Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN: 9781305627734

Author: Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What is the firm's degree of leverage?

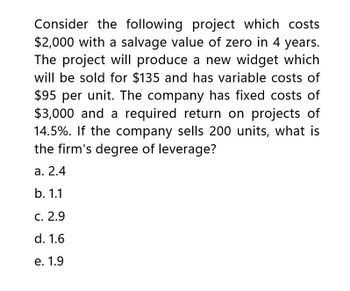

Transcribed Image Text:Consider the following project which costs

$2,000 with a salvage value of zero in 4 years.

The project will produce a new widget which

will be sold for $135 and has variable costs of

$95 per unit. The company has fixed costs of

$3,000 and a required return on projects of

14.5%. If the company sells 200 units, what is

the firm's degree of leverage?

a. 2.4

b. 1.1

c. 2.9

d. 1.6

e. 1.9

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Can you please answer the accounting question?arrow_forwardA company is considering a project which would involve purchasing amachine for $20,000 which will have no value at the end of the project.It will be used to produce a product which will have sales of 600 unitsper year for 4 years. The sales price per unit will be $50, the variablecosts per unit $20 and the incremental fixed costs of the project will be$10,000 per annum. These are all expressed in real terms and will besubject to inflation.Sales will inflate at 5% per annum, variable costs at 6% per annumand fixed costs at 7% per annum.The cost of capital is 15%Required:-Calculate NPV of the projectarrow_forwardJFINEX Corporation is considering a new project that will cost 50,000. If the IRR is 8%, what is the profitability index assuming the project generated an NPV of 80,000?" 130,000 30,000 1.62.6 None of the abovearrow_forward

- Suppose you are considering an investment project that requires $800.000, has a six-year life and has a salvage value of $100,000. Sales volume is projected 10 be 65,000 units per year. Price per unit is $63, variable cos! per unit is $42, and fixed costs are $532,000 per year. The depreciation method is a five-year MACRS. 1l1e tax rate is 35% and you expect a 20% return on this investment.(a) Determine The break-even sales volume.(b) Calculate the cash flows o( the base case over six years and its NPW.(c) lf the sales price per unit increases to $400, what is the required break-even volume?(d) Suppose the projections are given for price, sales volume, variable costs, and fixed costs are all accurate to within ± 15%. What would be the NPW Figures of the best-case and worst-case scenarios?arrow_forwardModern Artifacts can produce keepsakes that will be sold for $20 each. Nondepreciation fixed costs are $200 per year, and variable costs are $30 per unit. The initial investment of $600 will be depreciated straight-line over its useful life of 6 years to a final vlaue of zero, and the discount rate is 15%. a). What is the degree of operating leverage of Modern Artifacts when sales are $640?(Don't round intermediate calculations. Round answer to 2 decimal places) b). What is the degree of operating leverage when sales are $1,620? (Don't round intermediate calculations, round final answer to 2 decimal places)arrow_forwardmakaarrow_forward

- A company is considering expanding a factory. The expansion requires 400 MUSD investment immediately. It should generate 117 MUSD tax adjusted cash flow each year for 7 years. The factory can be scrapped for 360 at the end of its lifetime. The firm's cost c capital is 19%. 1. Compute the NPV of the project. MUSD 2. Compute the projects Profitability Index. Answer: 3. Estimate the Discounted Payback Period (0 means it doesn't break even): 4. Estimate the Break-Even Period (0 means it doesn't break even):arrow_forwardMost you can pay negative NPV? 22. You are getting ready to start a new project that will incur some cleanup and shutdown costs when it is completed. The project costs $5.4 million up front and is expected to generate $1.1 million per year for 10 years and then have some shutdown costs in year 11. Use the MIRR approach to find the maximum shutdown costs you could incur and still meet your cost of capital of 15% on this project. Cald in South Africaarrow_forwardThe X Division of NUBD Products Co. is considering an investment in a new project. The project has an estimated cost of P1,000,000. If NUBD Products Co. has a target rate of return of 12%, how large does the return on investment on this project need to be to generate P180,000 of residual income?arrow_forward

- 3. Schultz Company is considering purchasing a machine that would cost $478,800 and have a useful life of 5 years. The machine would reduce cash operating costs by $114,000 per year. The machine would have a salvage value of $6,200. Schultz Company prefers a payback period of 3.5 years or less.Required: a. Compute the payback period for the machine. What does this mean? b. Compute the return on average investment (ROI)arrow_forward4arrow_forwardOwearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning