FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

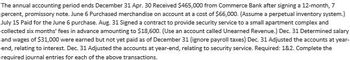

Transcribed Image Text:The annual accounting period ends December 31 Apr. 30 Received $465,000 from Commerce Bank after signing a 12-month, 7

percent, promissory note. June 6 Purchased merchandise on account at a cost of $66,000. (Assume a perpetual inventory system.)

July 15 Paid for the June 6 purchase. Aug. 31 Signed a contract to provide security service to a small apartment complex and

collected six months' fees in advance amounting to $18,600. (Use an account called Unearned Revenue.) Dec. 31 Determined salary

and wages of $31,000 were earned but not yet paid as of December 31 (ignore payroll taxes) Dec. 31 Adjusted the accounts at year-

end, relating to interest. Dec. 31 Adjusted the accounts at year-end, relating to security service. Required: 1&2. Complete the

required journal entries for each of the above transactions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following were selected from among the transactions completed by Caldemeyer Co. during the current year. Caldemeyer sells and installs home and business security systems. Jan. 3 Feb. 10 13 Mar. 12 14 Apr. 3 May 11 13 July 12 Aug. 1 Oct. 5 15 Loaned $18,000 cash to Trina Gelhaus, receiving a 90-day, 8% note. Sold merchandise on account to Bradford & Co., $24,000. The cost of the goods sold was $14,400. Sold merchandise on account to Dry Creek Co., $60,000. The cost of goods sold was $54,000. Accepted a 60-day, 7% note for $24,000 from Bradford & Co. on account. Accepted a 60-day, 9% note for $60,000 from Dry Creek Co. on account. Received the interest due from Trina Gelhaus and a new 120-day, 9% note as a renewal of the loan of January 3. (Record both the debit and the credit to the notes receivable account.) Received from Bradford & Co. the amount due on the note of March 12. Dry Creek Co. dishonored its note dated March 14. Received from Dry Creek Co. the amount owed on the…arrow_forwardListed below are selected transactions of Splish Department Store for the current year ending December 31. On December 5, the store received $470 from the Selig Players as a deposit to be returned after certain furniture to be used in stage production was returned on January 15. 1. 2. 3. 4. During December, cash sales totaled $802.200, which includes the 5% sales tax that must be remitted to the state by the fifteenth day of the following month. On December 10, the store purchased for cash three delivery trucks for $121.600. The trucks were purchased in a state that applies a 5% sales tax The store sold 30 gift cards for $100 per card. At year-end, 25 of the gift cards are redeemed. Splish expects three of the cards to expire unused. Prepare all the journal entries necessary to record the transactions noted above as they occurred and any adjusting journal entries relative to the transactions that would be required to present fair financial statements at December 31. Date each entry.…arrow_forwardListed below are selected transactions of Baileys’ Department Store for the current year ending December 31.1. On December 5, the store received $500 from the Jackson Players as a deposit to be returned after certain furniture to be used in stage production was returned on January 15.2. During December, cash sales totaled $798,000, which includes the 5% sales tax that must be remitted to the state by the fifteenth day of the following month.3. On December 10, the store purchased for cash three delivery trucks for $120,000. The trucks were purchased in a state that applies a 5% sales tax.4. The store determined it will cost $100,000 to restore the area (considered a land improvement) surrounding one of its store parking lots, when the store is closed in 2 years. Baileys’ estimates the fair value of the obligation at December 31 is $84,000.5. As a result of uninsured accidents during the year, personal injury suits for $350,000 and $60,000 have been filed against the company. It is the…arrow_forward

