FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Portions of the financial statements for Peach Computer are provided below.

| PEACH COMPUTER | ||

| Income Statement | ||

| For the year ended December 31, 2024 | ||

| Net sales | $1,625,000 | |

|---|---|---|

| Expenses: | ||

| Cost of goods sold | $980,000 | |

| Operating expenses | 490,000 | |

| 43,000 | ||

| Income tax expense | 33,000 | |

| Total expenses | 1,546,000 | |

| Net income | $79,000 |

| PEACH COMPUTER | ||||

| Selected |

||||

| December 31 | ||||

| 2024 | 2023 | Increase (I) or Decrease (D) | ||

|---|---|---|---|---|

| Cash | $95,000 | $81,500 | $13,500 | (I) |

| 46,700 | 52,500 | 5,800 | (D) | |

| Inventory | 68,000 | 51,500 | 16,500 | (I) |

| Prepaid rent | 2,300 | 3,600 | 1,300 | (D) |

| Accounts payable | 38,000 | 33,500 | 4,500 | (I) |

| Income tax payable | 4,300 | 6,500 | 2,200 | (D) |

Required:

Prepare the operating activities section of the statement of

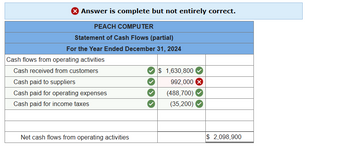

Transcribed Image Text:> Answer is complete but not entirely correct.

PEACH COMPUTER

Statement of Cash Flows (partial)

For the Year Ended December 31, 2024

Cash flows from operating activities

Cash received from customers

Cash paid to suppliers

Cash paid for operating expenses

Cash paid for income taxes

Net cash flows from operating activities

$ 1,630,800

992,000 ×

(488,700)

(35,200)

$ 2,098,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- [The following information applies to the questions displayed below.]Income statement and balance sheet data for The Athletic Attic are provided below. THE ATHLETIC ATTIC Income Statements For the years ended December 31 2022 2021 Net sales $ 11,240,000 $ 9,700,000 Cost of goods sold 7,340,000 6,000,000 Gross profit 3,900,000 3,700,000 Expenses: Operating expenses 1,660,000 1,610,000 Depreciation expense 200,000 200,000 Interest expense 46,000 46,000 Income tax expense 472,000 410,000 Total expenses 2,378,000 2,266,000 Net income $ 1,522,000 $ 1,434,000 THE ATHLETIC ATTIC Balance Sheets December 31 2022 2021 2020 Assets Current assets: Cash $ 231,000 $ 160,000 $ 216,000 Accounts receivable 996,000 746,000 766,000 Inventory…arrow_forwardGiven the following financial statement information: $ in millions Income Statement Net Income: $559 Depreciation Expense: $55 Balance Sheet Dec. 31, 2022 Accounts Receivable $38 Total Inventory $122 Accounts Payable $79 Calculate the cash from operating activities. Your Answer: Dec. 31, 2023 $64 $152 $108arrow_forwardReporting Net Cash Flow from Operating Activities The following information is available for Bernard Corporation for 2019: Net income $199,000 Decrease in accounts receivable 6,400 Increase in inventory 18,300 Decrease in prepaid rent 2,100 Increase in salaries payable 4,410 Decrease in income taxes payable 4,270 Increase in notes payable (due 2023) 50,000 Depreciation expense 44,700 Loss on disposal of equipment 11,000 Required: Compute the net cash flows from operating activities using the indirect method.arrow_forward

- Question: The following selected data for ABC Corporation for the year ended December 31, 2020, is available to you for preparing the cash flow statement: Cost of goods sold $56,500 Sales revenue $97,300 Amortization expense 14,100 Interest revenue 4,100 Income tax expense 2,300 Dividend revenuearrow_forwardPreparing a Cash Flow Statement—Indirect Method Sketchers Corporation’s recent comparative balance sheet and income statement follow. Balance Sheets, December 31 2019 2020 Assets Cash and cash equivalents $12,800 $54,400 Accounts receivable (net) 16,000 28,800 Inventory 32,000 38,400 Investment, long-term 6,400 Plant assets 96,000 150,400 Accumulated depreciation (16,000) (22,400) Total assets $147,200 $249,600 Liabilities and Stockholders’ Equity Accounts payable $9,600 $16,000 Notes payable, short-term (nontrade) 12,800 9,600 Notes payable, long-term 32,000 57,600 Common stock, no-par 80,000 128,000 Retained earnings 12,800 38,400 Total liabilities andstockholders’ equity $147,200 $249,600 Income Statement,For Year Ended December 31 2020 Sales revenue $480,000 Cost of goods sold (288,000) Gross margin 192,000 Depreciation expense (6,400) Other operating expenses (104,400) Net income $83,200 Additional…arrow_forwardPhilly Corporation Philly Corporation Income Statement Comparative Account Information Relating to Operations For the Year Ended December 31, 2020 For the Year Ended December 31, 2020 2020 2019 Sales Revenue 680,000 Accounts receivable -net 78,000 65,000 Cost of goods sold 355,000 Prepaid insurance 5,000 6,000 Salaries expense 50,000 Equipment 111,100 122,400 Depreciation expense equipment 6,800 Accumulated Depreciation 13,800 14,600 Interest expense 8,000 Land 56,000 36,000 Bad debt expense 2,400 Accounts Payable 59,000 47,000 Loss on sale of equipment 4,800 Interest payable 600 1,500 Miscellaneous…arrow_forward

- Perform a horizontal analysis for the balance sheet entry "Cash" given below. That is, find the amount of increase or decrease (in $) and the associated percent (rounded to the nearest tenth). Increase/Decrease Assets 2019 2018 Amount Percent Current Assets Cash $18,400 $11,800 Accounts Receivable 22,300 18,100 Merchandise Inventory 30,100 25,900 Supplies 5,600 7,600 Total Current Assets 76,400 63,400 Property, Plant, and Equipment Machinery and Equipment 56,000 57,100 Total Assets $132,400 $120,500arrow_forwardDanton Corporation has provided the following information for the year ended December 31, 2024. Danton Corporation Comparative Balance Sheet December 31, 2024 and 2023 Increase 2024 2023 (Decrease) Cash $52,000 $13,000 $39,000 Accounts Receivable 30,000…arrow_forwardUsing the information from below make a statement of cash flows for the year ended december 31, 2020 using the direct method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education