FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

PLEASE HELP ME WITH THIS ACCOUNTING PROBLEM!!!!

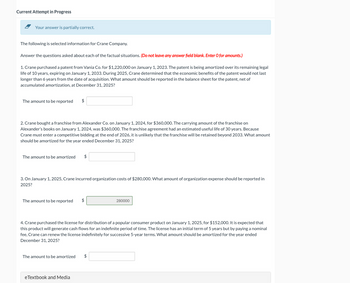

Transcribed Image Text:Current Attempt in Progress

Your answer is partially correct.

The following is selected information for Crane Company.

Answer the questions asked about each of the factual situations. (Do not leave any answer field blank. Enter O for amounts.)

1. Crane purchased a patent from Vania Co. for $1,220,000 on January 1, 2023. The patent is being amortized over its remaining legal

life of 10 years, expiring on January 1, 2033. During 2025, Crane determined that the economic benefits of the patent would not last

longer than 6 years from the date of acquisition. What amount should be reported in the balance sheet for the patent, net of

accumulated amortization, at December 31, 2025?

The amount to be reported

$

2. Crane bought a franchise from Alexander Co. on January 1, 2024, for $360,000. The carrying amount of the franchise on

Alexander's books on January 1, 2024, was $360,000. The franchise agreement had an estimated useful life of 30 years. Because

Crane must enter a competitive bidding at the end of 2026, it is unlikely that the franchise will be retained beyond 2033. What amount

should be amortized for the year ended December 31, 2025?

The amount to be amortized $

3. On January 1, 2025, Crane incurred organization costs of $280,000. What amount of organization expense should be reported in

2025?

The amount to be reported

$

280000

4. Crane purchased the license for distribution of a popular consumer product on January 1, 2025, for $152,000. It is expected that

this product will generate cash flows for an indefinite period of time. The license has an initial term of 5 years but by paying a nominal

fee, Crane can renew the license indefinitely for successive 5-year terms. What amount should be amortized for the year ended

December 31, 2025?

The amount to be amortized

eTextbook and Media

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following is selected information for Sunland Company. Answer the questions asked about each of the factual situations. (Do not leave any answer field blank. Enter o for amounts) 1. Sunland purchased a patent from Vania Co. for $1,280,000 on January 1, 2023. The patent is being amortized over its remaining legal life of 10 years, expiring on January 1, 2033. During 2025, Sunland determined that the economic benefits of the patent would not last longer than 6 years from the date of acquisition. What amount should be reported in the balance sheet for the patent, net of accumulated amortization, at December 31, 2025? The amount to be reported $ 2. Sunland bought a franchise from Alexander Co. on January 1, 2024, for $390,000. The carrying amount of the franchise on Alexander's books on January 1, 2024, was $390,000. The franchise agreement had an estimated useful life of 30 years. Because Sunland must enter a competitive bidding at the end of 2026, it is unlikely that the franchise…arrow_forwardPresented below is selected information for Sheridan Company. Answer the questions asked about each of the factual situations. (Do not leave any answer field blank. Enter O for amounts.) 1. Sheridan purchased a patent from Vania Co. for $1,160,000 on January 1, 2018. The patent is being amortized over its remaining legal life of 10 years, expiring on January 1, 2028. During 2020, Sheridan determined that the economic benefits of the patent would not last longer than 6 years from the date of acquisition. What amount should be reported in the balance sheet for the patent, net of accumulated amortization, at December 31, 2020? The amount to be reported $ 2. Sheridan bought a franchise from Alexander Co. on January 1, 2019, for $330,000. The carrying amount of the franchise on Alexander's books on January 1, 2019, was $330,000. The franchise agreement had an estimated useful life of 30 years. Because Sheridan must enter a competitive bidding at the end of 2021, it is unlikely that the…arrow_forwardAnswer the questions asked about each of the factual situations. (Do not leave any answer field blank. Enter O for amounts.) 1. Sandhill purchased a patent from Vania Co. for $1,190,000 on January 1, 2018. The patent is being amortized over its remaining legal life of 10 years, expiring on January 1, 2028. During 2020, Sandhill determined that the economic benefits of the patent would not last longer than 6 years from the date of acquisition. What amount should be reported in the balance sheet for the patent, net of accumulated amortization, at December 31, 2020? The amount to be reported $ 2. Sandhill bought a franchise from Alexander Co. on January 1, 2019, for $345,000. The carrying amount of the franchise on Alexander's books on January 1, 2019, was $345,000. The franchise agreement had an estimated useful life of 30 years. Because Sandhill must enter a competitive bidding at the end of 2021, it is unlikely that the franchise will be retained beyond 2028. What amount should be…arrow_forward

- Presented below is selected information for Alatorre Company. 1. Alatorre purchased a patent from Vania Co. for $1,000,000 on January 1, 2018. The patent is being amortized over its remaining legal life of 10 years, expiring on January 1, 2028. During 2020, Alatorre determined that the economic benefits of the patent would not last longer than 6 years from the date of acquisition. What amount should be reported in the balance sheet for the patent, net of accumulated amortization, at December 31, 2020? 2. Alatorre bought a franchise from Alexander Co. on January 1, 2019, for $400,000. The carrying amount of the franchise on Alexander's books on January 1, 2020, was $400,000. The franchise agreement had an estimated useful life of 30 years. Because Alatorre must enter a competitive bidding at the end of 2021, it is unlikely that the franchise will be retained beyond 2028. What amount should be amortized for the year ended December 31, 2020? 3. On January 1, 2020, Alatorre incurred…arrow_forwardNeed help with #2 onlyarrow_forwardTaylor Swift Corporation purchases a patent from Salmon Company on January 1, 2025, for $54,000. The patent has a remaining legal life of 16 years. Taylor Swift estimates the patent will have a useful life of 10 years, based on expected product innovations in the market. Prepare Taylor Swift's journal entries to record the purchase of the patent and 2025 amortization. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Patents cash (To record purchase of patents) Amortization Expense Patents (To record amortization of patents) Debit 24,000 8400 Credit 24,000 24,000arrow_forward

- Ayayai Corporation purchases a patent from Blossom Company on January 1, 2025, for $63,000. The patent has a remaining legal life of 14 years. Ayayai estimates the patent will have a useful life of 10 years, based on expected product innovations in the market. Prepare Ayayai's journal entries to record the purchase of the patent and 2025 amortization. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. List all debit entries before credit entries.) Account Titles and Explanation (To record purchase of patents) (To record amortization of patents) Debit Creditarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardYour answer is partially correct, costs of $171, 720 in successfully defending the patent in an infringement suit, manually. List all debit entries before credit entries.) Date Account Titles and Explanation December 31, 2025 Amortization Expense Patents Debit Credit Credit.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education