Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

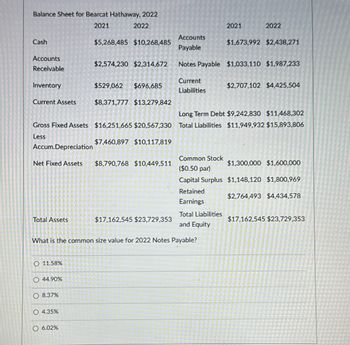

Transcribed Image Text:Balance Sheet for Bearcat Hathaway, 2022

2021

2022

Cash

Accounts

Receivable

Inventory

Current Assets

Accum.Depreciation

Net Fixed Assets

Gross Fixed Assets $16,251,665 $20,567,330

Less

$7,460,897 $10,117,819

Total Assets

O 11.58%

O 44.90%

O 8.37%

$5,268,485 $10,268,485

O 4.35%

$2,574,230 $2,314,672

O 6.02%

$529,062 $696,685

$8,371,777 $13,279,842

Total Liabilities

and Equity

What is the common size value for 2022 Notes Payable?

$8,790,768 $10,449,511

$17,162,545 $23,729,353

Current

Liabilities

2021

Accounts

Payable

Notes Payable $1,033,110 $1,987,233

2022

$1,673,992 $2,438,271

$2,707,102 $4,425,504

Long Term Debt $9,242,830 $11,468,302

Total Liabilities $11,949,932 $15,893,806

Common Stock

($0.50 par)

$1,300,000 $1,600,000

Capital Surplus $1,148,120 $1,800,969

Retained

$2,764,493 $4,434,578

Earnings

$17,162,545 $23,729,353

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Problem #1 The following balance sheet and income statement data is given: 31-Dec Yr 2021 Yr 2020 Cash $4,300 $3,700 Accounts receivable (net) 22,000 23,400 Inventories 10,000 7,000 Plant assets (net) 75,000 86,000 Total assets 111,300 120,100 Accounts payable 12,370 11,100 Bonds payable 70,000 70,000 Total liabilities 82,370 81,100 Common stock, $10 par 65,000 59,000 Paid-in capital 10,000 10,000 Retained earnings 24,300 20,600 Total stockholders’ equity 99,300 89,600 Net credit sales 100,000 Cost of goods sold 60,350 Gross profit 39,650 Net income 14,000 REQUIRED: Compute the following ratios for 2021. NOTE: Copy and paste the information below into the answer box first and then show your calculation steps for this problem to receive credits. (1) Accounts receivable turnover=____________________ (2) Inventory turnover=__________________ (3) Accounts payable…arrow_forwardQuestion Content Area The following information is available from the current period financial statements: Net income $102,978 Depreciation expense 26,870 Increase in accounts receivable 15,293 Decrease in accounts payable (29,031) The net cash flows from operating activities using the indirect method is a. $174,172 b. $85,524 c. $102,978 d. $31,784arrow_forwardSydMel Ltd Statement of financial position As of 30 June 2020. 2020 2019 Assets Cash at Bank 18000 - Account Receivable 34000 28000 Inventories 112000 96000 Land 40000 80000 Buildings 120000 120000 Accumulated depreciation-Buildings (10000) (6000) Equipment 72000 60000 Accumulated depreciation-Equipment (30000) (18000) Total assets 356000 360500 Liabilities Account Payables 52000 48000 Bank Overdraft - 20000 Equity Share Capital 214000 200000 Retained Earnings 90000 92500 Total liabilities and equity 356000 360500 SydMel Ltd Statement of profit and loss and other comprehensive income For the year ended 30 June 2020. 2020 income $ $ Sales revenue - 445500 Less: expenses Cost of sales 288000 Employee expenses 78000 Interest expenses 5000 Loss on…arrow_forward

- How does Accounts Payable impact Declan's Designs' 2022 Statement of Cash Flows?arrow_forwardSME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…arrow_forwardplease help mearrow_forward