- On May 22, Jarrett Company borrows $8,800, signing a 90-day, 8%, $8,800 note. What is the journal entry made by Jarrett Company to record the transaction? Multiple Choice Debit Cash $8,800; credit Accounts Payable $8,800. Debit Accounts Payable $8,800; credit Notes Payable $8,800. Debit Cash $8,976; credit Notes Payable $8,976. Debit Cash $8,800; credit Notes Payable $8,800. Debit Notes Receivable $8,800; credit Cash $8,800.arrow_forwardThe following transactions took place for Parker’s Grocery. a. Jan. 1 Loaned $50,000 to a cashier of the company and received back a one-year, 8 percent note. b. June 30 Accrued interest on the note. c. Dec. 31 Received interest on the note. (No interest has been recorded since June 30.) d. Dec. 31 Received principal on the note. Prepare the journal entries that Parker's Grocery would record for the above transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) 1) Record the receipt of a note on January 1 for a $50,000 loan to an employee. 2) Record the interest accrued on the note as of June 30. 3) Record the receipt of the interest on the note's maturity date. No interest has been recorded since June 30. 4) Record the receipt of the payment for the full principal.arrow_forwardThe following were selected from among the transactions completed by Caldemeyer Co. during the current year. Caldemeyer Co. sells and installs home and business security systems. Jan. 3. Loaned $18,000 cash to Trina Gelhaus, receiving a 90-day, 8% note. Feb. 10. Sold merchandise on account to Bradford & Co., $24,000. The cost of the merchandise sold was $14,400. 13. Sold merchandise on account to Dry Creek Co., $60,000. The cost of merchandise sold was $54,000. Mar. 12. Accepted a 60-day, 7% note for $24,000 from Bradford & Co. on account. 14. Accepted a 60-day, 9% note for $60,000 from Dry Creek Co. on account. Apr. 3. Received the interest due from Trina Gelhaus and a new 120-day, 9% note as a renewal of the loan of January 3. (Record both the debit and the credit to the notes receivable account. Use a compound journal entry with debits before credits.) May 11. Received from Bradford & Co. the amount due on the note of March 12. 13. Dry Creek Co.…arrow_forward

- The following items were selected from among the transactions completed by Sherwood Co. during the current year: Mar. 1 Purchased merchandise on account from Kirkwood Co., $225,000, terms n/30. 31 Issued a 30-day, 8% note for $225,000 to Kirkwood Co., on account. Apr. 30 Paid Kirkwood Co. the amount owed on the note of March 31. Jun. 1 Borrowed $600,000 from Triple Creek Bank, issuing a 45-day, 6% note. Jul. 1 Purchased tools by issuing a $50,000, 60-day note to Poulin Co., which discounted the note at the rate of 6%. 16 Paid Triple Creek Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 7% note for $600,000. (Journalize both the debit and credit to the notes payable account.) Aug. 15 Paid Triple Creek Bank the amount due on the note of July 16. 30 Paid Poulin Co. the amount due on the note of July 1. Dec. 1 Purchased equipment from Greenwood Co. for $280,000, paying $80,000 cash and issuing a series of ten 9% notes for…arrow_forwardApr. 30 Received $495,000 from Commerce Bank after signing a 12-month, 5 percent, promissory note. June Purchased merchandise on account at a cost of $68,000. (Assume a perpetual inventory 6 system.) July 15 Paid for the June 6 purchase. Aug. Signed a contract to provide security service to a small apartment complex and collected six months' fees in advance amounting to $19,800. (Use an account called Unearned Revenue.) 31 Dec. 31 Determined salary and wages of $33,000 were earned but not yet paid as of December 31 (ignore payroll taxes). Dec. 31 Adjusted the accounts at year-end, relating to interest. Dec. 31 Adjusted the accounts at year-end, relating to security service. Required: 182. Complete the required journal entries for each of the above transactions. (Do not round Intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" In the first account fleld.) 1. Record the borrowing of $495,000. 2. Record the purchase of inventory…arrow_forwardon november 1, 2018, Downtown Jewelers accepted a 3-month, 15% note for $6,000 in sttlement of an averdue account receivable. the account period ends on december 31. prepare the journal entry to record the accrued interest at the year end.arrow_forward

- Apr. 20 Purchased $38,000 of merchandise on credit from Locust, terms n/30. May 19 Replaced the April 20 account payable to Locust with a 90-day, 8%, $35,000 note payable along with paying $3,000 in cash. July 8 Borrowed $57,000 cash from NBR Bank by signing a 120-day, 11%, $57,000 note payable. __?__ Paid the amount due on the note to Locust at the maturity date. __?__ Paid the amount due on the note to NBR Bank at the maturity date. Nov. 28 Borrowed $30,000 cash from Fargo Bank by signing a 60-day, 6%, $30,000 note payable. Dec. 31 Recorded an adjusting entry for accrued interest on the note to Fargo Bank.arrow_forwardDuring December, Far West Services makes a $3,600 credit sale. The state sales tax rate is 6% and the local sales tax rate is 2.5%. (Note: the sales tax amount is in addition to the credit sale amount.) Record sales and sales tax payable. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardOn October 1, Dutta Incorporated borrowed $82 million and issued a nine-month promissory note. Interest was discounted at issuance at a 13% discount rate. Prepare the journal entry for the issuance of the note and the appropriate adjusting entry for the note at December 31, the end of the reporting period. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education