FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

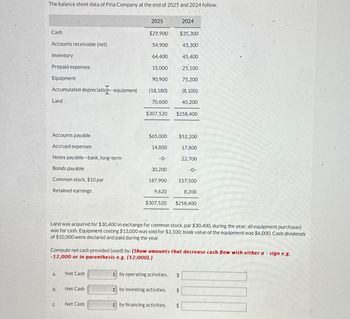

Transcribed Image Text:The balance sheet data of Pina Company at the end of 2025 and 2024 follow.

2025

2024

Cash

$29,900

$35,300

Accounts receivable (net)

54,900

45,300

Inventory

64,400

45,400

Prepaid expenses

15,000

25,100

Equipment

90,900

75,200

Accumulated depreciatich-equipment

(18,180)

(8,100)

Land

70,600

40,200

$307,520 $258,400

Accounts payable

$65,000 $52,200

Accrued expenses

14,800

17,800

Notes payable-bank, long-term

-0-

22,700

Bonds payable

30,200

-0-

Common stock, $10 par

187,900

157,500

Retained earnings

9,620

8,200

$307,520

$258,400

Land was acquired for $30,400 in exchange for common stock, par $30,400, during the year; all equipment purchased

was for cash. Equipment costing $13,000 was sold for $3,100; book value of the equipment was $6,000. Cash dividends

of $10,000 were declared and paid during the year.

Compute net cash provided (used) by: (Show amounts that decrease cash flow with either a - sign e.g.

-12,000 or in parenthesis e.g. (12,000).)

a.

Net Cash

by operating activities.

$

b.

Net Cash

by investing activities.

$

C.

Net Cash

by financing activities.

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Uramilabenarrow_forwardThe balance sheets for a company and additional information are provided below. A COMPANY Balance Sheets December 31, 2024 and 2023 2024 2023 Assets Current assets: Cash $160,000 $116,000 Accounts receivable 70,000 88,000 Inventory 91,000 76,000 Investments 3,600 1,600 Long-term assets: Land 440,000 440,000 Equipment 750,000 630,000 Less: Accumulated depreciation (388,000) (228,000) Total assets $1,126,600 $1,123,600 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $95,200 $81,000 Interest payable 5,500 11,600 Income tax payable 7,500 4,600 Long-term liabilities: Notes payable 120,000 240,000 Stockholders' equity: Common stock 660,000 660,000 Retained earnings 238,400 126,400 Total liabilities and stockholders' equity $1,126,600 $1,123,600 Additional information for 2024: Net income is $112,000. Sales on account are $1,382,500. (All sales are credit sales.) Cost of goods…arrow_forwardKIBAN INCORPORATED Comparative Balance Sheets At June 30 2021 2020 Assets Cash $ 81,500 $ 54,000 Accounts receivable, net 80,000 61,000 Inventory 73,800 101,500 Prepaid expenses 5,400 7,400 Total current assets 240,700 223,900 Equipment 134,000 125,000 Accumulated depreciation—Equipment (32,000) (14,000) Total assets $ 342,700 $ 334,900 Liabilities and Equity Accounts payable $ 35,000 $ 45,000 Wages payable 7,000 17,000 Income taxes payable 4,400 5,800 Total current liabilities 46,400 67,800 Notes payable (long term) 32,000 70,000 Total liabilities 78,400 137,800 Equity Common stock, $5 par value 240,000 170,000 Retained earnings 24,300 27,100 Total liabilities and equity $ 342,700 $ 334,900 IKIBAN INCORPORATED Income Statement For Year Ended June 30, 2021 Sales $ 728,000 Cost of goods sold 421,000 Gross profit 307,000 Operating expenses (excluding depreciation) 77,000 Depreciation expense 68,600 161,400…arrow_forward

- Condensed financial data of Concord Inc. follow. CONCORD INC.Comparative Balance SheetsDecember 31 Assets 2022 2021 Cash $80,500 $48,700 Accounts receivable 87,900 38,600 Inventory 111,900 102,100 Prepaid expenses 29,400 27,900 Long-term investments 139,800 113,700 Plant assets 284,200 241,900 Accumulated depreciation (47,700) (49,100) Total $686,000 $523,800 Liabilities and Stockholders’ Equity Accounts payable $106,000 $63,700 Accrued expenses payable 16,500 21,200 Bonds payable 117,100 149,500 Common stock 219,000 175,100 Retained earnings 227,400 114,300 Total $686,000 $523,800 CONCORD INC.Income StatementFor the Year Ended December 31, 2022 Sales revenue $382,500 Less: Cost of goods sold…arrow_forwardComparative balance sheets at December 31, 2020 and 2021 are show for the company below. 2020 2021 Cash 68,200 131,450 accounts receivable 81,400 86,900 Inventory 129,800 136,400 Prepaid expenses 5,500 6,600 Land 0 70,950 Plant assets 264,400 306,900 Accumulated depreciation (94,600) (88,000) Franchise 35,200 26,400 Total assets $471,900 $677,600 Accounts payable 45,100 58,300 Notes payable 69,300 63,800 Bonds payable 0 141,900 Common stock 275,000 302,500 Additional paid in capital 50,600 61,600 Retained earnings 31,900 49,500 Total liabilities and equity $471,900 $677,600 Additional Information:1. A fully depreciated plant asset, which originally cost $22,000 and had no salvage value, was sold for $1,100. 2. Bonds payable were issued at par value. One-half of the bonds were exchanged for land; the remaining one-half was issued for cash. 3. Common stock was sold for cash. 4. The only entries in the Retained…arrow_forwardThe comparative balance sheets for Naomi Corporation show the following information: 2021 2020 Cash $24,400 $20,700 Accounts receivable, net 43,300 20,300 Inventory 40,000 42,000 Investments 20,000 15,000 Building 160,000 100,000 Accumulated depreciation – building (27,700) (20,000) Equipment 61,500 50,000 Accumulated depreciation - equipment (10,000) (17,500) Total $311,500 $210,500 Accounts payable $17,000 $26,500 Salaries payable 21,000 17,000 Long-term notes payable 100,000 50,000 Common stock 110,000 90,000 Retained earnings 63,500 27,000 Total $311,500 $210,500 Additional data related to 2021 are as follows: $10,000 of the long-term note payable was paid by cash. Equipment that had cost $15,000 and had accumulated…arrow_forward