- Preparing a Cash Flow Statement—Indirect Method Sketchers Corporation’s recent comparative balance sheet and income statement follow. Balance Sheets, December 31 2019 2020 Assets Cash and cash equivalents $12,800 $54,400 Accounts receivable (net) 16,000 28,800 Inventory 32,000 38,400 Investment, long-term 6,400 Plant assets 96,000 150,400 Accumulated depreciation (16,000) (22,400) Total assets $147,200 $249,600 Liabilities and Stockholders’ Equity Accounts payable $9,600 $16,000 Notes payable, short-term (nontrade) 12,800 9,600 Notes payable, long-term 32,000 57,600 Common stock, no-par 80,000 128,000 Retained earnings 12,800 38,400 Total liabilities andstockholders’ equity $147,200 $249,600 Income Statement,For Year Ended December 31 2020 Sales revenue $480,000 Cost of goods sold (288,000) Gross margin 192,000 Depreciation expense (6,400) Other operating expenses (104,400) Net income $83,200 Additional…arrow_forwardQuestion 70 Using Financial Statements for 2018-2019, the amount of cash and marketable securities at the end of the year is $4,202,000. TRUE OR FALSE?arrow_forwardCash Accounts Receivable Inventory Property Plant & Equipment Other Assets Total Assets Valley Technology Balance Sheet As of March 11, 2020 (amounts in thousands) 9,700 Accounts Payable 4,500 Debt 3,800 Other Liabilities 16,400 Total Liabilities 1,700 Paid-In Capital Retained Earnings Total Equity 36,100 Total Liabilities & Equity 1,500 2,900 800 5,200 7,300 23,600 30,900 36,100 Use T-accounts to record the transactions below, which occur on March 12, 2020, close the T-accounts, and construct a balance sheet to answer the question. 1. Buy $15,000 worth of manufacturing supplies on credit 2. Issue $85,000 in stock 3. Borrow $63,000 from a bank 4. Pay $5,000 owed to a supplier 5. Receive payment of $12,000 owed by a customer What is the final amount in Total Liabilities? Please specify your answer in the same units as the balance sheet.arrow_forward

- P. P. Bank loan payable-current portion P. 26,000 21,000 P. P. P. Bank loan payable-non-current portion 382,000 217,000 P. Common shares P. 196,000 89,000 Retained earnings 41,000 26,000 P. P. P. Total liabilities and shareholders' equity $695,000 $396.000 P. P. P. P. Additional information regarding 2021: P. P. 1. Net income was $52,000. P. P. P. 2. A gain of $9,000 was recorded on the disposal of a small parcel of land. No land was purchased during the year. A gain on the disposal of $39,000 was recorded when an old building was sold for $57,000 cash. A new building was purchased for $367.000 and depreciation expense on buildings for the year was $60,000. 3. P. P. P. P. Equipment costing $68.000 was purchased while a loss of $9,000 was recorded on equipment that was sold for $5,000. The equipment that was sold late in the year had accumulated depreciation of $11,000. 4. 5. The company took out $205,000 of new bank loans during the year. 6. Dividends were declared and paid and no…arrow_forwardLoans and borrowings Deferred taxek liability 14,130 10,220- 1,010 960- 15,140 11,180 Current Liabilities Trade payable Current tax 1,260 1,140 1,040 920 payable Interest payable 980- 740k 3,280 40,190 2,800 32,960 Total Equity and Liabilities 2019 £'000 2018 £'000 Sales Cost of sales Distribution costse Administration expenses Gain on disposal of PPE 22,000 (11,800) (3,100) (1,630) 280 16,000 (8,200) (2,600) (1,420) Interest expensee a Тах еexpensee (1,140) (1,820) (760) (1,240) Net profit 2,790 1,780 1. The company disposal of PPE during the year with a book value of £1,000,000. 2. Depreciation of property, plant and equipment for the year was £650,000.4 The intangibles were acquired for cash towards the end of the year and were not sub ject to any amortisation in the current period.e 3. Prepare the statement of cash flows using the indirect method.arrow_forwardHow would you prepare a statement of Cash Flows using the following information? Maple Group Ltd Comparative Balance Sheet December 31, 2020 and 2019 2020 2019 Increase/Decrease Assets Cash and cash Equivalent $ 51,500.00 $ 45,400.00 $ 6,100.00 Accounts Receivable $ 51,100.00 $ 61,400.00 $ 10,000.00 Inventories $ 61,400.00 $ 51,900.00 $ 9,500.00 Fixed Assets, net $ 160,000.00 $ 110,000.00 $ 50,000.00 Total Assets $ 324,000.00 $ 268,700.00 $ 55,600.00 Liabilities Accounts Payable $ 35,450.00 $ 27,800.00 $ 7,650.00 Accrued liabilities $ 31,000.00 $ 37,550.00 -$ 6,550.00 Long-term notes payable $ 60,000.00 $ 78,540.00 -$ 18,540.00 Stockholders Equity: Common Stock $ 143,050.00 $ 105,110.00 $ 37,940.00 Retained Earnings $ 54,800.00 $ 19,700.00 $…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education