Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need help with this question

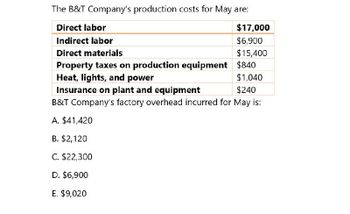

Transcribed Image Text:The B&T Company's production costs for May are:

Direct labor

Indirect labor

Direct materials

$17,000

$6,900

$15,400

Property taxes on production equipment $840

Heat, lights, and power

Insurance on plant and equipment

$1,040

$240

B&T Company's factory overhead incurred for May is:

A. $41,420

B. $2,120

C. $22,300

D. $6,900

E. $9,020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- York Company Is a machine shop that estimated overhead will be $50,000, consisting of 5,000 hours of direct labor. The cost to make job 0325 is $70 in aluminum and two hours of labor at $20 per hour. During the month. York incurs $50 in indirect material cost. $150 in administrative labor, $300 in utilities, and $250 in depreciation expense. What is the predetermined overhead rate if direct labor hours are considered the cost driver? What is the cost of Job 0325? What is the overhead incurred during the month?arrow_forwardGreen Bay Cheese Company estimates its overhead to be $375,000. It expects to have 125,000 direct labor hours costing $1,500,000 in labor and utilizing 15,000 machine hours. Calculate the predetermined overhead rate using: A. Direct labor hours B. Direct labor dollars C. Machine hoursarrow_forwardRulers Company is a neon sign company that estimated overhead will be $60,000, consisting of 1,500 machine hours. The cost to make Job 416 is $95 in neon, 15 hours of labor at $13 per hour, and five machine hours. During the month, it incurs $95 in indirect material cost, $130 in administrative labor, $320 in utilities, and $350 in depreciation expense. What is the predetermined overhead rate if machine hours are considered the cost driver? What is the cost of Job 416? What is the overhead incurred during the month?arrow_forward

- A company estimates its manufacturing overhead will be $750,000 for the next year. What is the predetermined overhead rate given the following independent allocation bases? Budgeted direct labor hours: 60,000 Budgeted direct labor expense: $1,500,000 Estimated machine hours: 100,000arrow_forwardPeacock Ltd.'s production cost for August are: Particulars Amount Direct Labor Indirect Labor Direct Materials Property Taxes on Production equipment Heat, Light and Power Insurance on Plant and Equipment 15,000 8,000 32,000 1,200 2,500 500 Calculate Peacock Ltd.'s factory overheads for August. a. Factory overheads for August are $21,500 b. Factory overheads for August are $12,200 c. Factory overheads for August are $27,200 d. Factory overheads for August are $30,000arrow_forwardAccountingarrow_forward

- A company estimated the manufacturing overhead costs for the coming year at $420,00 The total estimated direct labor hours are 15,000 hours, and the estimated machine hou to be worked are 6,000 hours. The company allocates its manufacturing overhead cos based on the direct labor hours. What is the pre-determined overhead allocation rate? a. $20 per direct labor hour b. $70 per machine hour c. $28 per machine hour d. $28 per direct labor hour Answer O A O B ODarrow_forwardJackson Furniture Company provided the following manufacturing costs for the months of June Direct labor costs $120,000 62,000 Direct materials costs Equipment depreciation (straight-line) Factory insurance Factory manager's salary Janitor's salary Packaging costs Property taxes on the factory From the above information, calculate Jackson's total fixed costs. OA. $279,700 OB. $64,100 OC. $78,900 OD. $68,400 27,000 10,500 10,000 14,800 18,800 16,600arrow_forwardReynolds Manufacturers Inc. has estimated total factory overhead costs of $88,800 and expected direct labor hours of 11,100 for the current fiscal year. If job number 117 incurs 2,000 direct labor hours, Work in Process will be debited and Factory Overhead will be credited for Oa. $88,800 b. $2,000 Oc. $44,400 Od. $16,000arrow_forward

- Reynolds Manufacturers Inc. has estimated total factory overhead costs of $92,800 and expected direct labor hours of 11,600 for the current fiscal year. If job 117 incurs 1,360 direct labor hours, Work in Process will be debited and Factory Overhead will be credited for a. $1,360 b. $46,400 Oc. $92,800 Od. $10,880arrow_forwardcompany's total overhead cost at various levels of activity is presented below: Month March April May June Machine Hours 5,000 4,000 6,000 8,000 Total Overhead Cost $ 38,750 $ 31,000 $ 46,500 $ 55,000 Assume that the overhead cost above consists of utilities, supervisory salaries, and maintenance. The breakdown of these costs at the 4,000 machine-hour level of activity is as follows: Utilities (considered variable) $8,000 Supervisory salaries (considered fixed) $5,000 Maintenance (considered mixed) $18,000 Total overhead cost $31,000 Suppose the company uses the high-low method to estimate a cost formula for mixed costs. What is the total maintenance cost the company expects to incur at an activity level of 6,900 machine hours? ○ $29,600 $29,200 O $30,400 $29,900arrow_forwardNova Company's total overhead cost at various levels of activity are presented below: Total Overhead Cost $ 210,600 $ 184,200 $ 237,000 $ 263,400 Month April May June July Machine-Hours 50,000 40,000 60,000 70,000 Assume the total overhead cost above consists of utilities, supervisory salaries, and maintenance. The breakdown of these costs at the 40,000 machine-hour level of activity is: Utilities (variable) Supervisory salaries (fixed) Maintenance (mixed) Total overhead cost $ 56,000 60,000 68,200 $ 184,200 Nova Company's management wants to break down the maintenance cost into its variable and fixed cost elements. Required: 1. Estimate how much of the $263,400 of overhead cost in July was maintenance cost. (Hint: To do this, it may be helpful to first determine how much of the $263,400 consisted of utilities and supervisory salaries. Think about the behavior of variable and fixed costs.) 2. Using the high-low method, estimate a cost formula for maintenance in the form Y = a + bx. 3.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College