- Balance Sheet for Bearcat Hathaway, 2022 2021 2022 Cash Accounts. Receivable $5,268,485 $10,268,485 Inventory $529,062 $696,685 Current Assets $8,371,777 $13,279,842 Less $2,574,230 $2,314,672 Gross Fixed Assets $16,251,665 $20,567,330 Accum.Depreciation Total Assets $7,460,897 $10,117,819 Accounts Payable Notes. Payable Current Liabilities Calculate the net working capital in 2022. Long Termi Debt Total Liabilities, None of these options are correct $10,572,740 $5,664,675 $8,854,338 $3,946,273 Total $17,162,545 $23,729,353 Liabilities and Equity Capital Surplus Retained. Earnings 2021 2022 $1,673,992 $2,438,271 Common Net Fixed Assets $8,790,768 $10,449,511 Stock ($0.50 $1,300,000 $1,600,000 par) $1,033,110 $1,987,233 $2,707,102 $4,425,504 $9,242,830 $11,468,302 $11,949,932 $15,893,806 $1,148,120 $1,800,969 $2,764,493 $4,434,578 $17,162,545 $23,729,353arrow_forwardWhat is Hershey's operating cash flow to operating income ratio in 2022 under the replacement cost?arrow_forwardHere are comparative balance sheets for Skysong Company. Prepare a statement of cash flows-indirect method. SKYSONG COMPANY Comparative Balance Sheets December 31 Assets 2020 2019 Cash $72,000 $22,000 Accounts receivable 86,000 77,000 Inventory 171,000 192,000 Land 72,000 101,000 Equipment 263,000 199,000 Accumulated depreciation - equipment (65,000) (32,000) Total $599,000 $559,000 Liabilities and Stockholders' Equity Accounts payable $37,000 $48,000 Bonds payable 149,000 209,000 Common stock ($1 par) 214,000 171,000 Retained earnings 199,000 131,000 Total $599,000 $559,000 Additional information: 1. Net income for 2020 was $98,000. 2. Cash dividends of $30,000 were declared and paid. 3. Bonds payable amounting to $60,000 were redeemed for cash $60,000. 4. Common stock was issued for $43,000 cash. 5. Equipment that cost $49,000 and had a book value of $28,000 was sold for $33,000 during 2020; land was sold at cost. Prepare a statement of cash flows for 2020 using the indirect method.…arrow_forward

- The comparative balance sheets for Carla Vista Corporation appear below: CARLA VISTA CORPORATION Comparative Balance Sheet at December 31st 2027 2026 Assets Cash $ 17,160 $ 12,840 Accounts receivable 25,440 28,080 Land 24,000 31,200 Building 84,000 84,000 Accumulated depreciation—equipment (18,000) (12,000) Total assets $ 132,600 $ 144,120 Liabilities and Shareholders' Equity Accounts payable $ 14,840 $ 37,320 Common shares 90,000 82,800 Retained earnings 27,760 24,000 Total liabilities and shareholders' equity $ 132,600 $ 144,120 Additional information: 1. Profit for the year ending December 31, 2027 was $27,160. 2. Land was sold for cash of $5,880, resulting in a loss of $1,320 on sale of the land. 3. Cash dividends were declared and paid during the year, $23,400. REQUIRED: Prepare a Statement of Cash Flows, using the indirect method, for the year ended December 31, 2027 in proper format.arrow_forwardAbe Manufacturing Corp. decided to expand further by purchasing the net assets of ERB Manufacturing Corp. ERB's statement of financial position at December 31, 2023 follows. Assets Receivables Inventory Plant assets (net) Total assets ERB MANUFACTURING CORP. Statement of Financial Position December 31, 2023 Cash 450,000 275,000 1,025,000 $1,960,000 $ 210,000 Liabilities and Equities Accounts payable $ 325,000 Common shares 800,000 Retained earnings 835,000 Total liabilities and equities $1,960,000 An appraisal, agreed to by both parties, indicated that the fair value of the inventory was $320,000 and the fair value of the plant assets was $1,225,000. The fair value of the receivables and payables is equal to the amount reported on the balance sheet. The agreed purchase price was $3 million, and this amount was paid in cash to the owners of ERB. Instructions Calculate the amount of goodwill (if any) implied in the purchase price of $3 million. Show calculations.arrow_forwardReturn on Assets Ratio and Asset Turnover Ratio Northern Systems reported the following financlal data (in millions) In its annual report: 2018 2019 Net Income $9,050 $7.500 Net Sales 52,350 37,200 Total Assets 58,734 68,128 If the company's total assets are $55,676 in 2017, calculate the company's: (a) return on assets (round answers to one decimal place - ex: 10.79%6) (b) asset turnover for 2018 and 2019 (round answers to two decimal places) 2018 2019 a. Return on Assets Ratio 96 96 b. Asset Turnover Ratio Check O Prevlous Save Answersarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education