation was organized early in 2024. The following expenditures were made during the first few months of the year: Attorneys’ fees in connection with the organization of the corporation $ 12,200 State filing fees and other incorporation costs 3,200 Purchase of a patent 20,100 Legal and other fees for transfer of the patent 2,200 Purchase of equipment 30,100 Preopening salaries and employee training 40,100 Total $ 107,900 Required: Prepare a summary journal entry to record the $107,900 in cash expenditures. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forwardYour firm has been engaged to examine the financial statements of Buffalo Corporation for the year 2020. The bookkeeper who maintains the financial records has prepared all the unaudited financial statements for the corporation since its organization on January 2, 2015. The client provides you with the information. Buffalo CorporationBalance SheetDecember 31, 2020 Assets Liabilities Current assets $1,899,000 Current liabilities $956,000 Other assets 5,138,660 Long-term liabilities 1,471,000 Stockholders’ equity 4,610,660 $7,037,660 $7,037,660 An analysis of current assets discloses the following. Cash (restricted in the amount of $298,000 for plant expansion) $582,000 Investments in land 187,000 Accounts receivable less allowance of $30,000 487,000 Inventories (LIFO flow assumption) 643,000 $1,899,000 Other assets include: Prepaid expenses $62,000 Plant…arrow_forwardOn July 1, 2025, Torvill Construction Company Inc. contracted to build an office building for Gumbel Corp. On July 1, Torvill estimated that it would take between 2 and 3 years to complete the building. On December 31, 2027, the building was deemed substantially completed. Following are accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Gumbel for 2025, 2026, and 2027. NOTE: The company's fiscal year aligns with the calendar year. The phrase "to date" that is used in the contract details below, as well as in the answer table, means up to the present time. Pay attention to the years that you're working with! Total contract price $ 2,400,000 Contract costs incurred to date $ Estimated costs to complete the contract Progress Billings to Gumbel during year At 12/31/25 300,000 1,200,000 300,000 1,100,000 At 12/31/26 At 12/31/27 $1,220,000 $2,150,000 800,000 800,000 Instructions a. b. Using the percentage-of-completion method, prepare…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT